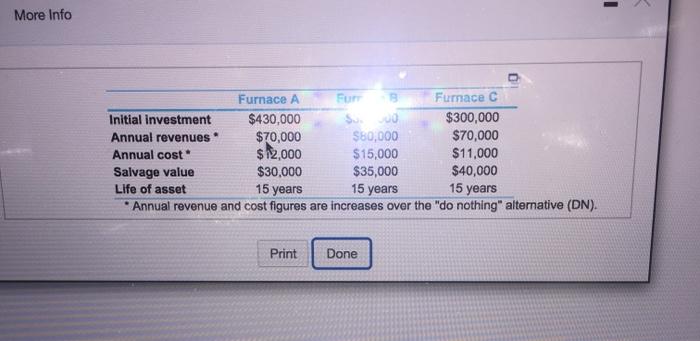

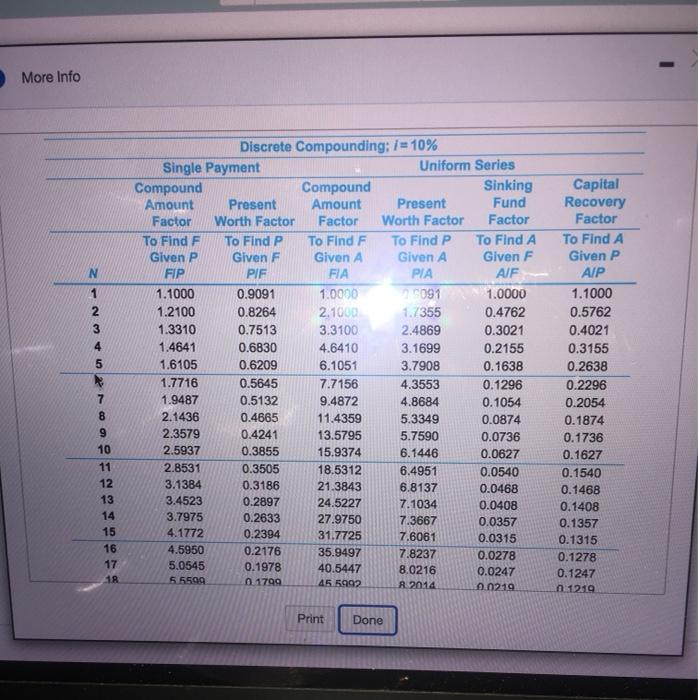

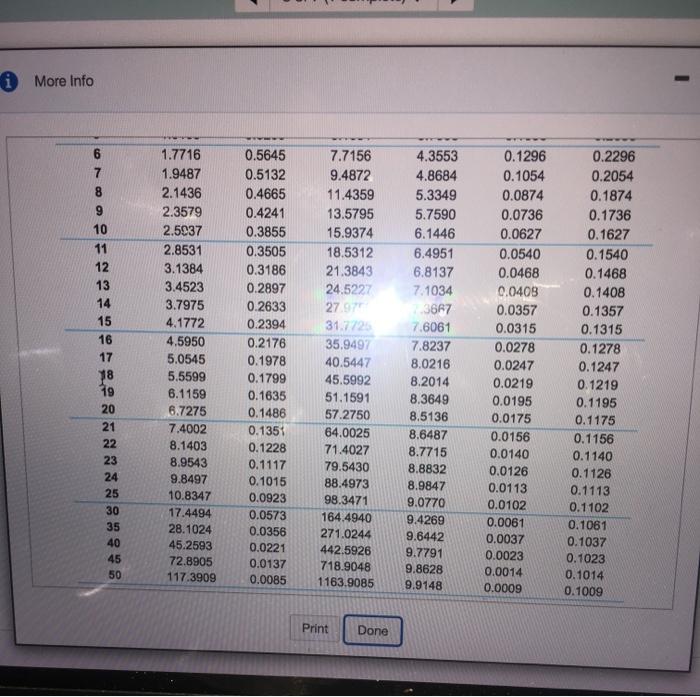

route Fancy in conceding a new trace that will show them to be more productive. Then allemande nacen we under consideration. Porten en verwarto analysis of the tematy Dows. The MARR 10% per year em Clax the toon to view the description of the tematies Cick the icon to view the interest and mulyate for discrete compounding when the MARRI 10 pryw. Perform the incremental PW Anwys vain the table below Onder heatives by creating capital investment on the west) Pw All Investment A al AL - More Info Furnace A Fur Fumace C Initial investment $430,000 JO $300,000 Annual revenues $70,000 $80,000 $70,000 Annual cost $ 12,000 $15,000 $11,000 Salvage value $30,000 $35,000 $40,000 Life of asset 15 years 15 years * Annual revenue and cost figures are increases over the "do nothing" alternative (DN). 15 years Print Done More Info N 1 2 3 4 5 Discrete Compounding: 1 - 10% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP PIF FIA PIA AIF 1.1000 0.9091 1.0000 3091 1.0000 1.2100 0.8264 2.1000 1.7355 0.4762 1.3310 0.7513 3.3100 2.4869 0.3021 1.4641 0.6830 4.6410 3.1699 0.2155 1.6105 0.6209 6.1051 3.7908 0.1638 1.7716 0.5645 7.7156 4.3553 0.1296 1.9487 0.5132 9.4872 4.8684 0.1054 2.1436 0.4665 11.4359 5.3349 0.0874 2.3579 0.4241 13.5795 5.7590 0.0736 2.5937 0.3855 15.9374 6.1446 0.0627 2.8531 0.3505 18.5312 6.4951 0.0540 3.1384 0.3186 21.3843 6.8137 0.0468 3.4523 0.2897 24.5227 7.1034 0.0408 3.7975 0.2633 27.9750 7.3667 0.0357 4.1772 0.2394 31.7725 7.6061 0.0315 4.5950 0.2176 35.9497 7.8237 0.0278 5.0545 0.1978 40.5447 8.0216 0.0247 6.5599 0.1799 45 5992 8. 2014 0.0219 Capital Recovery Factor To Find A Given P AIP 1.1000 0.5762 0.4021 0.3155 0.2638 0.2296 0.2054 0.1874 0.1736 0.1627 0.1540 0.1468 0.1408 0.1357 0.1315 0.1278 0.1247 0 1219 7 8 9 10 11 12 13 14 15 16 17 18 Print Done i More Info - 6 7 8 9 10 11 12 13 14 15 16 17 38 19 20 21 22 23 24 25 30 35 40 45 50 1.7716 1.9487 2.1436 2.3579 2.5937 2.8531 3.1384 3.4523 3.7975 4.1772 4.5950 5.0545 5.5599 6.1159 6.7275 7.4002 8.1403 8.9543 9.8497 10.8347 17.4494 28.1024 45.2593 72.8905 117.3909 0.5645 0.5132 0.4665 0.4241 0.3855 0.3505 0.3186 0.2897 0.2633 0.2394 0.2176 0.1978 0.1799 0.1635 0.1486 0.1351 0.1228 0.1117 0.1015 0.0923 0.0573 0.0356 0.0221 0.0137 0.0085 7.7156 9.4872 11.4359 13.5795 15.9374 18.5312 21.3843 24.5227 27.97 31.772 35.9497 40.5447 45.5992 51.1591 57.2750 64.0025 71.4027 79.5430 88.4973 99.3471 164.4940 271.0244 442.5926 718.9048 1163.9085 4.3553 4.8684 5.3349 5.7590 6.1446 6.4951 6.8137 7.1034 3667 7.6061 7.8237 8.0216 8.2014 8.3649 8.5136 8.6487 8.7715 8.8832 8.9847 9.0770 9.4269 9.6442 9.7791 9.8628 9.9148 0.1296 0.1054 0.0874 0.0736 0.0627 0.0540 0.0468 0.0403 0.0357 0.0315 0.0278 0.0247 0.0219 0.0195 0.0175 0.0156 0.0140 0.0126 0.0113 0.0102 0.0061 0.0037 0.0023 0.0014 0.0009 0.2296 0.2054 0.1874 0.1736 0.1627 0.1540 0.1468 0.1408 0.1357 0.1315 0.1278 0.1247 0.1219 0.1195 0.1175 0.1156 0.1140 0.1126 0.1113 0.1102 0.1061 0.1037 0.1023 0.1014 0.1009 Print Done route Fancy in conceding a new trace that will show them to be more productive. Then allemande nacen we under consideration. Porten en verwarto analysis of the tematy Dows. The MARR 10% per year em Clax the toon to view the description of the tematies Cick the icon to view the interest and mulyate for discrete compounding when the MARRI 10 pryw. Perform the incremental PW Anwys vain the table below Onder heatives by creating capital investment on the west) Pw All Investment A al AL - More Info Furnace A Fur Fumace C Initial investment $430,000 JO $300,000 Annual revenues $70,000 $80,000 $70,000 Annual cost $ 12,000 $15,000 $11,000 Salvage value $30,000 $35,000 $40,000 Life of asset 15 years 15 years * Annual revenue and cost figures are increases over the "do nothing" alternative (DN). 15 years Print Done More Info N 1 2 3 4 5 Discrete Compounding: 1 - 10% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP PIF FIA PIA AIF 1.1000 0.9091 1.0000 3091 1.0000 1.2100 0.8264 2.1000 1.7355 0.4762 1.3310 0.7513 3.3100 2.4869 0.3021 1.4641 0.6830 4.6410 3.1699 0.2155 1.6105 0.6209 6.1051 3.7908 0.1638 1.7716 0.5645 7.7156 4.3553 0.1296 1.9487 0.5132 9.4872 4.8684 0.1054 2.1436 0.4665 11.4359 5.3349 0.0874 2.3579 0.4241 13.5795 5.7590 0.0736 2.5937 0.3855 15.9374 6.1446 0.0627 2.8531 0.3505 18.5312 6.4951 0.0540 3.1384 0.3186 21.3843 6.8137 0.0468 3.4523 0.2897 24.5227 7.1034 0.0408 3.7975 0.2633 27.9750 7.3667 0.0357 4.1772 0.2394 31.7725 7.6061 0.0315 4.5950 0.2176 35.9497 7.8237 0.0278 5.0545 0.1978 40.5447 8.0216 0.0247 6.5599 0.1799 45 5992 8. 2014 0.0219 Capital Recovery Factor To Find A Given P AIP 1.1000 0.5762 0.4021 0.3155 0.2638 0.2296 0.2054 0.1874 0.1736 0.1627 0.1540 0.1468 0.1408 0.1357 0.1315 0.1278 0.1247 0 1219 7 8 9 10 11 12 13 14 15 16 17 18 Print Done i More Info - 6 7 8 9 10 11 12 13 14 15 16 17 38 19 20 21 22 23 24 25 30 35 40 45 50 1.7716 1.9487 2.1436 2.3579 2.5937 2.8531 3.1384 3.4523 3.7975 4.1772 4.5950 5.0545 5.5599 6.1159 6.7275 7.4002 8.1403 8.9543 9.8497 10.8347 17.4494 28.1024 45.2593 72.8905 117.3909 0.5645 0.5132 0.4665 0.4241 0.3855 0.3505 0.3186 0.2897 0.2633 0.2394 0.2176 0.1978 0.1799 0.1635 0.1486 0.1351 0.1228 0.1117 0.1015 0.0923 0.0573 0.0356 0.0221 0.0137 0.0085 7.7156 9.4872 11.4359 13.5795 15.9374 18.5312 21.3843 24.5227 27.97 31.772 35.9497 40.5447 45.5992 51.1591 57.2750 64.0025 71.4027 79.5430 88.4973 99.3471 164.4940 271.0244 442.5926 718.9048 1163.9085 4.3553 4.8684 5.3349 5.7590 6.1446 6.4951 6.8137 7.1034 3667 7.6061 7.8237 8.0216 8.2014 8.3649 8.5136 8.6487 8.7715 8.8832 8.9847 9.0770 9.4269 9.6442 9.7791 9.8628 9.9148 0.1296 0.1054 0.0874 0.0736 0.0627 0.0540 0.0468 0.0403 0.0357 0.0315 0.0278 0.0247 0.0219 0.0195 0.0175 0.0156 0.0140 0.0126 0.0113 0.0102 0.0061 0.0037 0.0023 0.0014 0.0009 0.2296 0.2054 0.1874 0.1736 0.1627 0.1540 0.1468 0.1408 0.1357 0.1315 0.1278 0.1247 0.1219 0.1195 0.1175 0.1156 0.1140 0.1126 0.1113 0.1102 0.1061 0.1037 0.1023 0.1014 0.1009 Print Done