Question

Rowan, Inc.'s, income statement is shown below. Based on this income statement and the other information provided, calculate the net cash provided by operations using

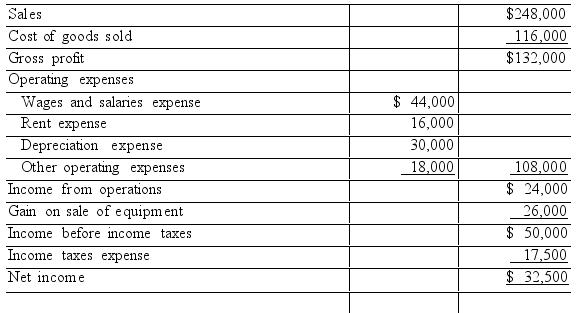

Rowan, Inc.'s, income statement is shown below. Based on this income statement and the other information provided, calculate the net cash provided by operations using the indirect method. Rowan, Inc. Income Statement For Year Ended December 31, 2015.

Sales $248,000 Cost of goods sold Gross profit Operating expenses Wages and salaries expense Rent expense 116,000 $132,000 $ 44,000 16,000 30,000 Depreciation expense Other operating expenses Income from operations Gain on sale of equipment 18,000 108,000 $ 24,000 26,000 $ 50,000 Income before income taxes Income taxes expense 17,500 Net income $ 32,500

Step by Step Solution

3.30 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

A B 1 Particulars Amount Amount 2 Cash flow from operating activities 3 Net income 24000 Adjsutmen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald E. Kieso, Jerry J. Weygandt, and Terry D. Warfield

15th edition

978-1118159644, 9781118562185, 1118159640, 1118147294, 978-1118147290

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App