Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rubio and Bisana established a trading partnership. They share profits equally after allowing salaries of P40,000 per year for Rubio and interest on partner's

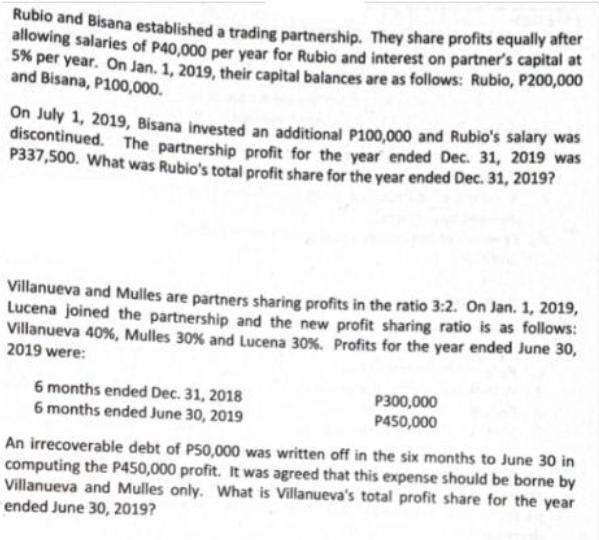

Rubio and Bisana established a trading partnership. They share profits equally after allowing salaries of P40,000 per year for Rubio and interest on partner's capital at 5% per year. On Jan. 1, 2019, their capital balances are as follows: Rubio, P200,000 and Bisana, P100,000. On July 1, 2019, Bisana invested an additional P100,000 and Rubio's salary was discontinued. The partnership profit for the year ended Dec. 31, 2019 was P337,500. What was Rubio's total profit share for the year ended Dec. 31, 2019? Villanueva and Mulles are partners sharing profits in the ratio 3:2. On Jan. 1, 2019, Lucena joined the partnership and the new profit sharing ratio is as follows: Villanueva 40%, Mulles 30% and Lucena 30%. Profits for the year ended June 30, 2019 were: 6 months ended Dec. 31, 2018 6 months ended June 30, 2019 P300,000 P450,000 An irrecoverable debt of P50,000 was written off in the six months to June 30 in computing the P450,000 profit. It was agreed that this expense should be borne by Villanueva and Mulles only. What is Villanueva's total profit share for the year ended June 30, 2019?

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Rubios salary Rubios salary is P40000 per year Since his salary was discontinued on July 1 2019 he w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started