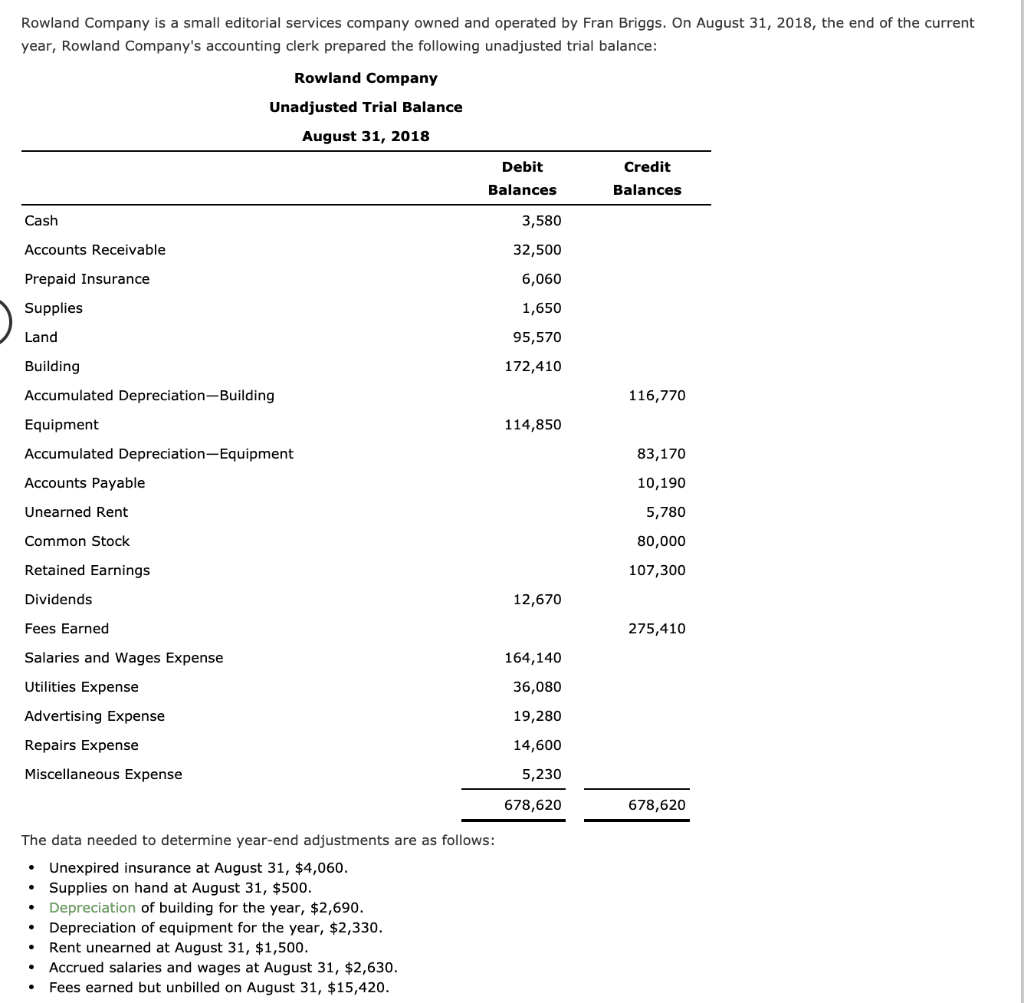

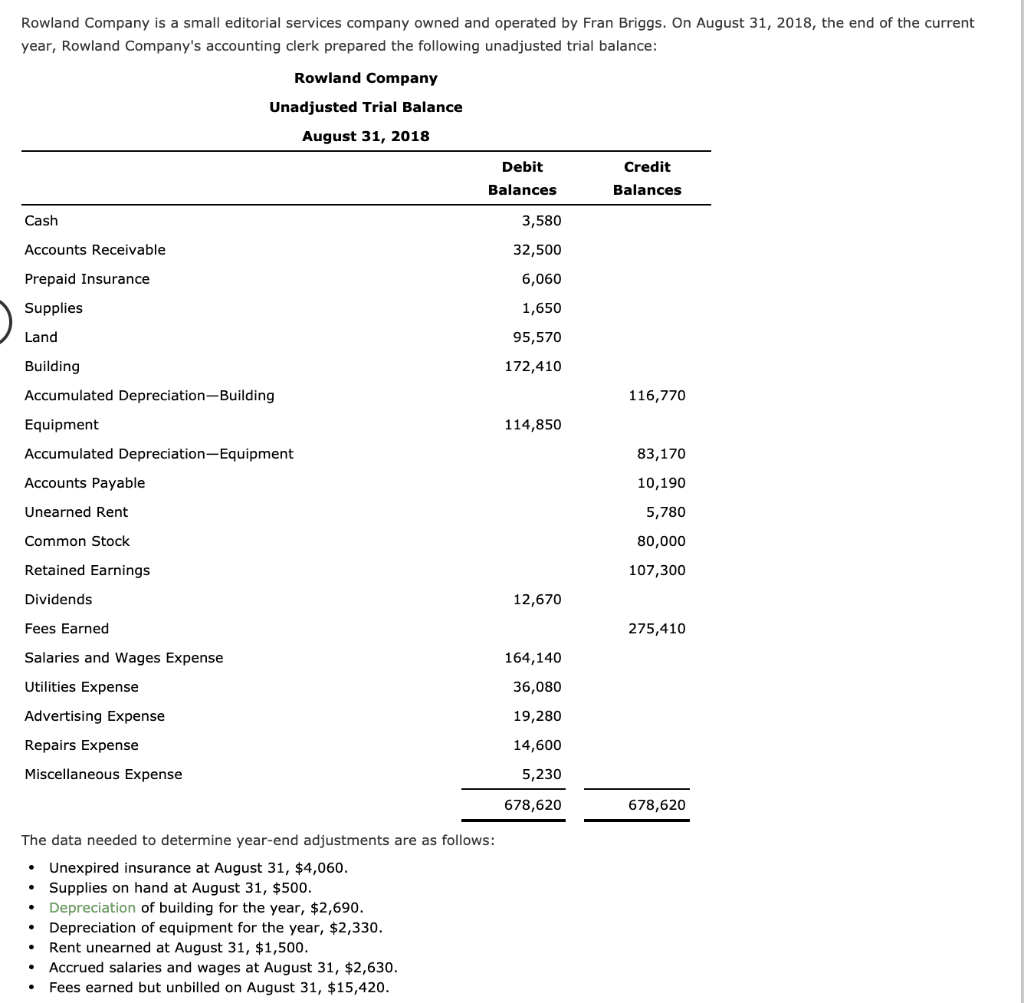

Rowland Company is a small editorial services company owned and operated by Fran Briggs. On August 31, 2018, the end of the current year, Rowland Company's accounting clerk prepared the following unadjusted trial balance: Rowland Company Unadjusted Trial Balance August 31, 2018 Debit Credit Balances Balances Cash 3,580 32,500 Accounts Receivable Prepaid Insurance 6,060 Supplies 1,650 Land 95,570 Building 172,410 Accumulated Depreciation-Building 116,770 Equipment 114,850 Accumulated Depreciation-Equipment 83,170 Accounts Payable 10,190 Unearned Rent 5,780 80,000 Common Stock Retained Earnings 107,300 Dividends 12,670 Fees Earned 275,410 Salaries and Wages Expense 164,140 Utilities Expense 36,080 Advertising Expense 19,280 Repairs Expense 14,600 Miscellaneous Expense 5,230 678,620 678,620 The data needed to determine year-end adjustments are as follows: Unexpired insurance at August 31, $4,060. Supplies on hand at August 31, $500. Depreciation of building for the year, $2,690. Depreciation of equipment for the year, $2,330. Rent unearned at August 31, $1,500. Accrued salaries and wages at August 31, $2,630. Fees earned but unbilled on August 31, $15,420. Rowland Company is a small editorial services company owned and operated by Fran Briggs. On August 31, 2018, the end of the current year, Rowland Company's accounting clerk prepared the following unadjusted trial balance: Rowland Company Unadjusted Trial Balance August 31, 2018 Debit Credit Balances Balances Cash 3,580 32,500 Accounts Receivable Prepaid Insurance 6,060 Supplies 1,650 Land 95,570 Building 172,410 Accumulated Depreciation-Building 116,770 Equipment 114,850 Accumulated Depreciation-Equipment 83,170 Accounts Payable 10,190 Unearned Rent 5,780 80,000 Common Stock Retained Earnings 107,300 Dividends 12,670 Fees Earned 275,410 Salaries and Wages Expense 164,140 Utilities Expense 36,080 Advertising Expense 19,280 Repairs Expense 14,600 Miscellaneous Expense 5,230 678,620 678,620 The data needed to determine year-end adjustments are as follows: Unexpired insurance at August 31, $4,060. Supplies on hand at August 31, $500. Depreciation of building for the year, $2,690. Depreciation of equipment for the year, $2,330. Rent unearned at August 31, $1,500. Accrued salaries and wages at August 31, $2,630. Fees earned but unbilled on August 31, $15,420