Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rotom - Navigatio... (1) Business Settings Brazilian Human Ha... A Guide to th Saved Help Save & E Todd Winningham IV has $5,000 to invest.

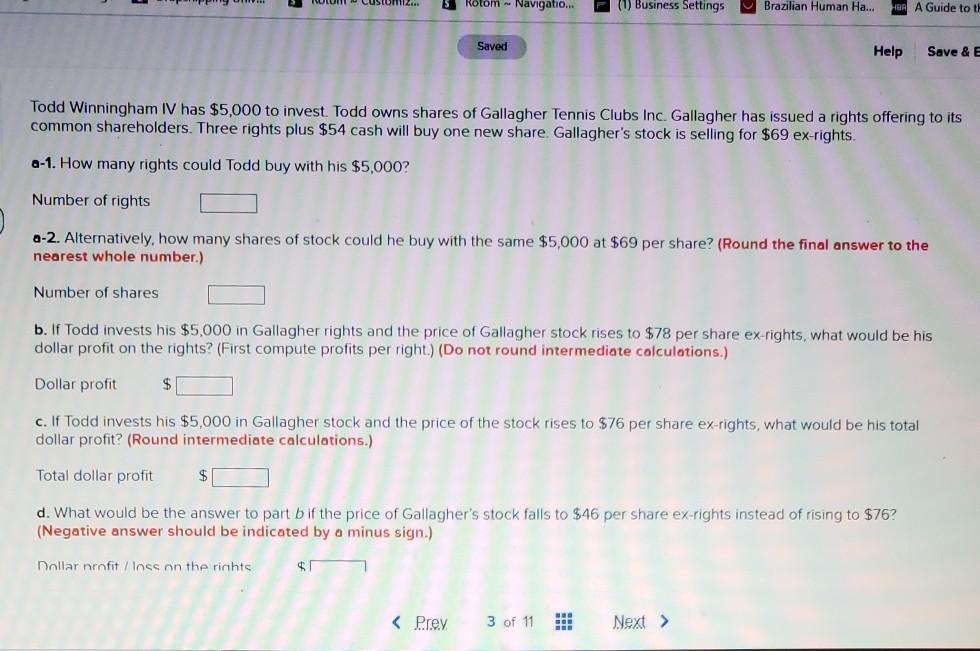

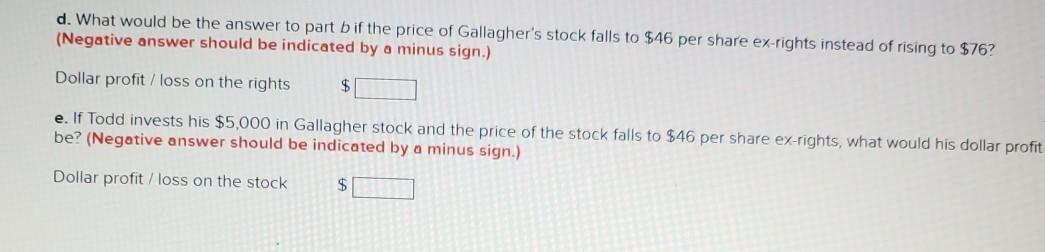

Rotom - Navigatio... (1) Business Settings Brazilian Human Ha... A Guide to th Saved Help Save & E Todd Winningham IV has $5,000 to invest. Todd owns shares of Gallagher Tennis Clubs Inc. Gallagher has issued a rights offering to its common shareholders. Three rights plus $54 cash will buy one new share. Gallagher's stock is selling for $69 ex-rights a-1. How many rights could Todd buy with his $5,000? Number of rights a-2. Alternatively, how many shares of stock could he buy with the same $5,000 at $69 per share? (Round the final answer to the nearest whole number.) Number of shares b. If Todd invests his $5,000 in Gallagher rights and the price of Gallagher stock rises to $78 per share ex-rights, what would be his dollar profit on the rights? (First compute profits per right.) (Do not round intermediate calculations.) Dollar profit c. If Todd invests his $5,000 in Gallagher stock and the price of the stock rises to $76 per share ex-rights, what would be his total dollar profit? (Round intermediate calculations.) Total dollar profit $ d. What would be the answer to part bif the price of Gallagher's stock falls to $46 per share ex-rights instead of rising to $76? (Negative answer should be indicated by a minus sign.) Dollar nrofit / Inss on the rights $ d. What would be the answer to part bif the price of Gallagher's stock falls to $46 per share ex-rights instead of rising to $76? (Negative answer should be indicated by a minus sign.) Dollar profit / loss on the rights $ e. If Todd invests his $5,000 in Gallagher stock and the price of the stock falls to $46 per share ex-rights, what would his dollar profit be? (Negative answer should be indicated by a minus sign.) Dollar profit / loss on the stock $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started