Answered step by step

Verified Expert Solution

Question

1 Approved Answer

round to the nearest dollar In 2021, Dangerous Dragon, Inc. (a retail clothing company) sold 535,500 units of its product at an average price of

round to the nearest dollar

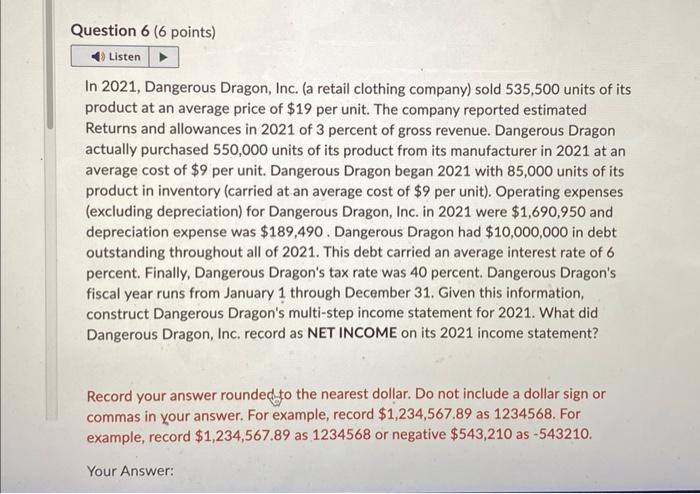

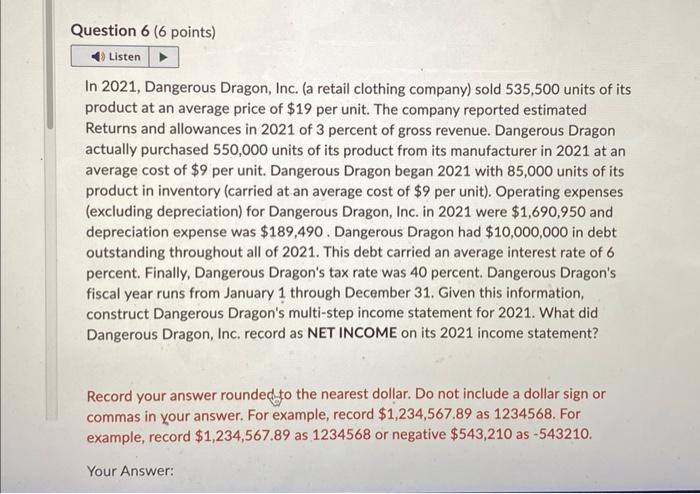

In 2021, Dangerous Dragon, Inc. (a retail clothing company) sold 535,500 units of its product at an average price of $19 per unit. The company reported estimated Returns and allowances in 2021 of 3 percent of gross revenue. Dangerous Dragon actually purchased 550,000 units of its product from its manufacturer in 2021 at an average cost of $9 per unit. Dangerous Dragon began 2021 with 85,000 units of its product in inventory (carried at an average cost of $9 per unit). Operating expenses (excluding depreciation) for Dangerous Dragon, Inc. in 2021 were $1,690,950 and depreciation expense was $189,490. Dangerous Dragon had $10,000,000 in debt outstanding throughout all of 2021. This debt carried an average interest rate of 6 percent. Finally, Dangerous Dragon's tax rate was 40 percent. Dangerous Dragon's fiscal year runs from January 1 through December 31. Given this information, construct Dangerous Dragon's multi-step income statement for 2021 . What did Dangerous Dragon, Inc, record as NET INCOME on its 2021 income statement? Record your answer rounded to the nearest dollar. Do not include a dollar sign or commas in your answer. For example, record $1,234,567.89 as 1234568 . For example, record $1,234,567.89 as 1234568 or negative $543,210 as -543210 . Your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started