Answered step by step

Verified Expert Solution

Question

1 Approved Answer

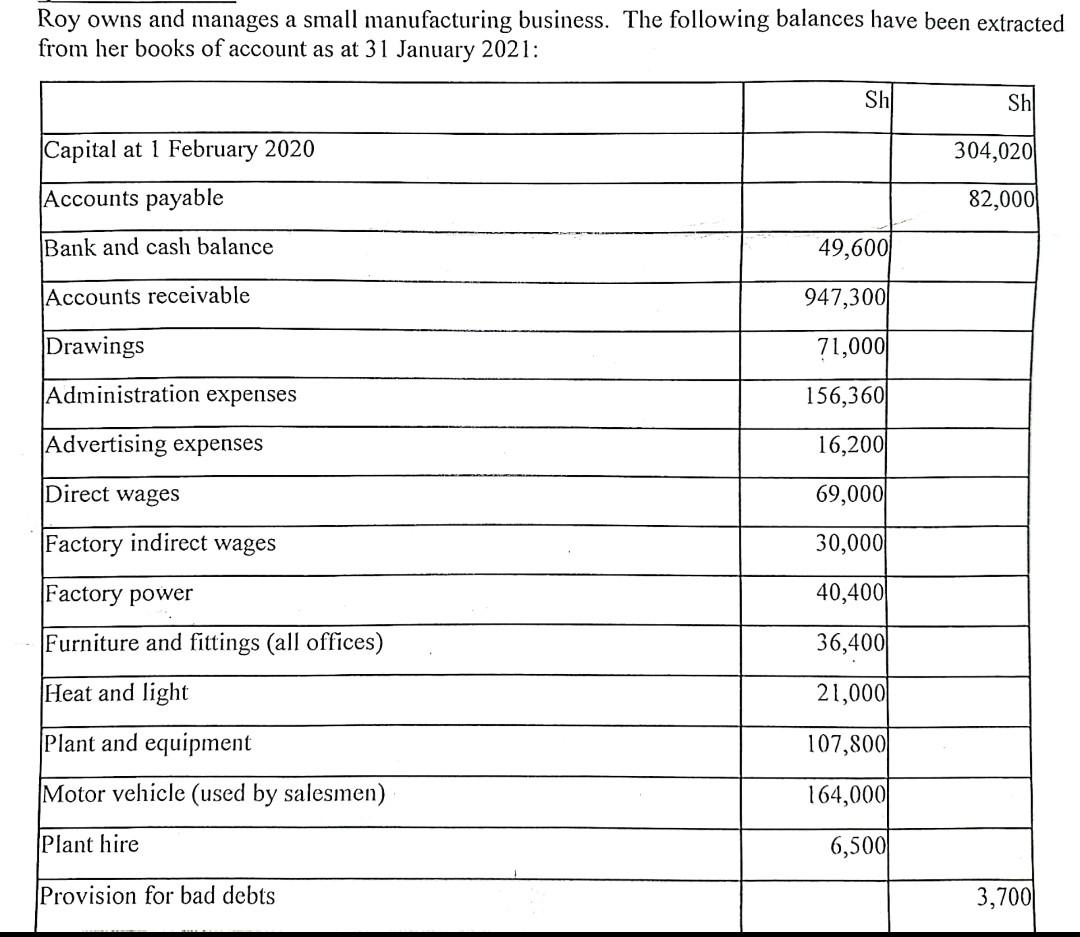

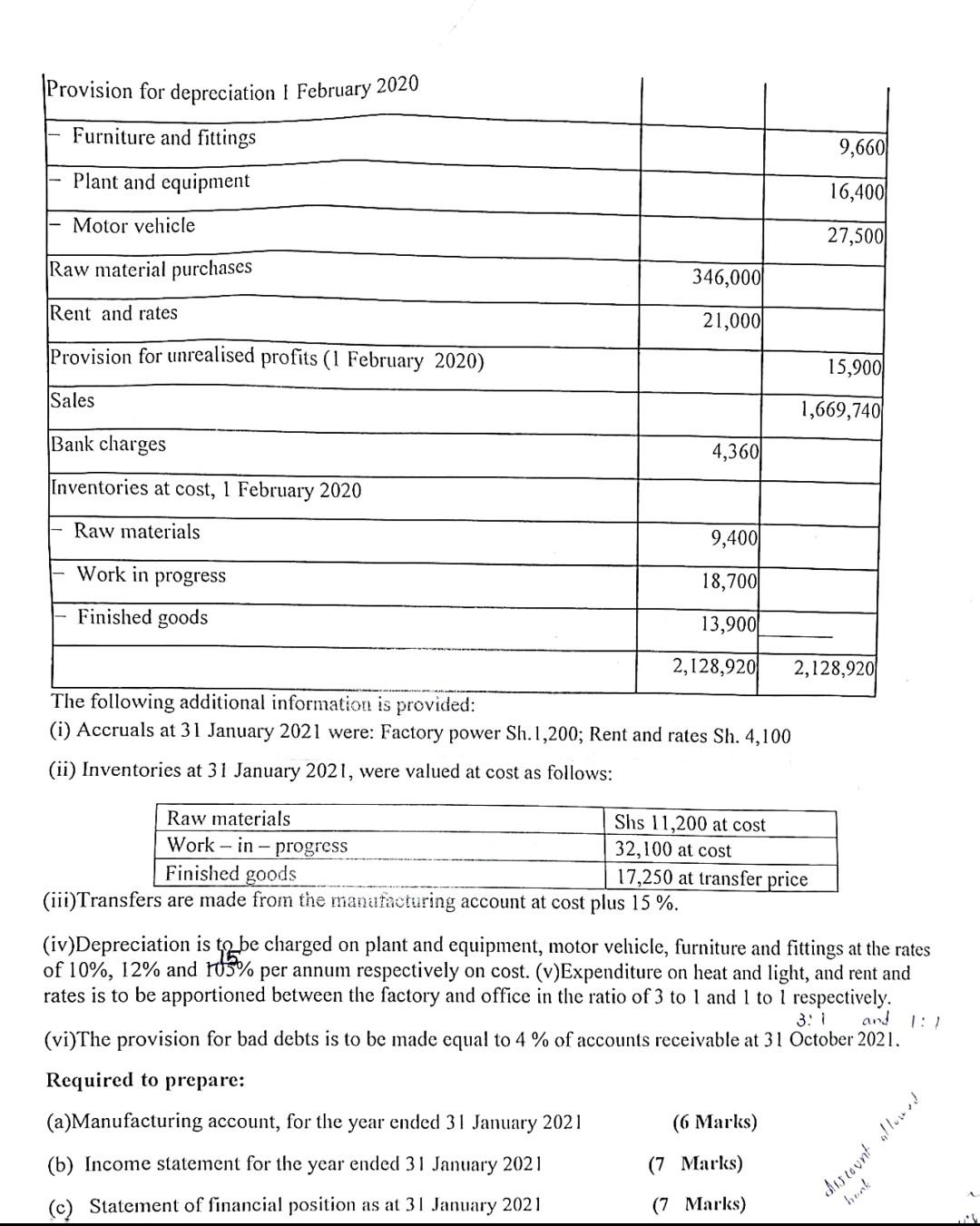

Roy owns and manages a small manufacturing business. The following balances have been extracted (i) Accruals at 31 January 2021 were: Factory power Sh.1,200; Rent

Roy owns and manages a small manufacturing business. The following balances have been extracted (i) Accruals at 31 January 2021 were: Factory power Sh.1,200; Rent and rates Sh. 4,100 (ii) Inventories at 31 January 2021 , were valued at cost as follows: (iii)Transfers are made trom the manatacturing account at cost plus 15%. (iv)Depreciation is tq be charged on plant and equipment, motor velicle, furniture and fittings at the rates of 10%,12% and 105% per annum respectively on cost. (v)Expenditure on heat and light, and rent and rates is to be apportioned between the factory and office in the ratio of 3 to 1 and 1 to 1 respectively. (vi)The provision for bad debts is to be made equal to 4% of accounts receivable at 31 October 2021 . Required to prepare: (a)Manufacturing account, for the year ended 31 January 2021 (6 Marks) (b) Income statement for the year ended 31 January 2021 (7 Marks) (c) Statement of financial position as at 31 January 2021 (7 Marks) Roy owns and manages a small manufacturing business. The following balances have been extracted (i) Accruals at 31 January 2021 were: Factory power Sh.1,200; Rent and rates Sh. 4,100 (ii) Inventories at 31 January 2021 , were valued at cost as follows: (iii)Transfers are made trom the manatacturing account at cost plus 15%. (iv)Depreciation is tq be charged on plant and equipment, motor velicle, furniture and fittings at the rates of 10%,12% and 105% per annum respectively on cost. (v)Expenditure on heat and light, and rent and rates is to be apportioned between the factory and office in the ratio of 3 to 1 and 1 to 1 respectively. (vi)The provision for bad debts is to be made equal to 4% of accounts receivable at 31 October 2021 . Required to prepare: (a)Manufacturing account, for the year ended 31 January 2021 (6 Marks) (b) Income statement for the year ended 31 January 2021 (7 Marks) (c) Statement of financial position as at 31 January 2021 (7 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started