Answered step by step

Verified Expert Solution

Question

1 Approved Answer

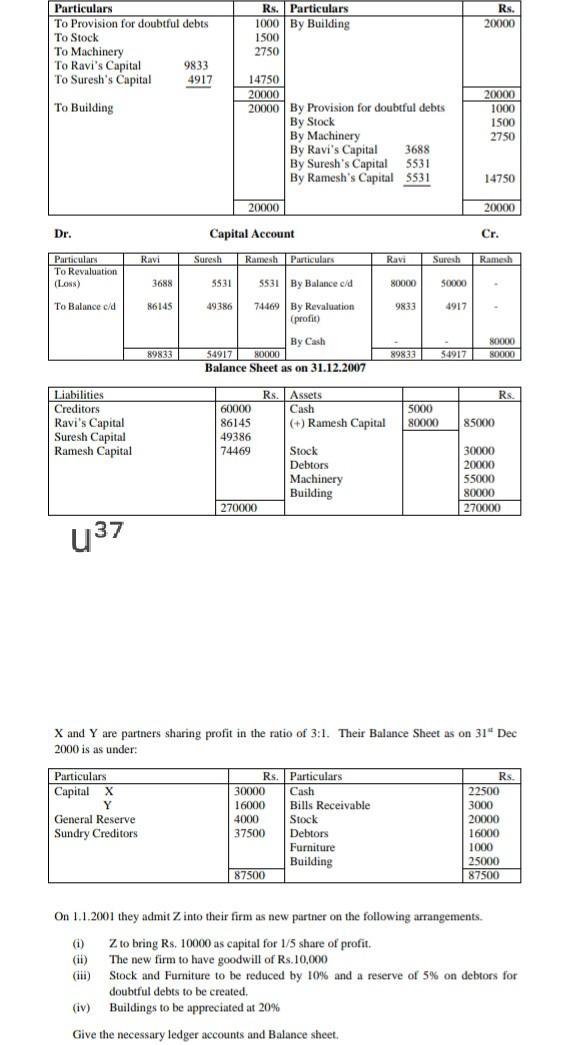

Rs. 20000 Particulars To Provision for doubtful debts To Stock To Machinery To Ravi's Capital 9833 To Suresh's Capital 4917 Rs. Particulars 1000 By Building

Rs. 20000 Particulars To Provision for doubtful debts To Stock To Machinery To Ravi's Capital 9833 To Suresh's Capital 4917 Rs. Particulars 1000 By Building 1500 2750 To Building 14750 20000 20000 By Provision for doubtful debts By Stock By Machinery By Ravi's Capital 3688 By Suresh's Capital 5531 By Ramesh's Capital 5531 20000 1000 1500 2750 14750 20000 20000 Dr. Capital Account Cr. Ravi Suresh Ramesh Particulars Ravi Suresh Ramesh Particulars To Revaluation (LxW8) 3688 5531 5531 By Balance c/d 80000 50000 To Balance cld 86145 49386 9833 4917 74469 By Revaluation (profit) By Cash 54917 80000 Balance Sheet as on 31.12.2007 80000 80000 89833 89833 54917 Rs. Liabilities Creditors Ravi's Capital Suresh Capital Ramesh Capital Rs. Assets Cash (+) Ramesh Capital 60000 86145 49386 74469 5000 80000 85000 Stock Debtors Machinery Building 30000 20000 55000 80000 270000 270000 37 X and Y are partners sharing profit in the ratio of 3:1. Their Balance Sheet as on 31" Dec 2000 is as under: Particulars Rs. Particulars Rs. Capital X 30000 Cash 22500 Y 16000 Bills Receivable 3000 General Reserve 4000 Stock 20000 Sundry Creditors 37500 Debtors 16000 Furniture 1000 Building 25000 87500 87500 On 1.1.2001 they admit Z into their firm as new partner on the following arrangements. . (1) ( Z to bring Rs. 10000 as capital for 1/5 share of profit. (11) The new firm to have goodwill of Rs.10,000 (iii) Stock and Furniture to be reduced by 10% and a reserve of 5% on debtors for doubtful debts to be created. (iv) Buildings to be appreciated at 20% Give the necessary ledger accounts and Balance sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started