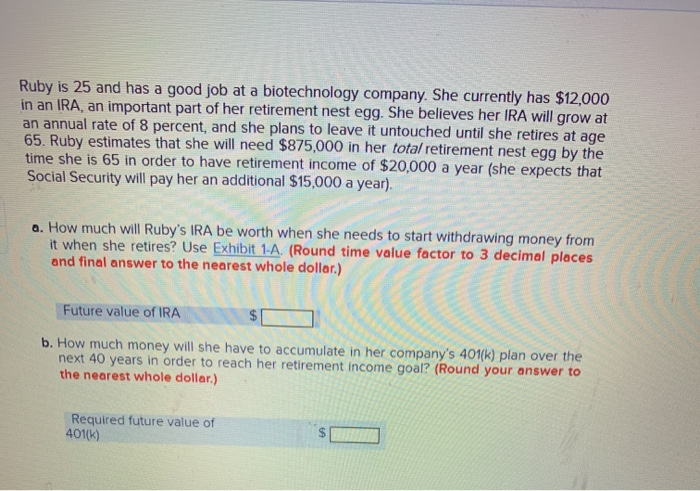

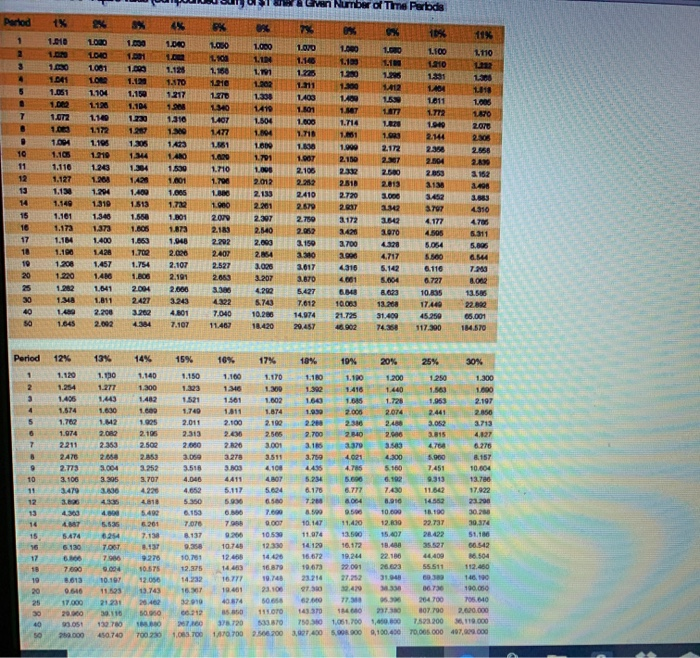

Ruby is 25 and has a good job at a biotechnology company. She currently has $12,000 in an IRA, an important part of her retirement nest egg. She believes her IRA will grow at an annual rate of 8 percent, and she plans to leave it untouched until she retires at age 65. Ruby estimates that she will need $875,000 in her total retirement nest egg by the time she is 65 in order to have retirement income of $20,000 a year (she expects that Social Security will pay her an additional $15,000 a year). a. How much will Ruby's IRA be worth when she needs to start withdrawing money from it when she retires? Use Exhibit 1-A. (Round time value factor to 3 decimal places and final answer to the nearest whole dollar.) Future value of IRA b. How much money will she have to accumulate in her company's 401(k) plan over the next 40 years in order to reach her retirement income goal? (Round your answer to the nearest whole dollar.) Required future value of 401(k) of Time Perbds Num Partod 1% 2% 4% 0% 7% 0% 0% 10% 11% 1010 1.000 1.000 1.000 1.00 1.000 1.080 1.100 1110 LO40 1.001 1.002 1.125 1.104 1.146 1.100 1100 1210 1232 1.000 1.081 1.000 1.168 191 1.225 1.20 1.296 1.331 1366 1.041 1O 1.120 1370 1.216 1.202 1.211 1300 1412 1404 1818 1.051 1.104 1.150 1217 1.338 1403 1.4 1811 1,006 1,002 1128 1.104 1.28 1.340 1410 1.801 1877 1772 1870 1.072 1.140 1.230 1.310 1407 1504 1.600 1.714 1940 2.078 1.083 1172 1.27 1.30 1477 1.804 1.718 1.61 1.03 2144 2.306 1.004 1.196 1.305 1423 1600 1.838 1.999 2.172 2.358 2.504 2.853 2.558 10 1.105 1.210 1344 1.480 1.020 1.701 1.007 2.150 2.37 11 1.110 1.243 1.34 1.530 1006 2.106 2.332 2.580 3162 12 1.264 1.127 1.801 142 1.706 2.012 2.282 2818 2.013 3138 3.408 13 1.130 1.204 1.400 1.005 1.80 2.133 2410 2.720 3.000 342 3.683 14 1.149 1.319 1.513 1.72 1.080 2.201 2.679 2.837 3342 3707 4.310 15 1.101 1.346 1.558 1.801 2.079 2.307 2.750 3172 3642 4.177 4706 16 1.173 1.373 1,805 1.873 2.183 2.540 2.052 3426 3.070 4.505 5.311 17 1.184 1.400 1.663 1.948 2.003 2.202 3.150 3.700 4.328 5.054 5.805 18 1.190 1.428 1.702 2.020 2407 2.854 3.380 3.006 4.717 5.500 6.544 19 1.208 1,457 1.754 2.527 2.107 3.026 3.017 4316 5.142 6.116 7.260 20 1,220 1,806 1.486 2.191 2.663 3.207 3.870 4.001 5.004 6.727 8.062 25 1,282 2.004 3.36 1.641 2.666 4.202 5.427 6848 10.835 13.585 30 1348 1.811 2427 3.243 4.322 5.743 7.612 10.063 13.268 17440 22.892 40 1.400 2.200 3.262 4.801 7.040 10.280 14.974 21.725 31.400 45.259 66.001 1.645 2.002 4384 7.107 18.420 11.467 29.457 46.902 74.358 117.300 184.570 Period 12% 13% 14% 15% 16% 17% 10% 19% 20% 25% 30% 1.90 1.120 1.140 1.150 1.160 1.170 1.250 1.180 1.190 1.200 1.300 1.254 1.277 1.300 1.323 1346 1.300 1.392 1000 1416 1.440 1.563 1405 1,443 1.482 1.521 1.561 1.602 1.963 1643 1.685 1.728 2.197 1.574 1.630 1.600 1.740 1811 1.874 1.930 2.006 2.074 2.441 2.856 1.762 1.925 2.011 2.100 2.192 2.2 2386 2.488 3.052 3.713 2.430 1.074 2.082 2106 2313 2.505 2.700 2.006 4.827 2840 3.815 2.353 2211 2.502 2.000 2826 3.001 3.379 3.583 3.185 4.768 6.276 2476 3.059 3.278 3511 3.750 4.021 5.960 8.157 4.300 2.773 3.004 3.252 3.516 4.108 4.435 4.75 5.160 7451 10.604 5.24 5.600 6.192 9.313 13.786 10 3.106 3.305 3.707 4.046 4411 4807 3.836 4.226 4.652 5.117 5.024 6.176 6.777 7430 11.642 17.922 11 3479 4335 6.500 .004 14552 23200 12 3.800 4818 5.350 5.936 7.2 7.600 9.500 10.600 18190 30.2 13 4363 4.800 5.490 .153 6.00 0.007 10.147 11.420 12.800 22.737 30.374 6.536 6.201 7.076 7.968 14 11.074 13.50 10.530 15.407 28422 51.1 15 S474 6254 7.138 8.137 35.527 18.488 10.748 12.330 14129 16.172 60.542 7.007 8.137 9.358 16 6.130 22.186 16.672 19.244 44.409 6.504 112.460 12.468 14.426 17 7.986 9276 10.761 6.00 16.879 10673 22.001 26.603 55.511 12.375 7.600 9.004 10.197 10.575 14.463 18 60.380 19.748 23.214 27.252 31048 146. 190 16.777 8.013 12.056 14.232 19 190.050 97.50 32.429 06.730 20 11.525 13.743 19.461 23.100 0.646 16.307 96.30 77. 204.700 705.040 40.874 50.658 6240 21.231 26 462 32910 25 17.000 B07 700 2,620.000 111.070 143.370 184 0 S0.950 180.80 66.212 85860 20.000 30116 30 7523200 34, 119.000 750.30 1,061.700 1,400.800 378.720 533870 132 780 267.60 40 93.051 700 20 170.700 2500.200 3,927.400 5,00900 9,100.400 70,005.000 407,00.000 260.000 450.740 1,065.700