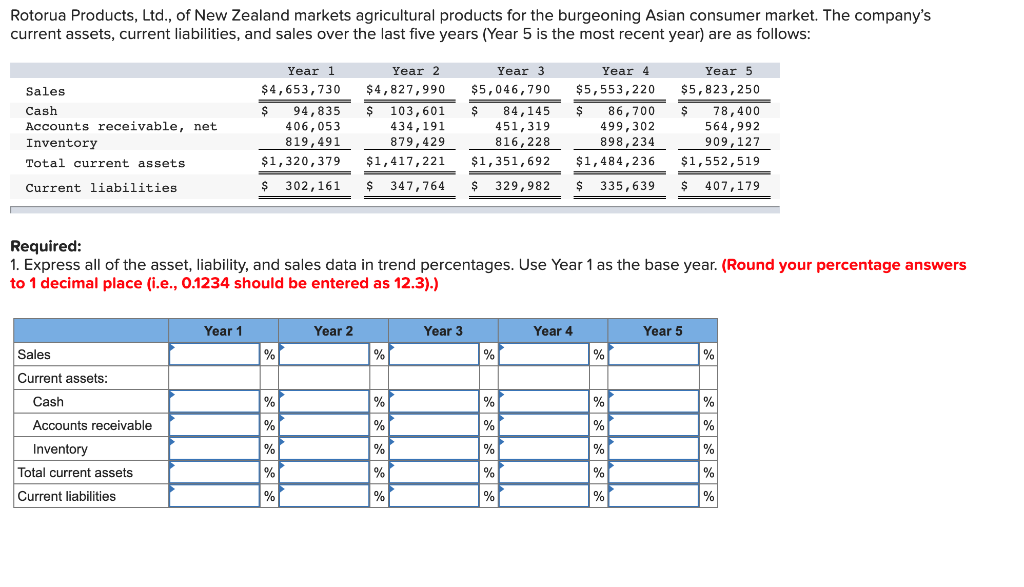

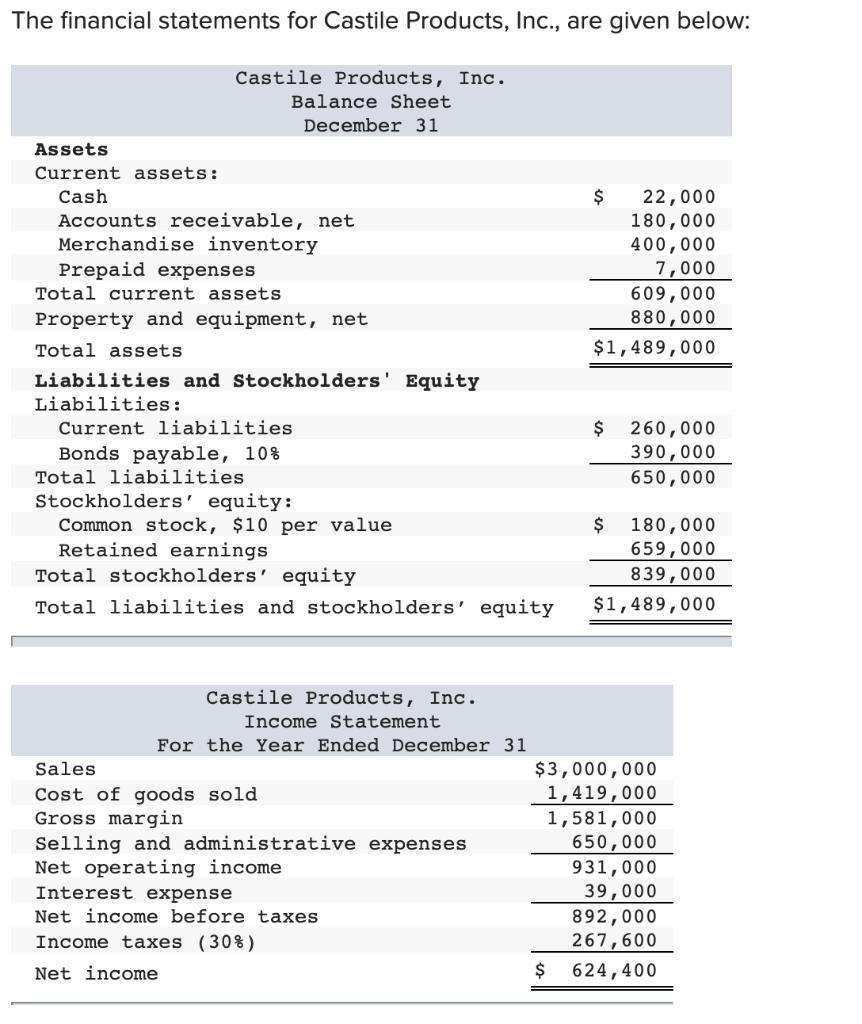

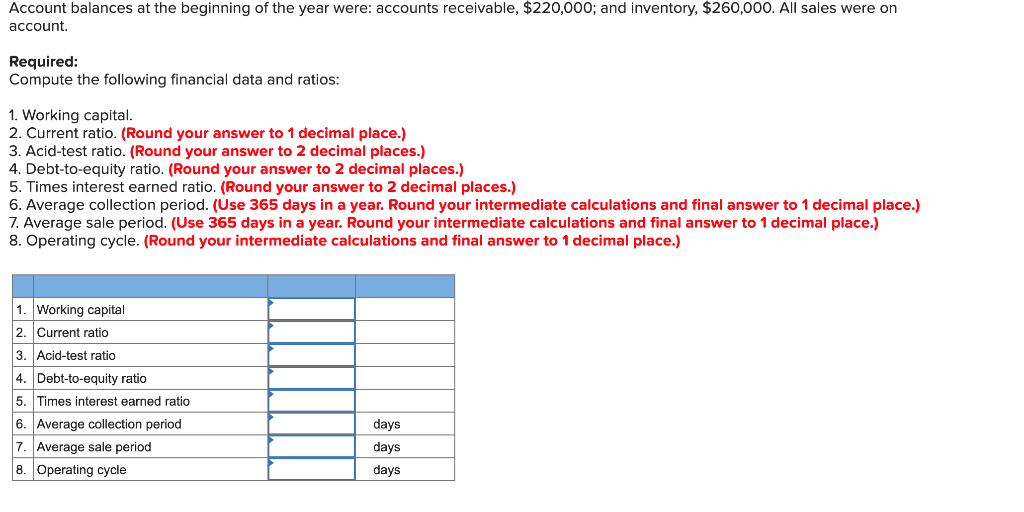

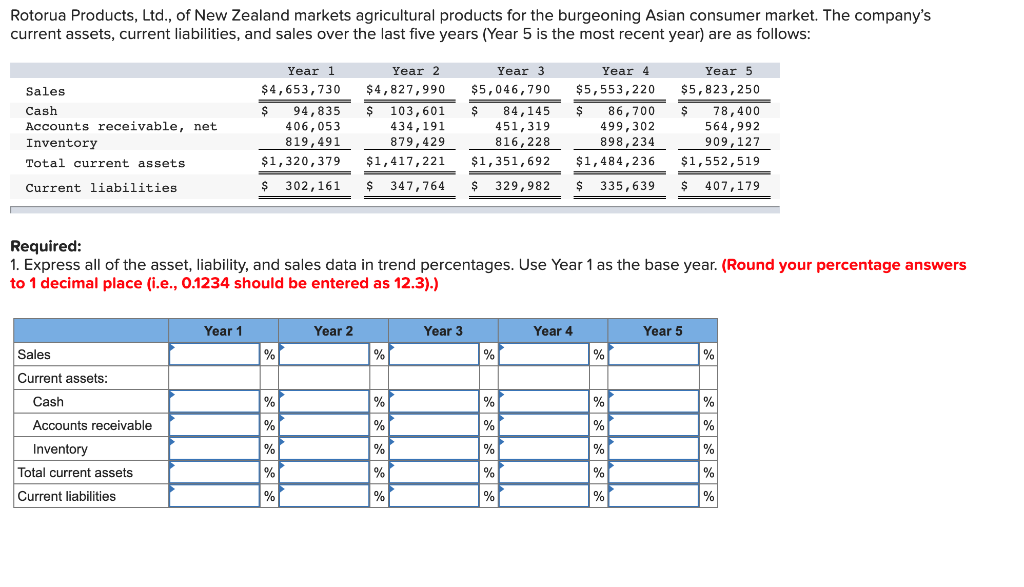

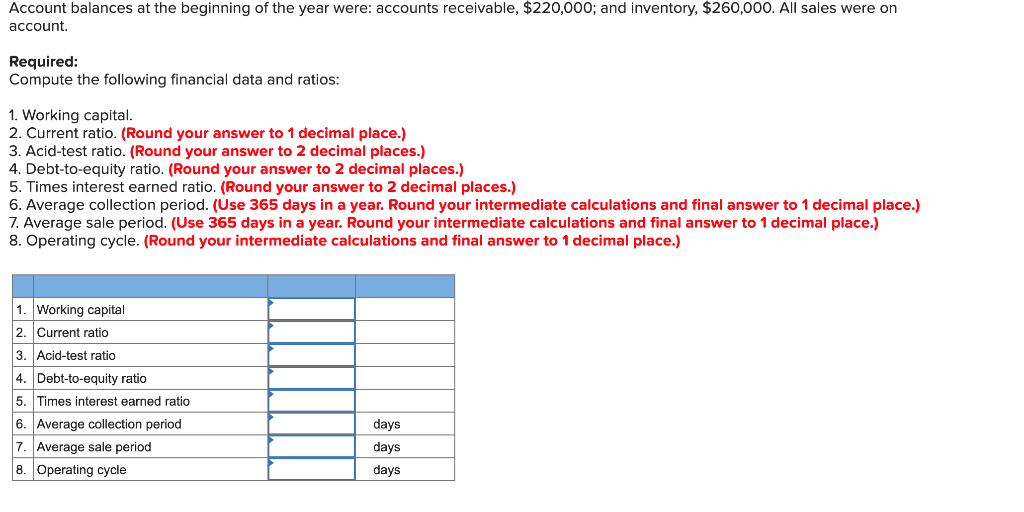

Rotorua Products, Ltd., of New Zealand markets agricultural products for the burgeoning Asian consumer market. The company's current assets, current liabilities, and sales over the last five years (Year 5 is the most recent year) are as follows: Sales Cash Accounts receivable, net Inventory Total current assets Year 1 $4,653,730 $ 94,835 406,053 819,491 $1,320,379 $ 302,161 Year 2 $4,827,990 $ 103,601 434, 191 879,429 $1,417, 221 $ 347,764 Year 3 $5,046,790 $ 84,145 451,319 816, 228 $1,351,692 Year 4 $5,553, 220 $ 86,700 499,302 898, 234 $1,484,236 $ 335, 639 Year 5 $5,823,250 $ 78,400 564,992 909, 127 $1,552,519 $ 407,179 Current liabilities $ 329,982 Required: 1. Express all of the asset, liability, and sales data in trend percentages. Use Year 1 as the base year. (Round your percentage answers to 1 decimal place (i.e., 0.1234 should be entered as 12.3).) Year 1 Year 2 Year 3 Year 4 Year 5 Sales % % % % % % Current assets: Cash Accounts receivable Inventory Total current assets % % % % % % % % % % % % % % % % % % Current liabilities % % The financial statements for Castile Products, Inc., are given below: Castile Products, Inc. Balance Sheet December 31 Assets Current assets: Cash Accounts receivable, net Merchandise inventory Prepaid expenses Total current assets Property and equipment, net Total assets Liabilities and Stockholders' Equity Liabilities: Current liabilities Bonds payable, 10% Total liabilities Stockholders' equity: Common stock, $10 per value Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 22,000 180,000 400,000 7,000 609,000 880,000 $1,489,000 $ 260,000 390,000 650,000 $ 180,000 659,000 839,000 $1,489,000 Castile Products, Inc. Income Statement For the Year Ended December 31 Sales $3,000,000 Cost of goods sold 1,419,000 Gross margin 1,581,000 Selling and administrative expenses 650,000 Net operating income 931,000 Interest expense 39,000 Net income before taxes 892,000 Income taxes (30%) 267,600 Net income $ 624,400 Account balances at the beginning of the year were: accounts receivable, $220,000; and inventory, $260,000. All sales were on account. Required: Compute the following financial data and ratios: 1. Working capital. 2. Current ratio. (Round your answer to 1 decimal place.) 3. Acid-test ratio. (Round your answer to 2 decimal places.) 4. Debt-to-equity ratio. (Round your answer to 2 decimal places.) 5. Times interest earned ratio. (Round your answer to 2 decimal places.) 6. Average collection period. (Use 365 days in a year. Round your intermediate calculations and final answer to 1 decimal place.) 7. Average sale period. (Use 365 days in a year. Round your intermediate calculations and final answer to 1 decimal place.) 8. Operating cycle. (Round your intermediate calculations and final answer to 1 decimal place.) 1. Working capital 2. Current ratio 3 Acid-test ratio 4. Debt-to-equity ratio 5. Times interest earned ratio 6. Average collection period 7. Average sale period 8. Operating cycle days days days