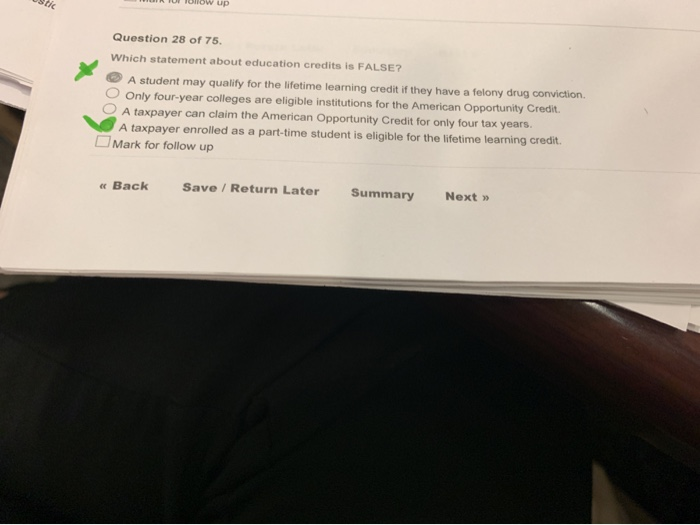

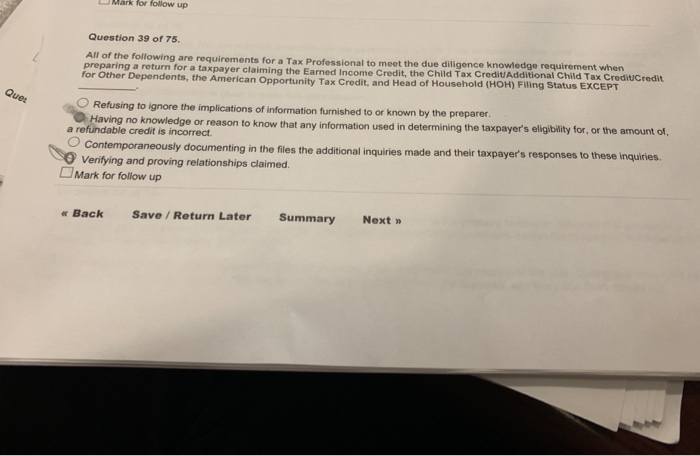

RT 1ollow up stic Question 28 of 75. Which statement about education credits is FALSE? A student may quality for the lifetime learning credit if they have a felony drug conviction. Only four-year colleges are eligible institutions for the American Opportunity Credit. A taxpayer can claim the American Opportunity Credit for only four tax years A taxpayer enrolled as a part-time student is eligible for the lifetime learning credit Mark for follow up Next Summary BackSave/Return Later LJMark for follow up Question 39 of 75 All of the following are requirements for a Tax Professional to meet the due diligence k preparing a return for a taxpayer claiming the Earned Income Credit, the Child Tax CreditAdditional Child Tax CredituCredit nowledge requirement when for Other Dependents, th e American Opportunity Tax Credit, and Head of Household (HOH) Filing Status EXCEPT ORefusing to ignore the implications of information furnished to or known by the preparer. Having no knowledge or reason to know that any information used in determining the taxpayer's eligibility for, or the amount of a refundable credit is incorrect Contemporaneously documenting in the files the additional inquiries made and their taxpayer's responses to these inquiries. Verifying and proving relationships claimed. Mark for follow up Summary Next > Back Save/ Return Later RT 1ollow up stic Question 28 of 75. Which statement about education credits is FALSE? A student may quality for the lifetime learning credit if they have a felony drug conviction. Only four-year colleges are eligible institutions for the American Opportunity Credit. A taxpayer can claim the American Opportunity Credit for only four tax years A taxpayer enrolled as a part-time student is eligible for the lifetime learning credit Mark for follow up Next Summary BackSave/Return Later LJMark for follow up Question 39 of 75 All of the following are requirements for a Tax Professional to meet the due diligence k preparing a return for a taxpayer claiming the Earned Income Credit, the Child Tax CreditAdditional Child Tax CredituCredit nowledge requirement when for Other Dependents, th e American Opportunity Tax Credit, and Head of Household (HOH) Filing Status EXCEPT ORefusing to ignore the implications of information furnished to or known by the preparer. Having no knowledge or reason to know that any information used in determining the taxpayer's eligibility for, or the amount of a refundable credit is incorrect Contemporaneously documenting in the files the additional inquiries made and their taxpayer's responses to these inquiries. Verifying and proving relationships claimed. Mark for follow up Summary Next > Back Save/ Return Later