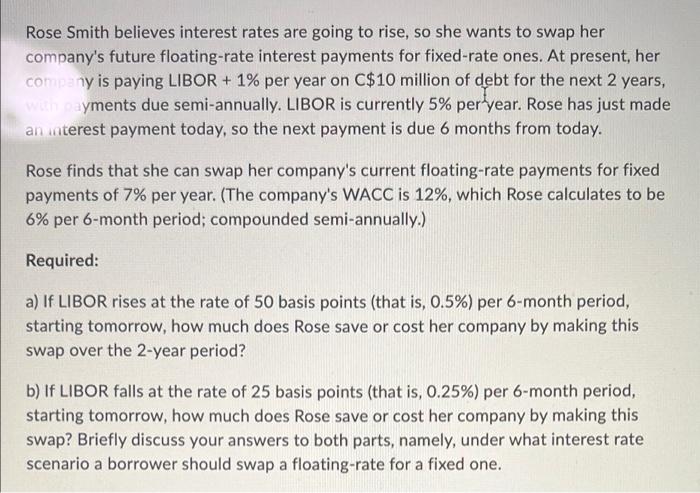

Rose Smith believes interest rates are going to rise, so she wants to swap her company's future floating-rate interest payments for fixed-rate ones. At present, her company is paying LIBOR + 1% per year on C$10 million of debt for the next 2 years, with payments due semi-annually. LIBOR is currently 5% per year. Rose has just made an interest payment today, so the next payment is due 6 months from today. Rose finds that she can swap her company's current floating-rate payments for fixed payments of 7% per year. (The company's WACC is 12%, which Rose calculates to be 6% per 6-month period; compounded semi-annually.) Required: a) If LIBOR rises at the rate of 50 basis points (that is, 0.5%) per 6-month period, starting tomorrow, how much does Rose save or cost her company by making this swap over the 2-year period? b) If LIBOR falls at the rate of 25 basis points (that is, 0.25%) per 6-month period, starting tomorrow, how much does Rose save or cost her company by making this swap? Briefly discuss your answers to both parts, namely, under what interest rate scenario a borrower should swap a floating-rate for a fixed one. Rose Smith believes interest rates are going to rise, so she wants to swap her company's future floating-rate interest payments for fixed-rate ones. At present, her company is paying LIBOR + 1% per year on C$10 million of debt for the next 2 years, with payments due semi-annually. LIBOR is currently 5% per year. Rose has just made an interest payment today, so the next payment is due 6 months from today. Rose finds that she can swap her company's current floating-rate payments for fixed payments of 7% per year. (The company's WACC is 12%, which Rose calculates to be 6% per 6-month period; compounded semi-annually.) Required: a) If LIBOR rises at the rate of 50 basis points (that is, 0.5%) per 6-month period, starting tomorrow, how much does Rose save or cost her company by making this swap over the 2-year period? b) If LIBOR falls at the rate of 25 basis points (that is, 0.25%) per 6-month period, starting tomorrow, how much does Rose save or cost her company by making this swap? Briefly discuss your answers to both parts, namely, under what interest rate scenario a borrower should swap a floating-rate for a fixed one