Answered step by step

Verified Expert Solution

Question

1 Approved Answer

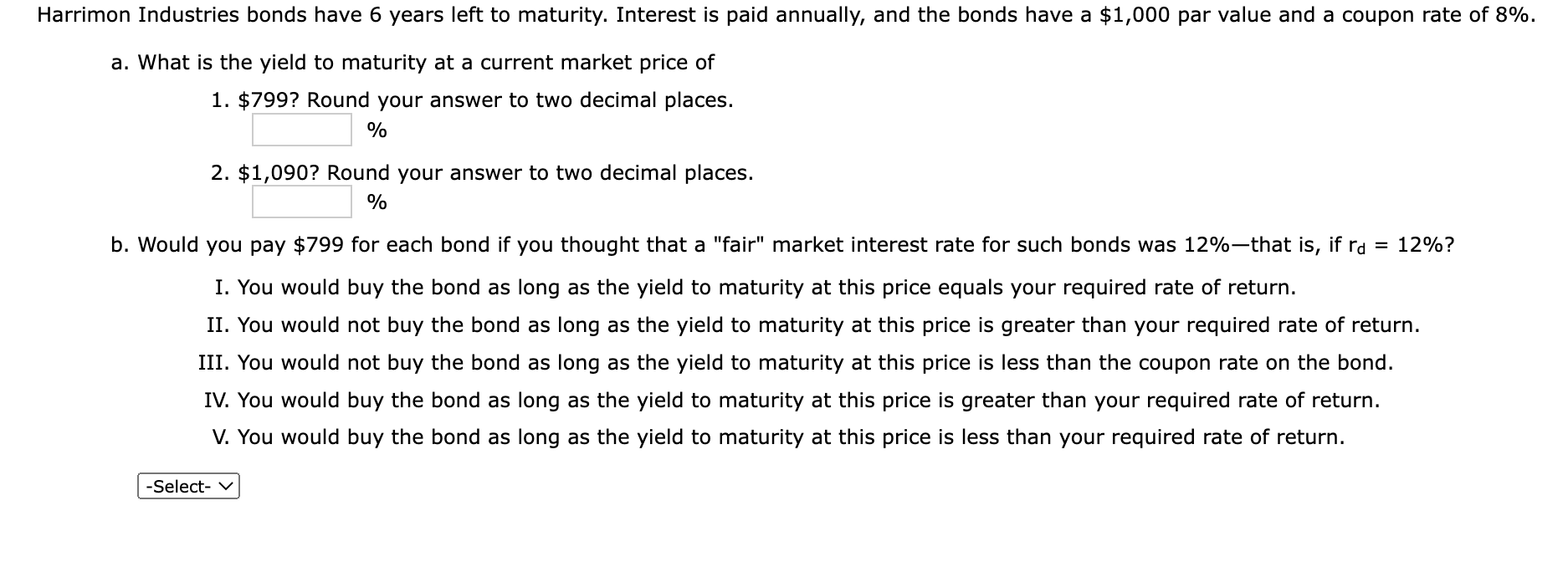

rrimon Industries bonds have 6 years left to maturity. Interest is paid annually, and the bonds have a $1,000 par value and a coupon rate

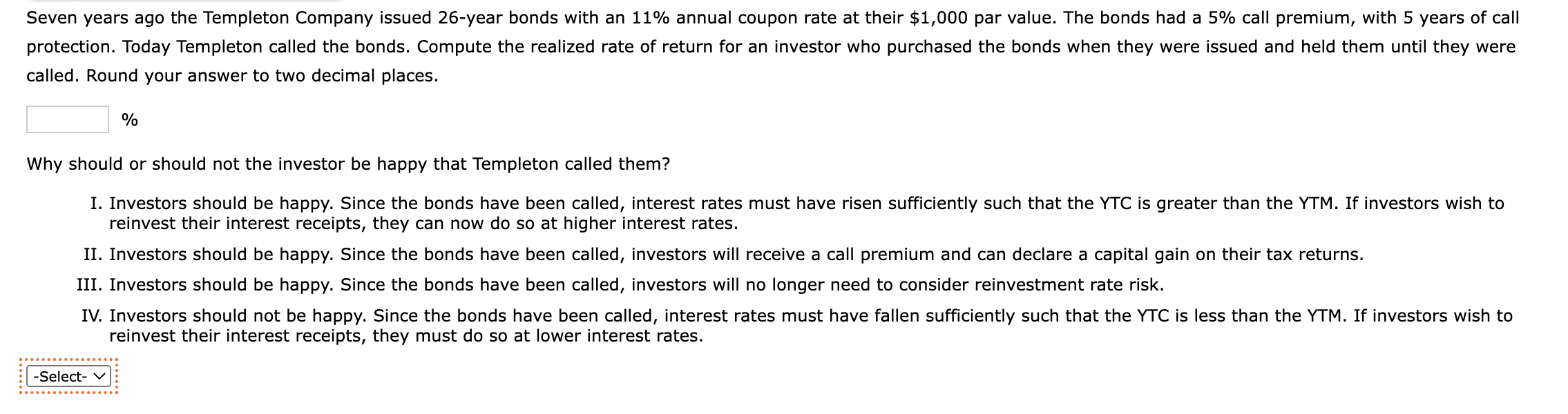

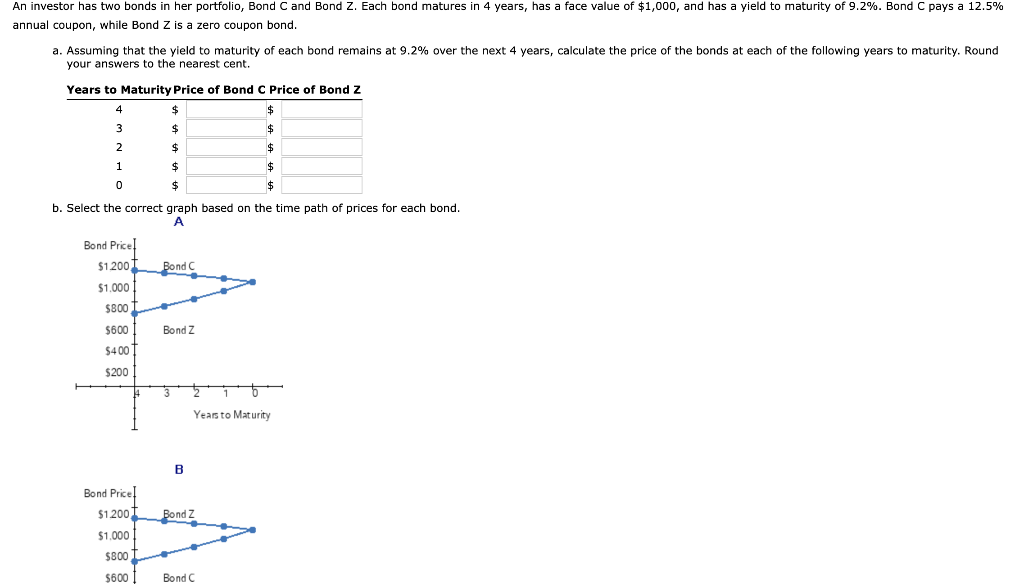

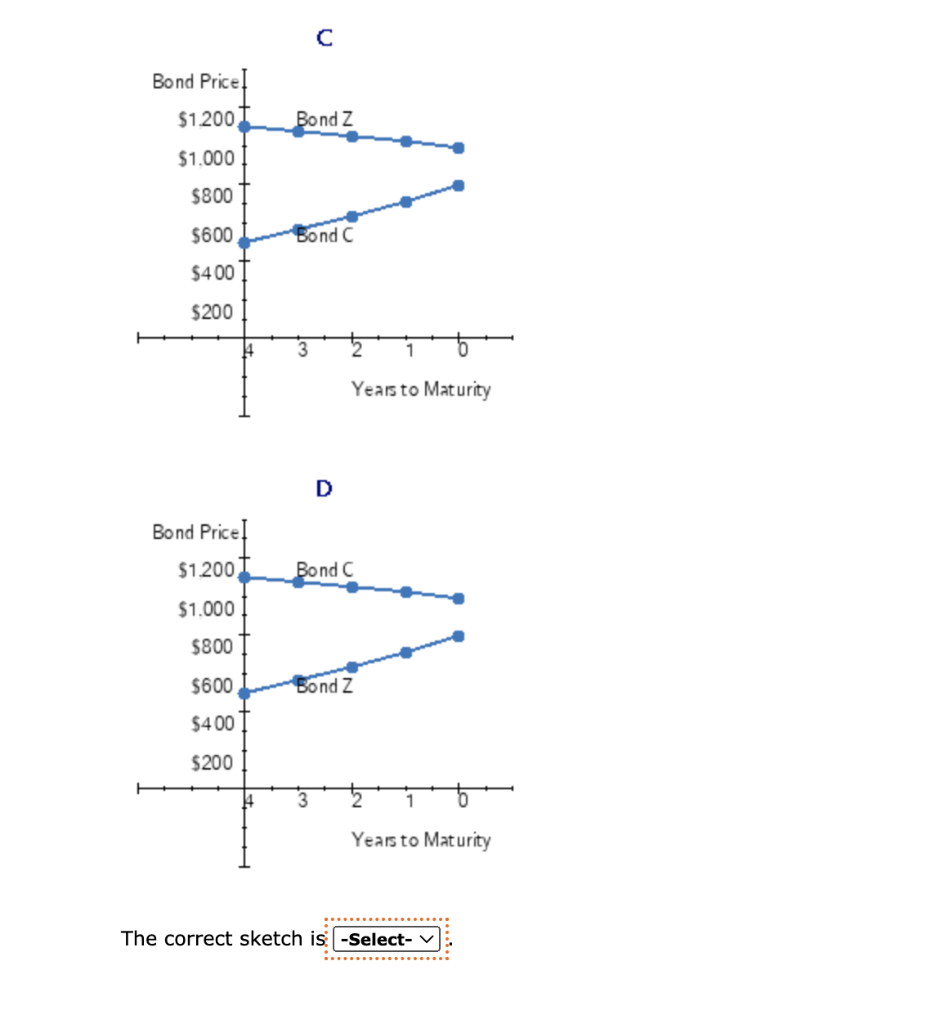

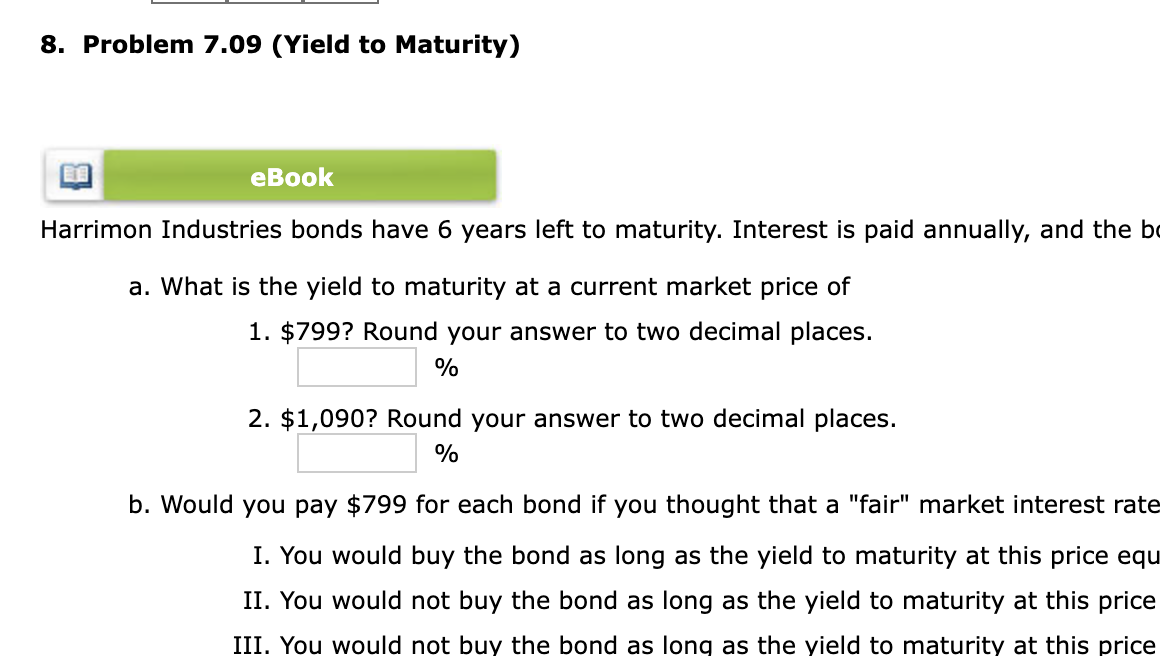

rrimon Industries bonds have 6 years left to maturity. Interest is paid annually, and the bonds have a $1,000 par value and a coupon rate of 8%. a. What is the yield to maturity at a current market price of 1. \$799? Round your answer to two decimal places. % 2. $1,090 ? Round your answer to two decimal places. % b. Would you pay $799 for each bond if you thought that a "fair" market interest rate for such bonds was 12%-that is, if rd=12% ? I. You would buy the bond as long as the yield to maturity at this price equals your required rate of return. III. You would not buy the bond as long as the yield to maturity at this price is less than the coupon rate on the bond. IV. You would buy the bond as long as the yield to maturity at this price is greater than your required rate of return. V. You would buy the bond as long as the yield to maturity at this price is less than your required rate of return. Seven years ago the Templeton Company issued 26 -year bonds with an 11% annual coupon rate at their $1,000 par value. The bonds had a 5% call premium, with 5 years of call called. Round your answer to two decimal places. % Why should or should not the investor be happy that Templeton called them? I. Investors should be happy. Since the bonds have been called, interest rates must have risen sufficiently such that the YTC is greater than the YTM. If investors wish to reinvest their interest receipts, they can now do so at higher interest rates. II. Investors should be happy. Since the bonds have been called, investors will receive a call premium and can declare a capital gain on their tax returns. III. Investors should be happy. Since the bonds have been called, investors will no longer need to consider reinvestment rate risk. IV. Investors should not be happy. Since the bonds have been called, interest rates must have fallen sufficiently such that the YTC is less than the YTM. If investors wish to reinvest their interest receipts, they must do so at lower interest rates. annual coupon, while Bond Z is a zero coupon bond. your answers to the nearest cent. b. Select the correct graph based on the time path of prices for each bond. A The correct sketch is 8. Problem 7.09 (Yield to Maturity) Harrimon Industries bonds have 6 years left to maturity. Interest is paid annually, and the b a. What is the yield to maturity at a current market price of 1. \$799? Round your answer to two decimal places. % 2. $1,090 ? Round your answer to two decimal places. % b. Would you pay $799 for each bond if you thought that a "fair" market interest rate I. You would buy the bond as long as the yield to maturity at this price equ II. You would not buy the bond as long as the yield to maturity at this price III. You would not buy the bond as lonq as the yield to maturity at this price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started