Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rowe Tool and Die (RTD) produces metal fittings as a supplier to various manufacturing firms in the area. The following is the forecasted income

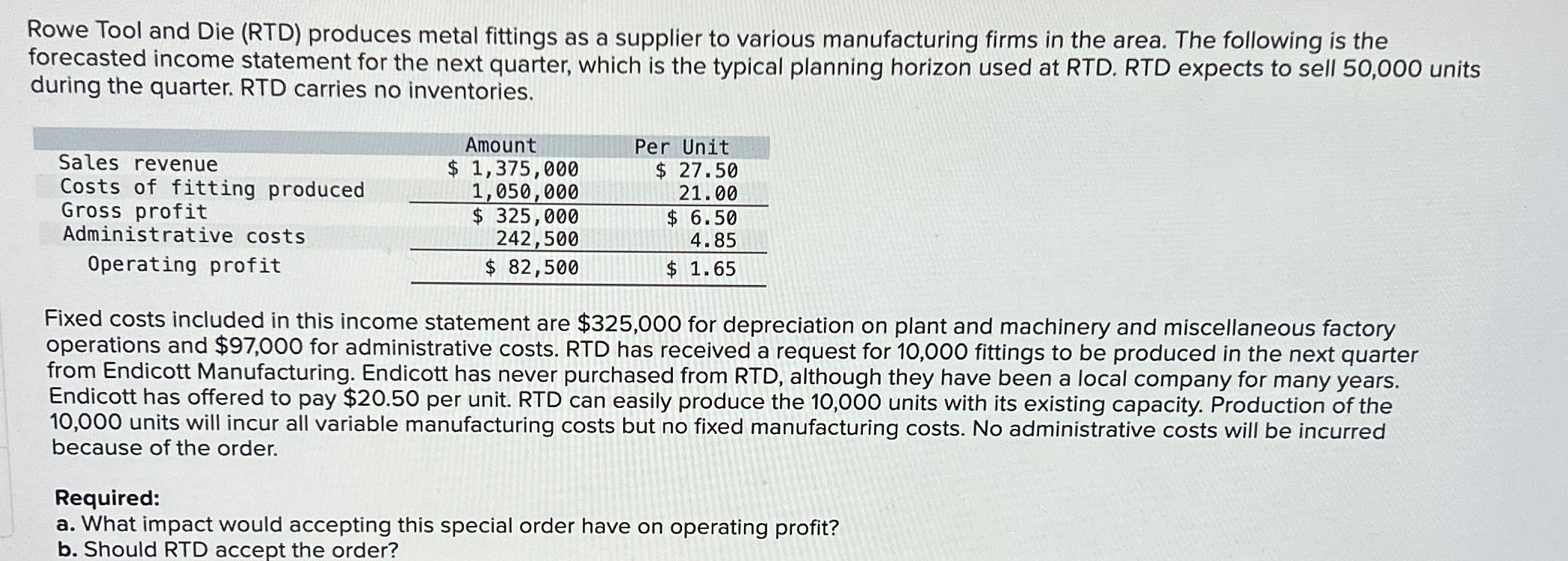

Rowe Tool and Die (RTD) produces metal fittings as a supplier to various manufacturing firms in the area. The following is the forecasted income statement for the next quarter, which is the typical planning horizon used at RTD. RTD expects to sell 50,000 units during the quarter. RTD carries no inventories. Sales revenue Costs of fitting produced Gross profit Administrative costs Operating profit Amount $ 1,375,000 1,050,000 $ 325,000 242,500 Per Unit $ 82,500 $ 27.50 21.00 $ 6.50 4.85 $ 1.65 Fixed costs included in this income statement are $325,000 for depreciation on plant and machinery and miscellaneous factory operations and $97,000 for administrative costs. RTD has received a request for 10,000 fittings to be produced in the next quarter from Endicott Manufacturing. Endicott has never purchased from RTD, although they have been a local company for many years. Endicott has offered to pay $20.50 per unit. RTD can easily produce the 10,000 units with its existing capacity. Production of the 10,000 units will incur all variable manufacturing costs but no fixed manufacturing costs. No administrative costs will be incurred because of the order. Required: a. What impact would accepting this special order have on operating profit? b. Should RTD accept the order?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Impact of Accepting the Special Order on Operating Profit a Increased Revenue 10000 units 2050unit 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started