Question

Royal Gorge Company uses the gross profit method to estimate ending inventory and cost of goods sold when preparing monthly financial statements required by its

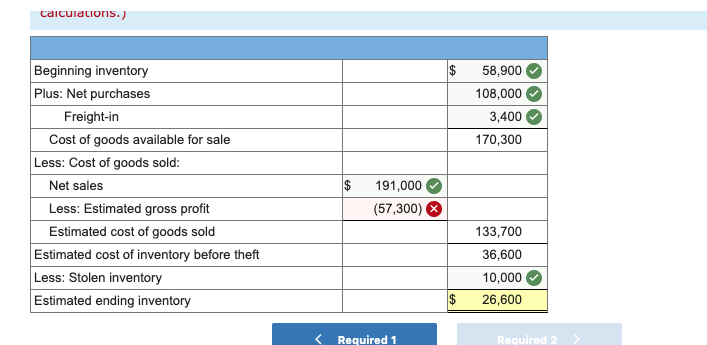

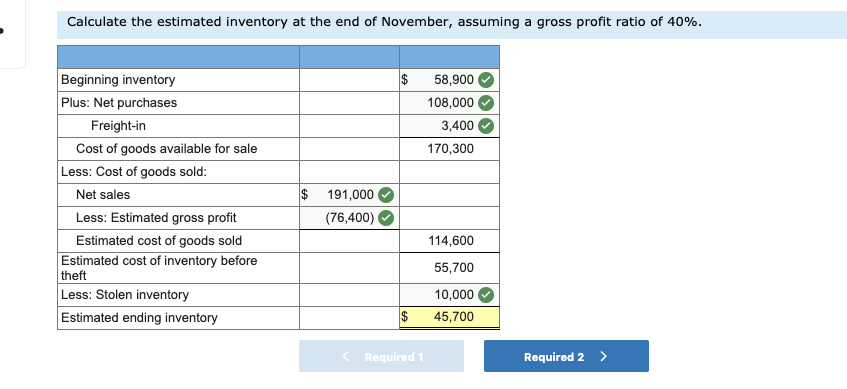

Royal Gorge Company uses the gross profit method to estimate ending inventory and cost of goods sold when preparing monthly financial statements required by its bank. Inventory on hand at the end of October was $58,900. The following information for the month of November was available from company records: Purchases $ 114,000 Freight-in 3,400 Sales 200,000 Sales returns 9,000 Purchases returns 6,000 In addition, the controller is aware of $10,000 of inventory that was stolen during November from one of the company's warehouses. Required: 1. Calculate the estimated inventory at the end of November, assuming a gross profit ratio of 40%. 2. Calculate the estimated inventory at the end of November, assuming a markup on cost of 60%.

Royal Gorge Company uses the gross profit method to estimate ending inventory and cost of goods sold when preparing monthly financial statements required by its bank. Inventory on hand at the end of October was $58,900. The following information for the month of November was available from company records: Purchases $ 114,000 Freight-in 3,400 Sales 200,000 Sales returns 9,000 Purchases returns 6,000 In addition, the controller is aware of $10,000 of inventory that was stolen during November from one of the company's warehouses. Required: 1. Calculate the estimated inventory at the end of November, assuming a gross profit ratio of 40%. 2. Calculate the estimated inventory at the end of November, assuming a markup on cost of 60%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started