Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ross E. Geller, born April 3, 1989, is a single taxpayer who works at the local museum. He lives at 90 Bedford Street, New

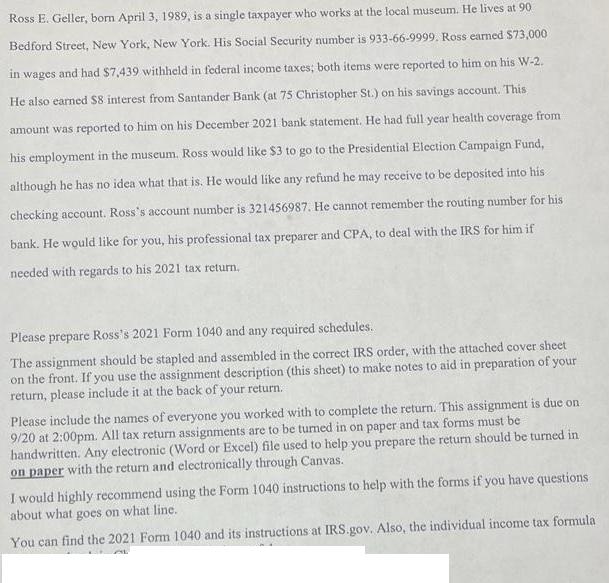

Ross E. Geller, born April 3, 1989, is a single taxpayer who works at the local museum. He lives at 90 Bedford Street, New York, New York. His Social Security number is 933-66-9999. Ross earned $73,000 in wages and had $7,439 withheld in federal income taxes; both items were reported to him on his W-2. He also earned $8 interest from Santander Bank (at 75 Christopher St.) on his savings account. This amount was reported to him on his December 2021 bank statement. He had full year health coverage from his employment in the museum. Ross would like $3 to go to the Presidential Election Campaign Fund, although he has no idea what that is. He would like any refund he may receive to be deposited into his checking account. Ross's account number is 321456987. He cannot remember the routing number for his bank. He would like for you, his professional tax preparer and CPA, to deal with the IRS for him if needed with regards to his 2021 tax return. Please prepare Ross's 2021 Form 1040 and any required schedules. The assignment should be stapled and assembled in the correct IRS order, with the attached cover sheet on the front. If you use the assignment description (this sheet) to make notes to aid in preparation of your return, please include it at the back of your return. Please include the names of everyone you worked with to complete the return. This assignment is due on 9/20 at 2:00pm. All tax return assignments are to be turned in on paper and tax forms must be handwritten. Any electronic (Word or Excel) file used to help you prepare the return should be turned in on paper with the return and electronically through Canvas. I would highly recommend using the Form 1040 instructions to help with the forms if you have questions about what goes on what line. You can find the 2021 Form 1040 and its instructions at IRS.gov. Also, the individual income tax formula

Step by Step Solution

★★★★★

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

I can help you fill out Rosss 2021 Form 1040 Heres the information you provided Form 1040 US Individ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started