Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rounder specializes in the manufacture of ball bearings for aircraft. Direct materials are added at the start of the production process. Conversion costs are

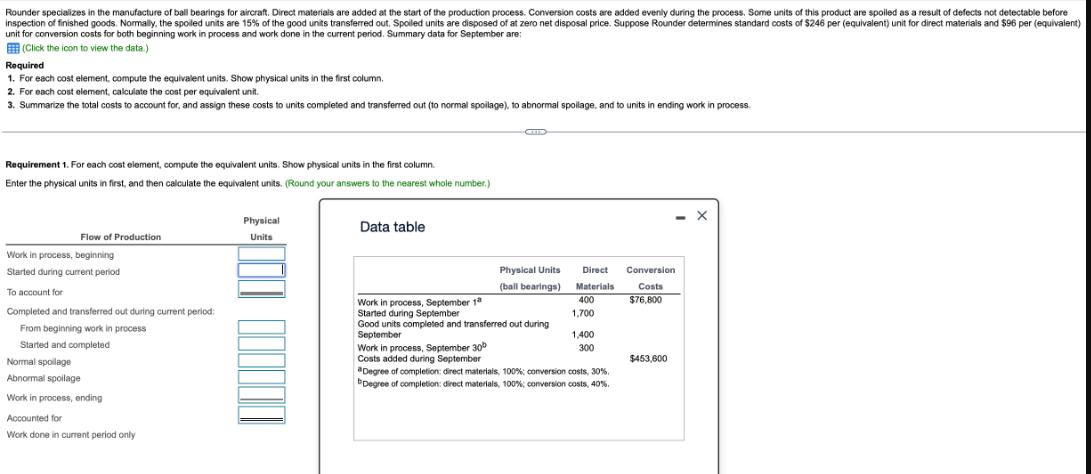

Rounder specializes in the manufacture of ball bearings for aircraft. Direct materials are added at the start of the production process. Conversion costs are added evenly during the process. Some units of this product are spoiled as a result of defects not detectable before inspection of finished goods. Normally, the spoiled units are 15% of the good units transferred out. Spoiled units are disposed of at zero net disposal price. Suppose Rounder determines standard costs of $246 per (equivalent) unit for direct materials and $96 per (equivalent) unit for conversion costs for both beginning work in process and work done in the current period. Summary data for September are: (Click the icon to view the data.). Required 1. For each cost element, compute the equivalent units. Show physical units in the first column. 2. For each cost element, calculate the cost per equivalent unit. 3. Summarize the total costs to account for, and assign these costs to units completed and transferred out (to normal spoilage), to abnormal spollage, and to units in ending work in process. Requirement 1. For each cost element, compute the equivalent units. Show physical units in the first column. Enter the physical units in first, and then calculate the equivalent units. (Round your answers to the nearest whole number.) Flow of Production Work in process, beginning Started during current period To account for Completed and transferred out during current period: From beginning work in process Started and completed Normal spoilage Abnormal spoilage Work in process, ending Accounted for Work done in current period only Physical Units Data table Physical Units (ball bearings) Work in process, September 18 Started during September Good units completed and transferred out during September Work in process, September 30 Costs added during September Direct Materials 400 1,700 1,400 300 Degree of completion: direct materials, 100%; conversion costs, 30% Degree of completion: direct materials, 100%; conversion costs, 40%. Conversion Costs $76,800 $453,600 X

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To compute the equivalent units for each cost element well need to consider the physical units and the degree of completion for both direct materials ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started