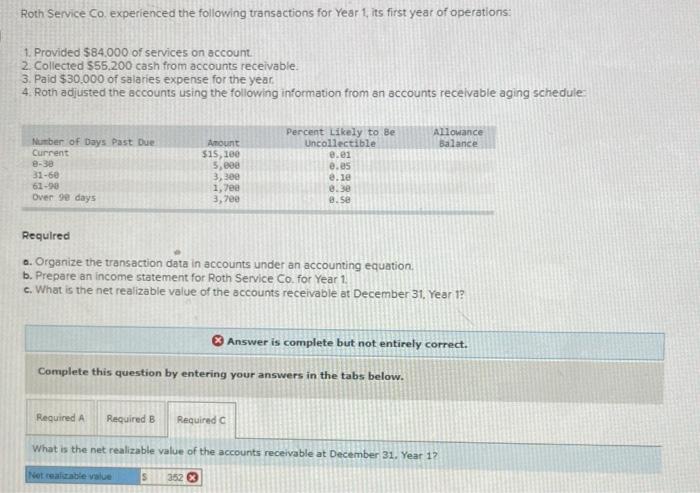

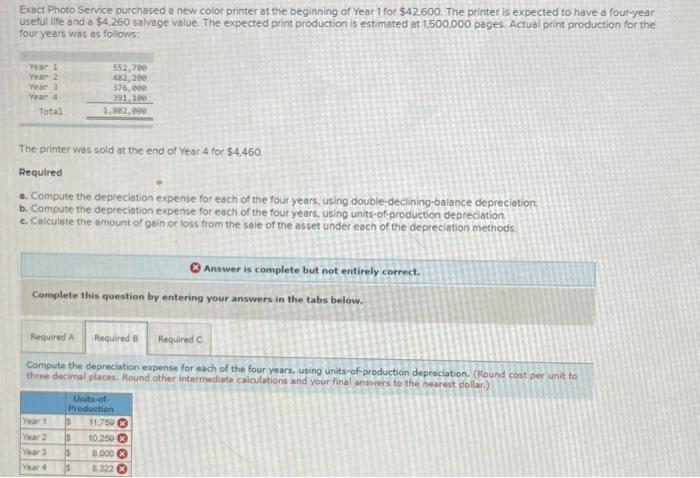

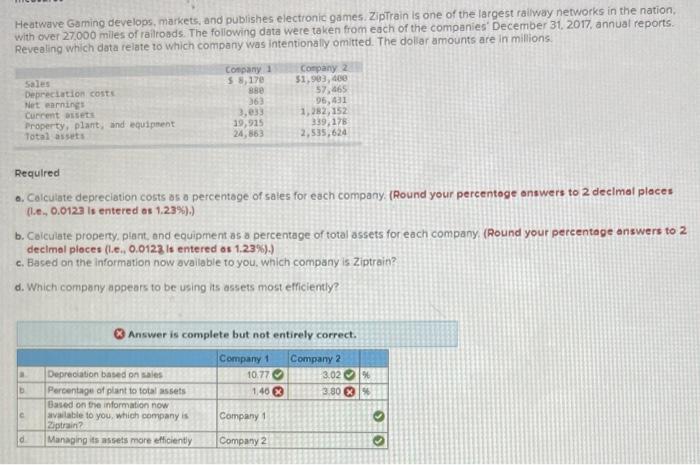

Roth Service Co experienced the following uansactions for Year 1, its first year of operations: 1. Provided $84.000 of services on account 2 Collected $55,200 cash from accounts receivable. 3. Paid $30,000 of salaries expense for the year. 4 Roth adjusted the accounts using the following information from an accounts receivable aging schedule Allowance Balance Number of Days Past Due Current e-30 31-60 61-90 Over 9e days Amount $15, 100 5, 3,30 1,7ee 3,700 Percent Likely to Be Uncollectible e.es e.es a.le 8.3e B.se Required a. Organize the transaction data in accounts under an accounting equation b. Prepare an income statement for Roth Service Co, for Year 1. c. What is the net realizable value of the accounts receivable at December 31, Year 17 Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Required What is the net realizable value of the accounts receivable at December 31. Year 1% Netrable value 352 X Exact Photo Service purchased a new color printer at the beginning of Year 1 for $42.600. The printer is expected to have a four-year useful life and a $4.260 salvage value. The expected print production is estimated at 1,500,000 pages. Actual print production for the four years was as follows: Year 1 Year 2 Year Year 4 Total 552,700 452,200 376,000 391,100 1,382,00 The printer was sold at the end of Year 4 for $4,460 Required a. Compute the depreciation expense for each of the four years, using double-declining balance depreciation b. Compute the depreciation expense for each of the four years, using units of production depreciation e. Calculate the amount of gain or loss from the sale of the asset under each of the depreciation methods Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required Required Compute the depreciation expense for each of the four years, using units of production depreciation. (Round cost per unit to three decimal places. Round other intermediate calculations and your firal answers to the nearest dollar) Units of Production Yeart 11.750 Year 2 10.250 Year 3.000 Year 0.322 Heatwave Gaming develops, markets, and publishes electronic games ZipTrain is one of the largest railway networks in the nation, with over 27,000 miles of railroads. The following data were taken from each of the companies December 31, 2017, annual reports Revealing which data relate to which company was intentionally omitted. The dollar amounts are in millions Sales Depreciation cost Net earnings Current on Property, plant, and equipment Total assets Company 1 $ 8,170 Be 363 3.833 39,935 24,863 Company 2 51,903, 400 57,665 96,431 1,282,152 339,178 2,535,624 Required a. Calculate depreciation costs as a percentage of sales for each company. (Round your percentage answers to 2 decimal places (.e., 0.0123 is entered os 1.23%).) b. Calculate property, plant, and equipment as a percentage of total assets for each company (Round your percentage answers to 2 decimal places (l.e. 0.0123 is entered of 1.23%).) c. Based on the information now available to you, which company is Ziptrain? d. Which company appears to be using its assets most efficiently? Answer is complete but not entirely correct. Company 1 Company 2 Depreciation based on sales 10.77 -3.02 Percentage of plant to total assets 1.40 3.30 3 Based on the information now available to you, which company is Company 1 Zitrin? Managing its assets more efficiently Company 2 e d