You purchased an asset three years ago at a cost of $135,000 and sold it today for $82,500. The equipment is 5-year property for

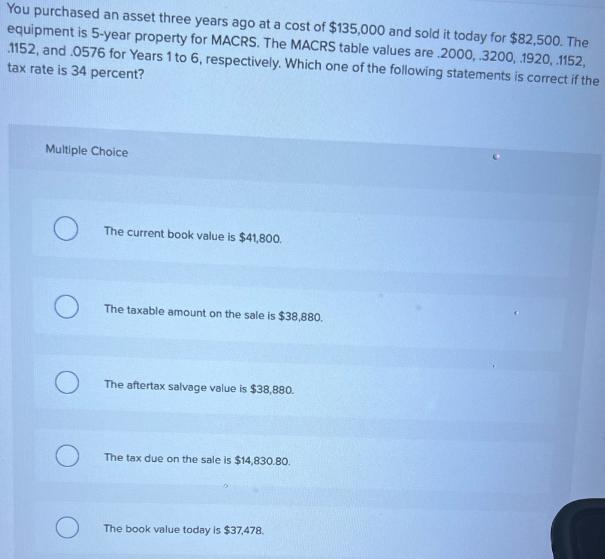

You purchased an asset three years ago at a cost of $135,000 and sold it today for $82,500. The equipment is 5-year property for MACRS. The MACRS table values are 2000, 3200, 1920, 1152, 1152, and .0576 for Years 1 to 6, respectively. Which one of the following statements is correct if the tax rate is 34 percent? Multiple Choice The current book value is $41,800. The taxable amount on the sale is $38,880. The aftertax salvage value is $38,880. The tax due on the sale is $14,830.80. The book value today is $37,478.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Given information Cost of asset135000 S...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started