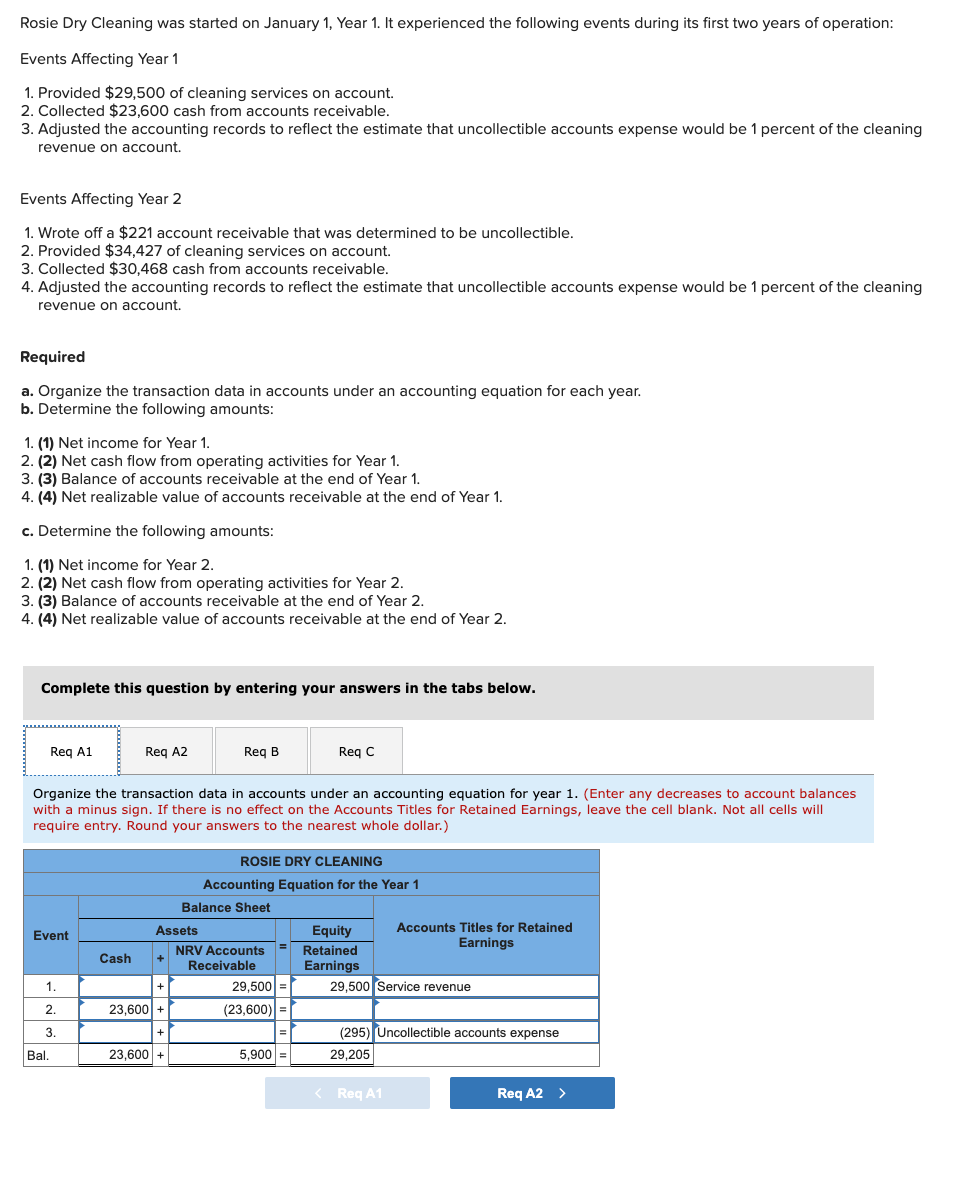

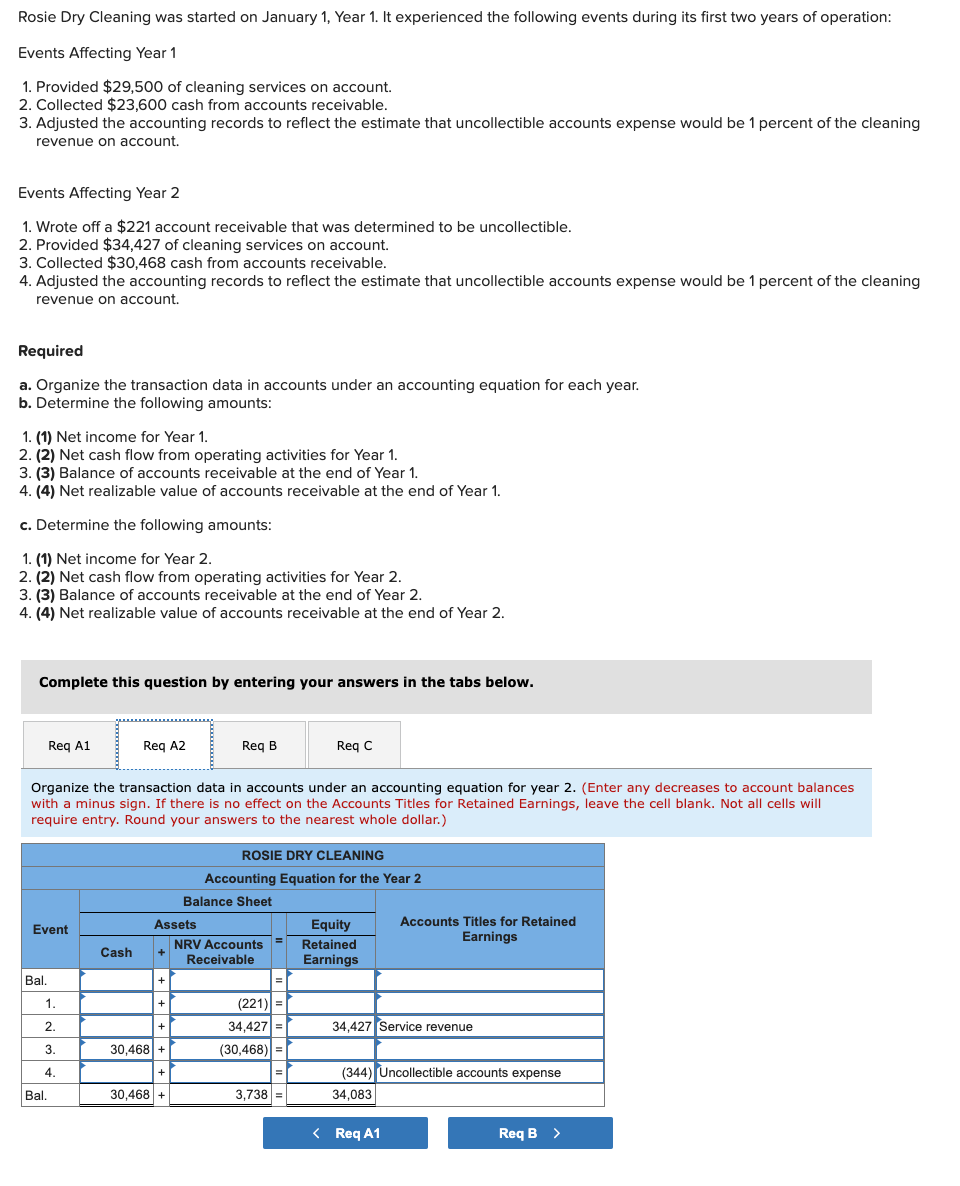

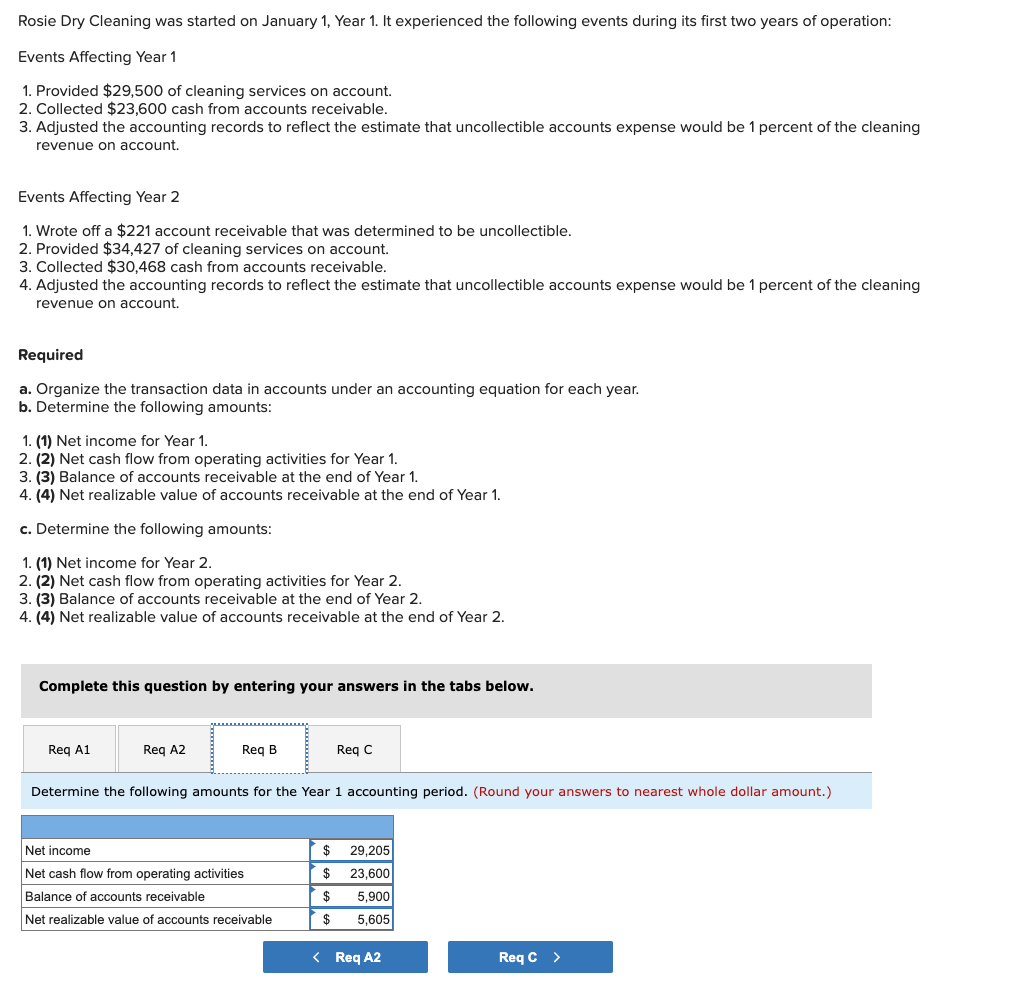

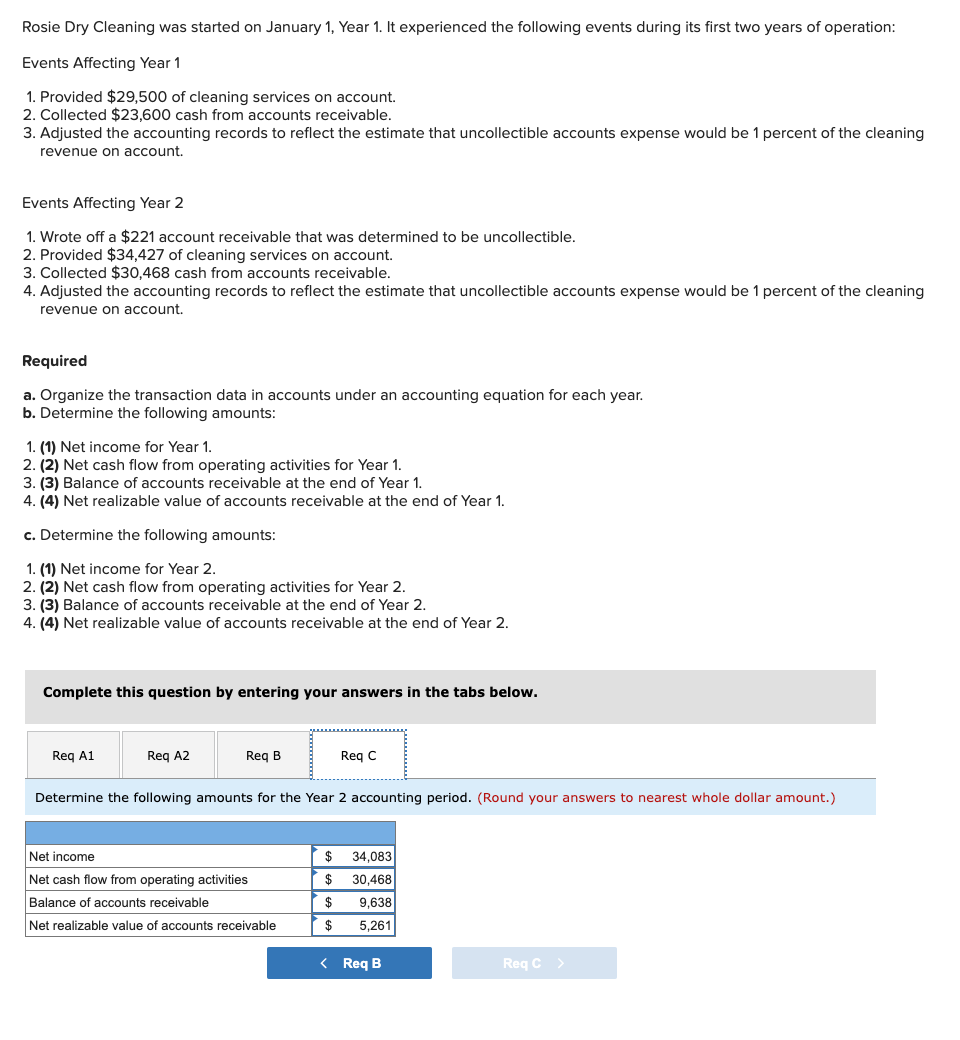

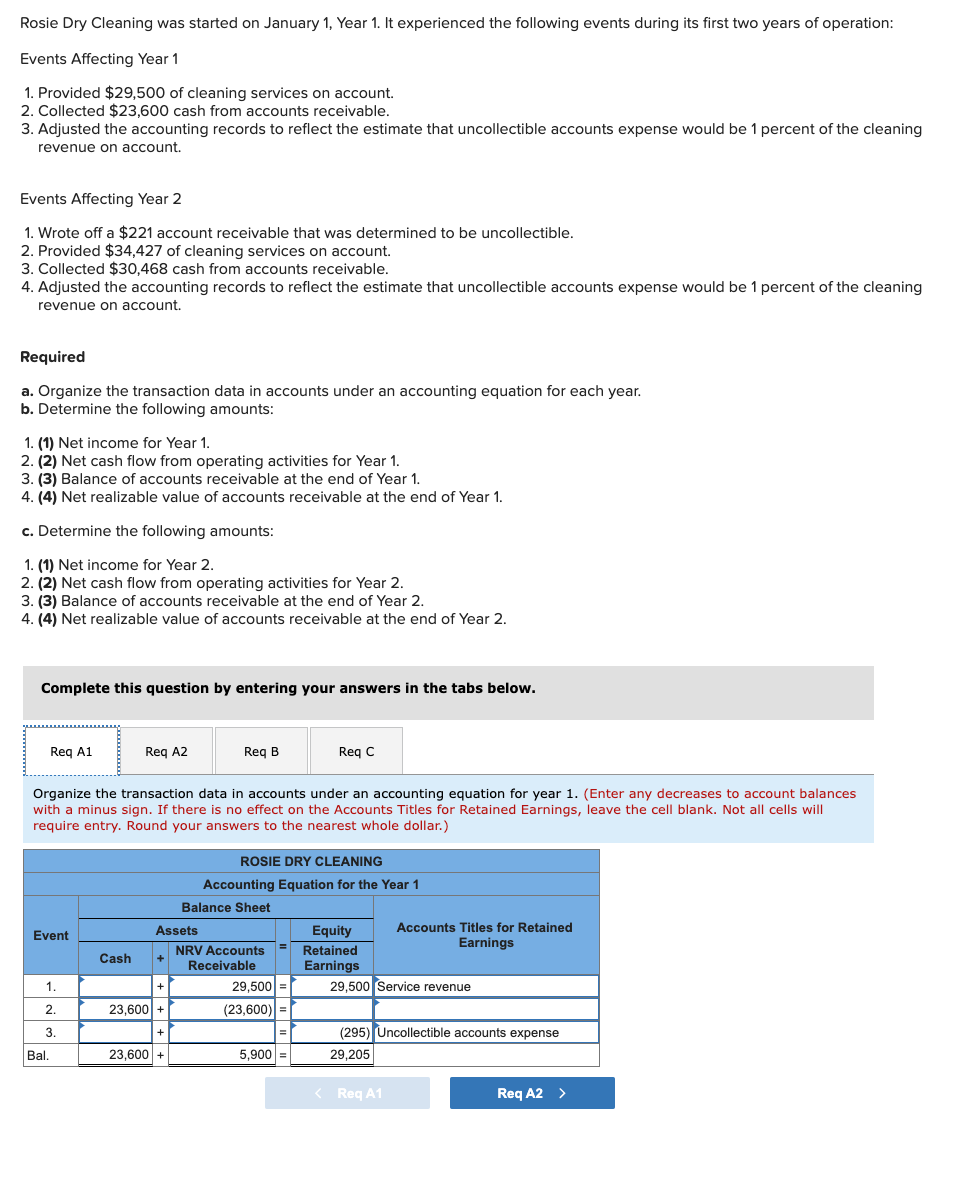

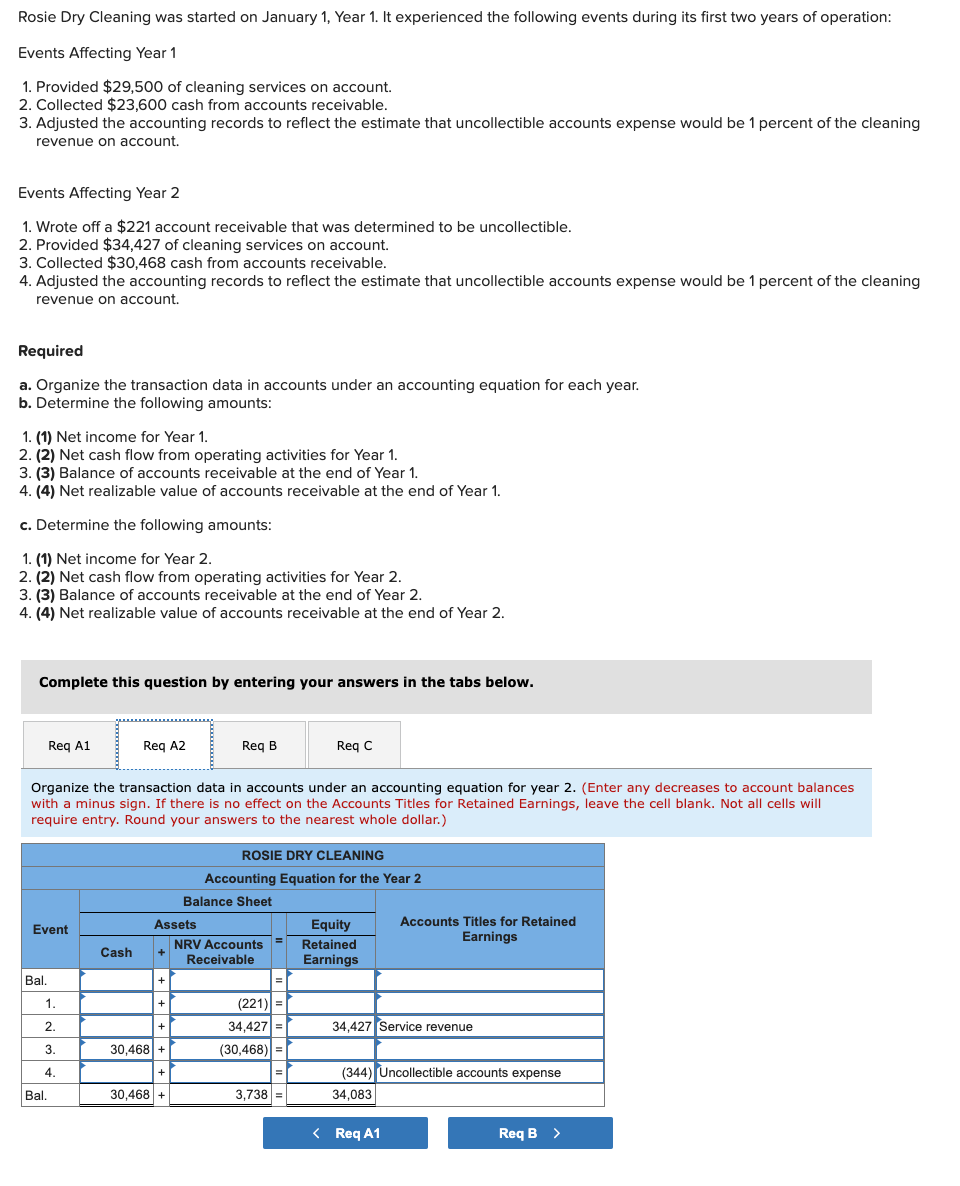

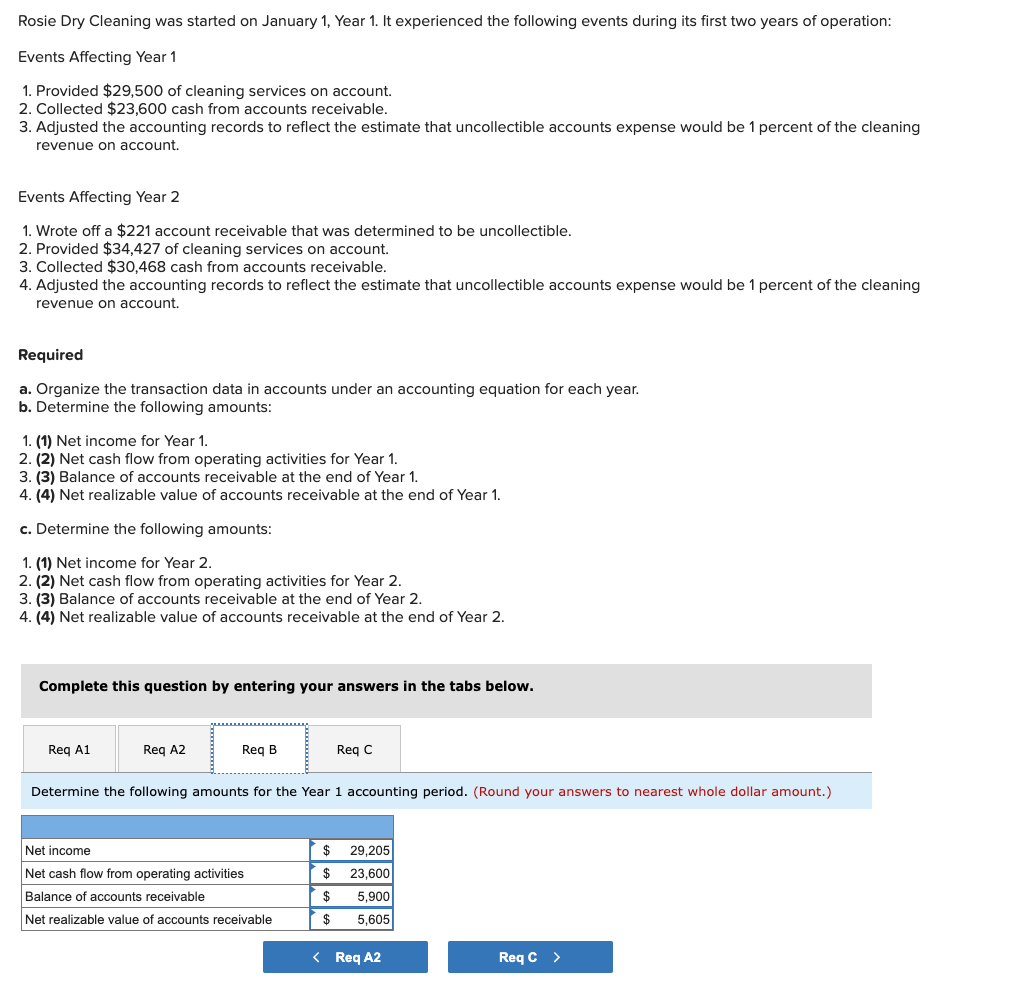

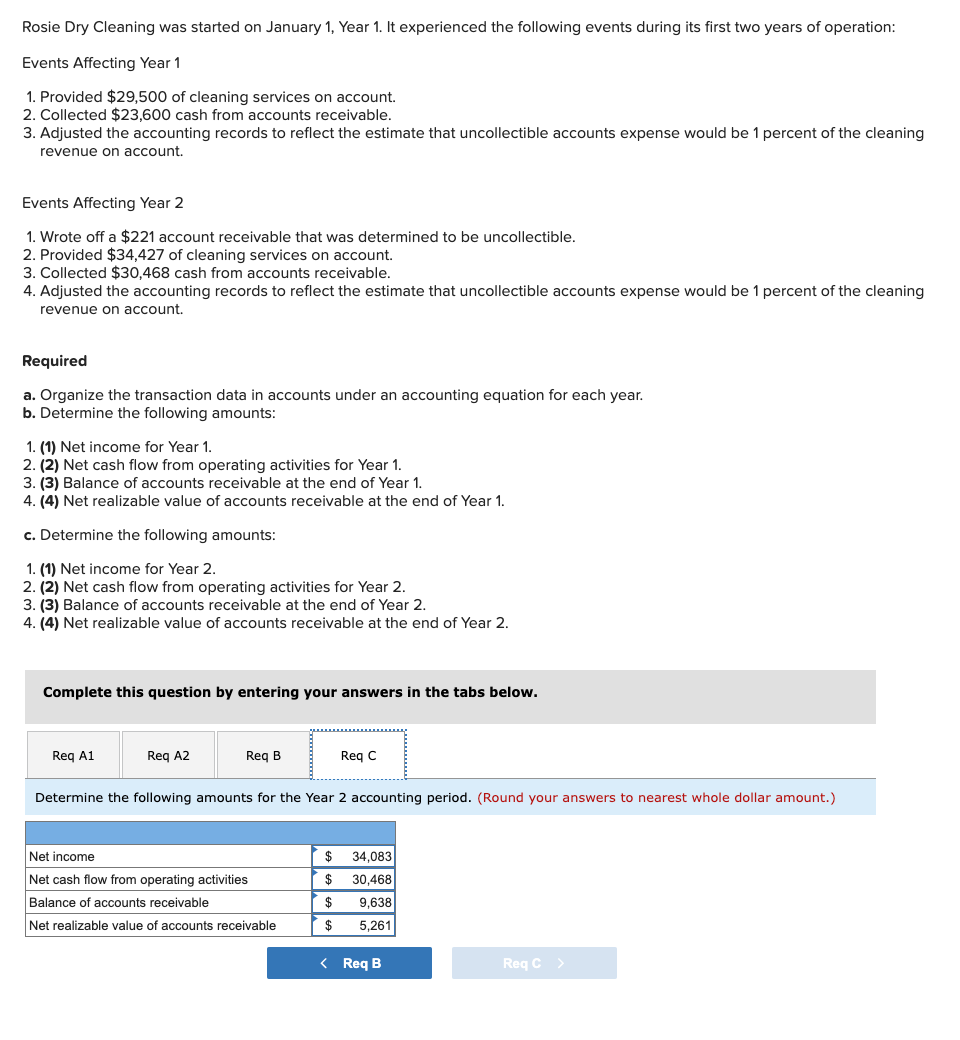

Rosie Dry Cleaning was started on January 1, Year 1. It experienced the following events during its first two years of operation: Events Affecting Year 1 1. Provided $29,500 of cleaning services on account. 2 . Collected $23,600 cash from accounts receivable. 3. Adjusted the accounting records to reflect the estimate that uncollectible accounts expense would be 1 percent of the cleaning revenue on account. Events Affecting Year 2 1. Wrote off a $221 account receivable that was determined to be uncollectible. 2 . Provided $34,427 of cleaning services on account. 3. Collected $30,468 cash from accounts receivable. 4. Adjusted the accounting records to reflect the estimate that uncollectible accounts expense would be 1 percent of the cleaning revenue on account. Required a. Organize the transaction data in accounts under an accounting equation for each year. b. Determine the following amounts: 1. (1) Net income for Year 1. 2. (2) Net cash flow from operating activities for Year 1. 3. (3) Balance of accounts receivable at the end of Year 1. 4. (4) Net realizable value of accounts receivable at the end of Year 1. c. Determine the following amounts: 1. (1) Net income for Year 2. 2. (2) Net cash flow from operating activities for Year 2. 3. (3) Balance of accounts receivable at the end of Year 2. 4. (4) Net realizable value of accounts receivable at the end of 2. Complete this question by entering your answers in the tabs below. Organize the transaction data in accounts under an accounting equation for year 1 . (Enter any decreases to account balances with a minus sign. If there is no effect on the Accounts Titles for Retained Earnings, leave the cell blank. Not all cells will require entry. Round your answers to the nearest whole dollar.) Rosie Dry Cleaning was started on January 1 , Year 1 . It experienced the following events during its first two years of operation: Events Affecting Year 1 1. Provided $29,500 of cleaning services on account. 2. Collected $23,600 cash from accounts receivable. 3. Adjusted the accounting records to reflect the estimate that uncollectible accounts expense would be 1 percent of the cleaning revenue on account. Events Affecting Year 2 1. Wrote off a $221 account receivable that was determined to be uncollectible. 2. Provided $34,427 of cleaning services on account. 3. Collected $30,468 cash from accounts receivable. 4. Adjusted the accounting records to reflect the estimate that uncollectible accounts expense would be 1 percent of the cleaning revenue on account. Required a. Organize the transaction data in accounts under an accounting equation for each year. b. Determine the following amounts: 1. (1) Net income for Year 1. 2. (2) Net cash flow from operating activities for Year 1. 3. (3) Balance of accounts receivable at the end of Year 1. 4. (4) Net realizable value of accounts receivable at the end of Year 1. c. Determine the following amounts: 1. (1) Net income for Year 2. 2. (2) Net cash flow from operating activities for Year 2. 3. (3) Balance of accounts receivable at the end of Year 2. 4. (4) Net realizable value of accounts receivable at the end of Year 2. Complete this question by entering your answers in the tabs below. Organize the transaction data in accounts under an accounting equation for year 2. (Enter any decreases to account balances with a minus sign. If there is no effect on the Accounts Titles for Retained Earnings, leave the cell blank. Not all cells will require entry. Round your answers to the nearest whole dollar.) Rosie Dry Cleaning was started on January 1 , Year 1 . It experienced the following events during its first two years of operation: Events Affecting Year 1 1. Provided $29,500 of cleaning services on account. 2. Collected $23,600 cash from accounts receivable. 3. Adjusted the accounting records to reflect the estimate that uncollectible accounts expense would be 1 percent of the cleaning revenue on account. Events Affecting Year 2 1. Wrote off a $221 account receivable that was determined to be uncollectible. 2. Provided $34,427 of cleaning services on account. 3. Collected $30,468 cash from accounts receivable. 4. Adjusted the accounting records to reflect the estimate that uncollectible accounts expense would be 1 percent of the cleaning revenue on account. Required a. Organize the transaction data in accounts under an accounting equation for each year. b. Determine the following amounts: 1. (1) Net income for Year 1. 2. (2) Net cash flow from operating activities for Year 1. 3. (3) Balance of accounts receivable at the end of Year 1. 4. (4) Net realizable value of accounts receivable at the end of Year 1. c. Determine the following amounts: 1. (1) Net income for Year 2. 2. (2) Net cash flow from operating activities for Year 2. 3. (3) Balance of accounts receivable at the end of Year 2. 4. (4) Net realizable value of accounts receivable at the end of Year 2. Complete this question by entering your answers in the tabs below. Rosie Dry Cleaning was started on January 1, Year 1. It experienced the following events during its first two years of operation: Events Affecting Year 1 1. Provided $29,500 of cleaning services on account. 2. Collected $23,600 cash from accounts receivable. 3. Adjusted the accounting records to reflect the estimate that uncollectible accounts expense would be 1 percent of the cleaning revenue on account. Events Affecting Year 2 1. Wrote off a $221 account receivable that was determined to be uncollectible. 2 . Provided $34,427 of cleaning services on account. 3. Collected $30,468 cash from accounts receivable. 4. Adjusted the accounting records to reflect the estimate that uncollectible accounts expense would be 1 percent of the cleaning revenue on account. Required a. Organize the transaction data in accounts under an accounting equation for each year. b. Determine the following amounts: 1. (1) Net income for Year 1. 2. (2) Net cash flow from operating activities for Year 1. 3. (3) Balance of accounts receivable at the end of Year 1. 4. (4) Net realizable value of accounts receivable at the end of 1. c. Determine the following amounts: 1. (1) Net income for Year 2. 2. (2) Net cash flow from operating activities for Year 2. 3. (3) Balance of accounts receivable at the end of Year 2. 4. (4) Net realizable value of accounts receivable at the end of Year 2. Complete this question by entering your answers in the tabs below. Determine the following amounts for the Year 2 accounting period. (Round your answers to nearest whole dollar amount.)