Answered step by step

Verified Expert Solution

Question

1 Approved Answer

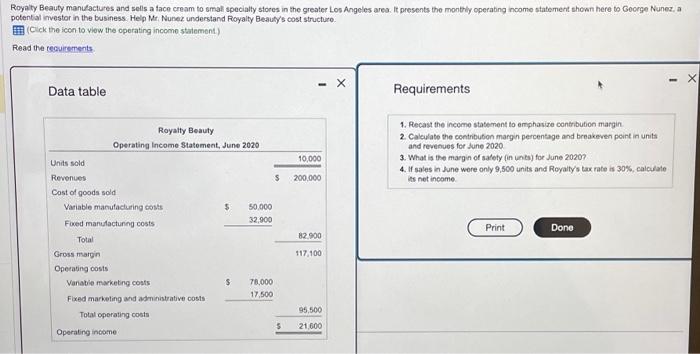

Royalty Beauty manufactures and sells a face cream to small specialty stores in the greater Los Angeles area. It presents the monthly operating income

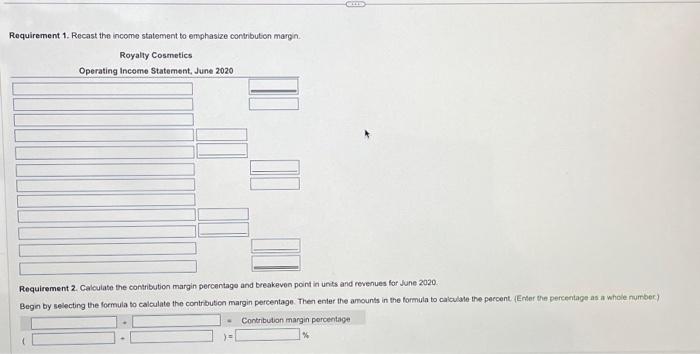

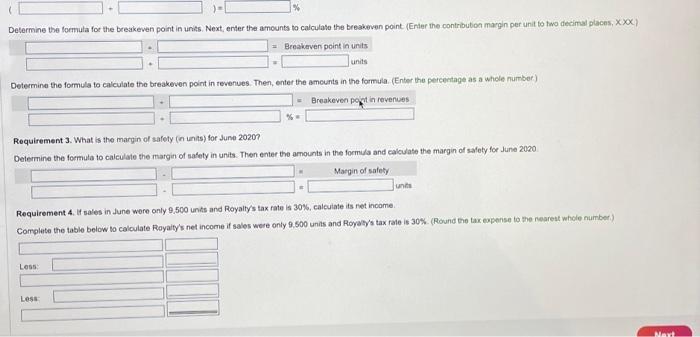

Royalty Beauty manufactures and sells a face cream to small specialty stores in the greater Los Angeles area. It presents the monthly operating income statement shown here to George Nunez, a potential investor in the business. Help Mr. Nunez understand Royalty Beauty's cost structure. (Click the icon to view the operating income statement.) Read the requirements Data table Royalty Beauty Operating Income Statement, June 2020 Requirements 1. Recast the income statement to emphasize contribution margin 2. Calculate the contribution margin percentage and breakeven point in units and revenues for June 2020 10,000 3. What is the margin of safety (in units) for June 20207 4. If sales in June were only 9,500 units and Royalty's tax rate is 30%, calculate $ 200,000 its net income. Units sold Revenues Cost of goods sold Variable manufacturing costs $ 50,000 Foxed manufacturing costs 32,900 82.900 Total Gross margin 1 117,100 Operating costs Vanable marketing costs $ 78,000 Fixed marketing and administrative costs 17,500 Total operating costs 95,500 S 21,600 Operating income - Print Done X Royalty Beauty manufactures and sells a face cream to small specialty stores in the greater Los Angeles area. It presents the monthly operating income statement shown here to George Nunez, a potential investor in the business. Help Mr. Nunez understand Royalty Beauty's cost structure. (Click the icon to view the operating income statement.) Read the requirements Data table Royalty Beauty Operating Income Statement, June 2020 Requirements 1. Recast the income statement to emphasize contribution margin 2. Calculate the contribution margin percentage and breakeven point in units and revenues for June 2020 10,000 3. What is the margin of safety (in units) for June 20207 4. If sales in June were only 9,500 units and Royalty's tax rate is 30%, calculate $ 200,000 its net income. Units sold Revenues Cost of goods sold Variable manufacturing costs $ 50,000 Foxed manufacturing costs 32,900 82.900 Total Gross margin 1 117,100 Operating costs Vanable marketing costs $ 78,000 Fixed marketing and administrative costs 17,500 Total operating costs 95,500 S 21,600 Operating income - Print Done X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started