Answered step by step

Verified Expert Solution

Question

1 Approved Answer

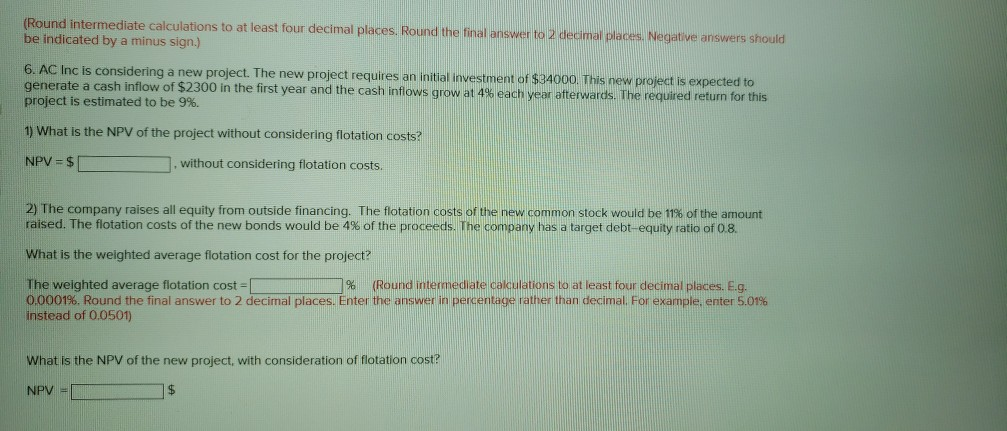

(Round intermediate calculations to at least four decimal places. Round the final answer to 2 decimal places Negative answers should be indicated by a minus

(Round intermediate calculations to at least four decimal places. Round the final answer to 2 decimal places Negative answers should be indicated by a minus sign.) 6. AC Inc is considering a new project. The new project requires an initial investment of $34000. This new project is expected to generate a cash inflow of $2300 in the first year and the cash inflows grow at 4% each year afterwards. The required return for this project is estimated to be 9%. 1) What is the NPV of the project without considering flotation costs? NPV =$1 1. without considering flotation costs. 2) The company raises all equity from outside financing. The flotation costs of the new common stock would be 11% of the amount raised. The flotation costs of the new bonds would be 4% of the proceeds. The company has a target debt-equity ratio of 0.8. What is the weighted average flotation cost for the project? The weighted average flotation cost = 1% (Round intermediate calculations to at least four decimal places. E.g. 0.0001%. Round the final answer to 2 decimal places. Enter the answer in percentage rather than decimal. For example, enter 5.01% instead of 0.0501) What is the NPV of the new project with consideration of flotation cost? NPV = $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started