Question

Ruby purchased a 10-year 4.2% p.a. Treasury bond with a face value of $100 at a price of 98.545 10 years ago. The bond was

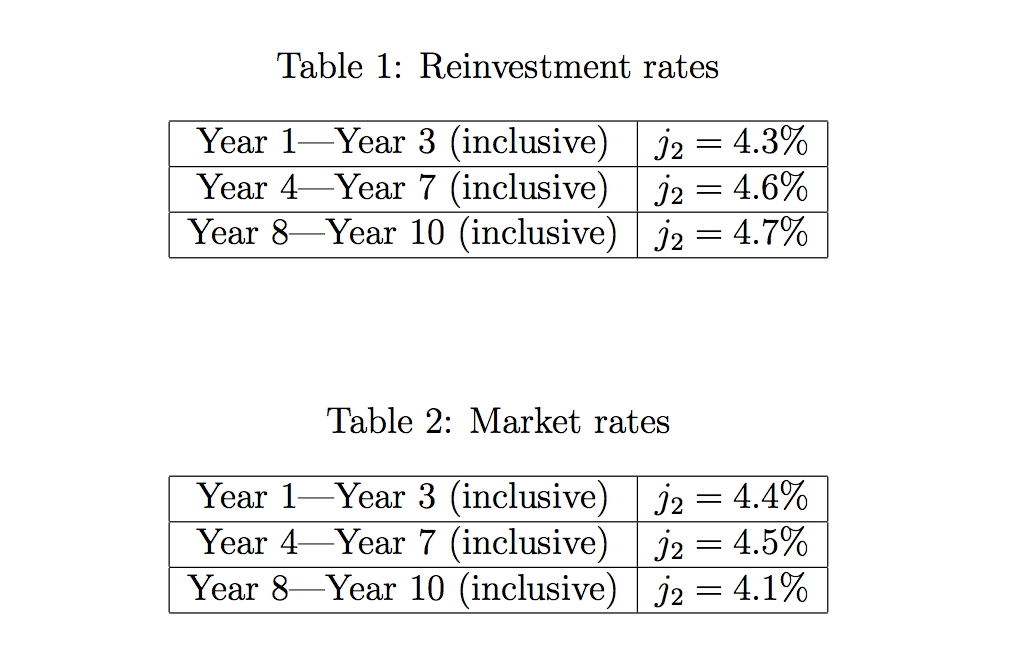

Ruby purchased a 10-year 4.2% p.a. Treasury bond with a face value of $100 at a price of 98.545 10 years ago. The bond was redeemable at par. Immediately following the receipt of each coupon, Ruby deposited the coupon into a bank account earning a particular reinvestment rate. Over the 10 years the reinvestment rates Ruby earns are shown in table 1. At the time of purchase, Ruby used her financial modelling skills to model and predict the market rates of return rates for the next 10 years which are shown in table 2 below. Assume her 10-year forecast (in table 2) is actually correct. Hence, these rates represent the appropriate rates to discount Rubys future cash flows. Note that these rates are not constant, so Ruby would value a dollar paid at t = 3.5 years as $1 (1+0.045/2)(1+0.044/2) if her valuation date was at t = 2.5 years a.

a. [8.5 marks] Calculate the accumulated value of Rubys reinvested coupons at the end of years 3, 6 and 9 (your calculation should refer to rates in table 1).

b. [10 marks] Calculate Rubys sale price at the end of years 3, 6 and 9 (your calculation should refer to rates in table 2).

c. [6.5 marks] Calculate Rubys holding period yield if she sells the bond after 3, 6 or 9 years (Express your answer as a j2 rate). Calculate Rubys total realised compound yield rate (express your answer as a j2 rate given that she holds the bond to maturity). Use a bar chart to plot your results of three holding period yields and the total realised compound yield rate.

Please send a finished excel file to this email bloomingblush99@g_m_a_i_l.com (without _), will paypal $15. Answer has to be correct

Table 1: Reinvestment rates Year 1-Year 3 (inclusive) J2 = 4.3% Year 4-Year 7 (inclusive) | J2 = 4.6% Year 8-Year 10 (inclusive) J2 = 4.7% Table 2: Market rates Year 1-Year 3 (inclusive) Year 4-Year 7 (inclusive) Year 8-Year 10 (inclusive) | J2-4.4% J2-4.5% J2-4.1% Table 1: Reinvestment rates Year 1-Year 3 (inclusive) J2 = 4.3% Year 4-Year 7 (inclusive) | J2 = 4.6% Year 8-Year 10 (inclusive) J2 = 4.7% Table 2: Market rates Year 1-Year 3 (inclusive) Year 4-Year 7 (inclusive) Year 8-Year 10 (inclusive) | J2-4.4% J2-4.5% J2-4.1%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started