Answered step by step

Verified Expert Solution

Question

1 Approved Answer

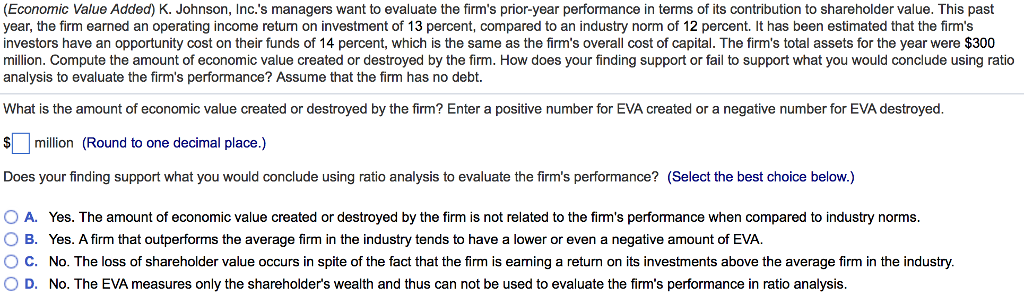

Round to one decimal place. Part 2: Multiple choice (Economic Value Added) K. Johnson, Inc.'s managers want to evaluate the firm's prior-year performance in terms

Round to one decimal place.

Round to one decimal place.

Part 2: Multiple choice

(Economic Value Added) K. Johnson, Inc.'s managers want to evaluate the firm's prior-year performance in terms of its contribution to shareholder value. This past year, the firm earned an operating income retum on investment of 13 percent, compared to an industry norm of 12 percent. It has been estimated that the firm's investors have an opportunity cost on their funds of 14 percent, which is the same as the firm's overall cost of capital. The firm's total assets for the year were $300 million. Compute the amount of economic value created or destroyed by the firm. How does your finding support or fail to support what you would conclude using ratio analysis to evaluate the firm's performance? Assume that the firm has no debt. What is the amount of economic value created or destroyed by the firm? Enter a positive number for EVA created or a negative number for EVA destroyed Smillion (Round to one decimal place.) Does your finding support what you would conclude using ratio analysis to evaluate the firm's performance? (Select the best choice below.) O A. O B. ( C. Yes. The amount of economic value created or destroyed by the firm is not related to the firm's performance when compared to industry norms Yes. A firm that outperforms the average firm in the industry tends to have a lower or even a negative amount of EVA. No. The loss of shareholder value occurs in spite of the fact that the firm is eaming a return on its investments above the average firm in the industry. D. No. The EVA measures only the shareholder's wealth and thus can not be used to evaluate the firm's performance in ratio analysisStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started