Question

Roseys Roses has several questions for you that Excel can help answer. Use student file ch7-13 to solve 3 of these problems. This file has

Roseys Roses has several questions for you that Excel can help answer. Use student file ch7-13 to solve 3 of these problems. This file has three worksheets labeled: Present and Future Values, Cost Prediction, and Allowance for Uncollectibles. Complete the file answering the questions below and then save the file as ch7-13_student_name (replacing student_name with your name). Print a Value view of each worksheet. (Note: This file has three worksheets.) a. Present and Future Values (Calculate the answer and then provide a table for each question. Use the first worksheet of the workbook to answer this problem.): 1. How much they would have to pay at the end of each year, assuming a 6 percent rate of return, to yield $15,000 at the end of 4 years. 2. How much they would have at the end of 4 years if they invested $1,000 at the end of each year, earning 5 percent per year. 3. How much they would have to invest today to have $15,000 in 4 years, earning 6 percent per year. 4. How much they would have at the end of 4 years if they invested $4,000 today, earning 5 percent per year. b. Roseys Roses is trying to better understand the behavior of their delivery expenses. They have accumulated the delivery expenses over the last 24 months and believe that miles driven per month are a good predictor of expense behavior. Use the second worksheet of the workbook to answer this problem: 1. Using the Hi-Lo method, calculate variable cost per mile, fixed costs, and a prediction of delivery expense when they travel 10,000 miles in a month. 2. Using the Least Squares/Regression method, calculate variable cost per mile, fixed costs, and a prediction of delivery expense when they travel 10,000 miles in a month.

Display a chart of delivery expense and miles driven with a trend line. (Be sure to modify each axis so your scatter diagram is better displayed, as you did earlier in this chapter.)

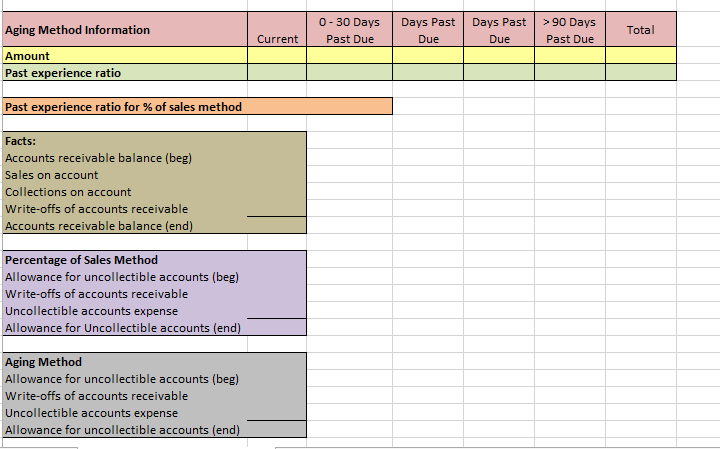

(C) During a recent year, Roseys Roses had sales on account of $345,000, collections of $337,000, write-offs of $3,700, a beginning balance in accounts receivable of $37,000, and a beginning balance in the allowance for uncollectible accounts of $1,200. At year end, $34,000 of accounts receivable were current, $4,900 were 030 days past due, $1,500 were 3160 days past due, $500 were 6190 days past due, and $400 were over 90 days past due. The company believes 1.3 percent of sales will not be collected. They also have experience suggesting that 3 percent of all current receivables, 10 percent of receivables 030 days past due, 15 percent of receivables 3160 days past due, 20 percent of receivables 6190 days past due, and 30 percent of receivables over 90 days past due will not be collected. Use the third worksheet of the workbook to answer this problem: 1. Complete an allowance for uncollectible accounts analysis using the percentage of sales method. 2. Complete an allowance for uncollectible accounts analysis using the aging method.

Do only the BOLD AND ITALICIZE Portion ONLY WHICH IS THE (C) PART and do this in Excel, FILLING THE TEMPLATE IM ATTACHING , SHOW ALL FORMULAS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started