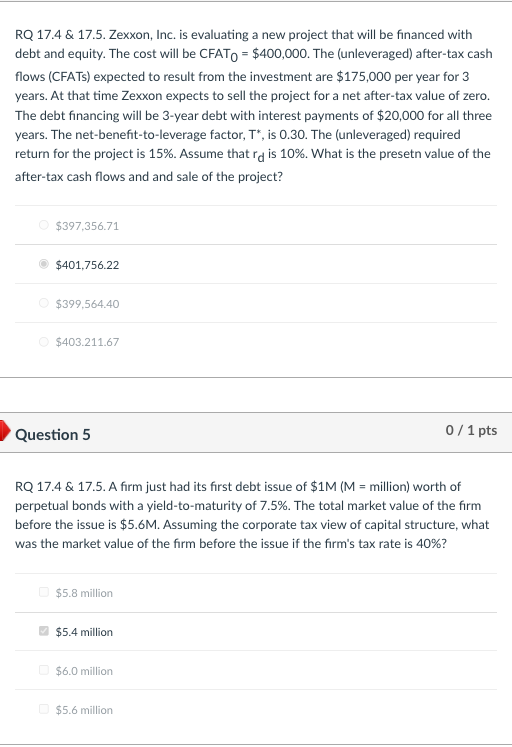

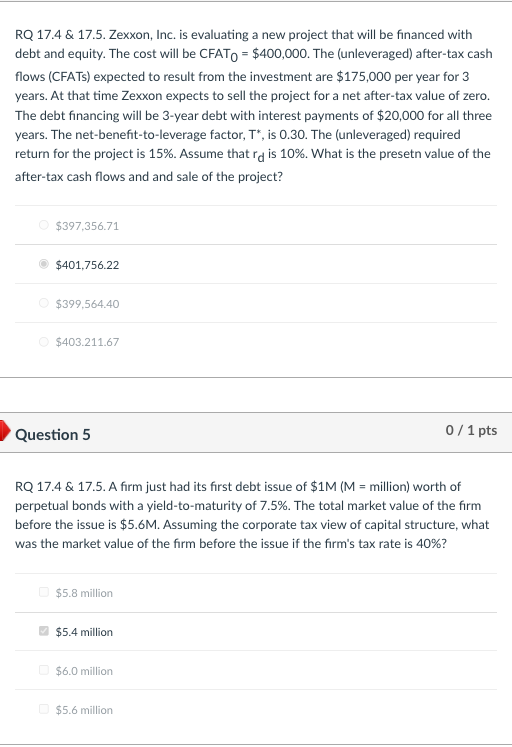

RQ 17.4 & 17.5. Zexxon, Inc. is evaluating a new project that will be financed with debt and equity. The cost will be CFATO = $400,000. The (unleveraged) after-tax cash flows (CFATs) expected to result from the investment are $175,000 per year for 3 years. At that time Zexxon expects to sell the project for a net after-tax value of zero. The debt financing will be 3-year debt with interest payments of $20,000 for all three years. The net-benefit-to-leverage factor, T*, is 0.30. The (unleveraged) required return for the project is 15%. Assume that rd is 10%. What is the presetn value of the after-tax cash flows and and sale of the project? $397,356.71 $401.756.22 $399.564.40 $403.211.67 Question 5 0/1 pts RQ 17.4 & 17.5. A firm just had its first debt issue of $1M (M = million) worth of perpetual bonds with a yield-to-maturity of 7.5%. The total market value of the firm before the issue is $5.6M. Assuming the corporate tax view of capital structure, what was the market value of the firm before the issue if the firm's tax rate is 40%? $5.8 million $5.4 million $6.0 million $5.6 million RQ 17.4 & 17.5. Zexxon, Inc. is evaluating a new project that will be financed with debt and equity. The cost will be CFATO = $400,000. The (unleveraged) after-tax cash flows (CFATs) expected to result from the investment are $175,000 per year for 3 years. At that time Zexxon expects to sell the project for a net after-tax value of zero. The debt financing will be 3-year debt with interest payments of $20,000 for all three years. The net-benefit-to-leverage factor, T*, is 0.30. The (unleveraged) required return for the project is 15%. Assume that rd is 10%. What is the presetn value of the after-tax cash flows and and sale of the project? $397,356.71 $401.756.22 $399.564.40 $403.211.67 Question 5 0/1 pts RQ 17.4 & 17.5. A firm just had its first debt issue of $1M (M = million) worth of perpetual bonds with a yield-to-maturity of 7.5%. The total market value of the firm before the issue is $5.6M. Assuming the corporate tax view of capital structure, what was the market value of the firm before the issue if the firm's tax rate is 40%? $5.8 million $5.4 million $6.0 million $5.6 million