Question

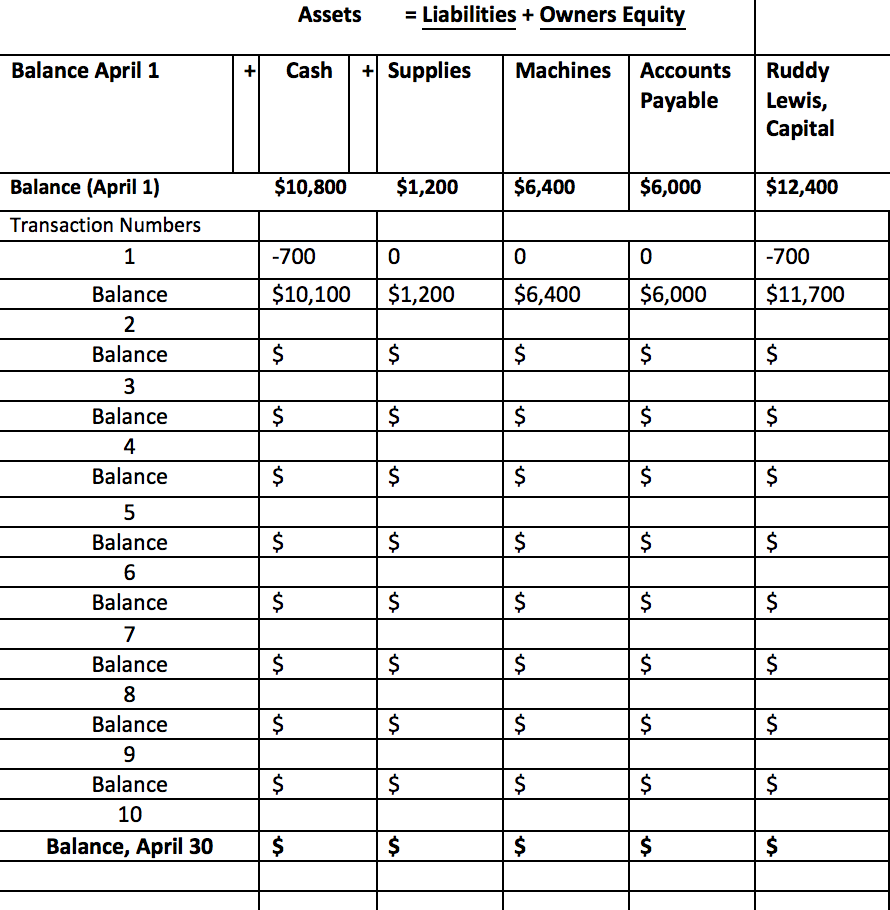

Ruddy Lewis operates a bike repair shop operating under the name R.L. Bike Repairs. The balances of his accounts on April 1 of the current

Ruddy Lewis operates a bike repair shop operating under the name R.L. Bike Repairs. The balances of his accounts on April 1 of the current year were as follows:

Cash $10,800

Supplies 1,200

Machines 6,400

Accounts Payable 6,000

Capital 12,400

The following transactions were incurred for the month of April:

Paid wages of $700 for 1st pay period in the month

Paid creditors on account $4,000

Purchased a new machine on account for $3,100

Received $7,200 cash from customers for bike repairs service

Paid courier service expense $280

Paid $850 cash for wages for the 2nd pay period in the month.

Ruddy Lewis withdrew $500 cash for personal use (drawings)

Paid creditors on account $1,200

Inventory of supplies at end of the month (April 30) was $550

Received $3,500 cash from customers for bike repairs service

You are required to record the transactions in the form provided, showing the balances on each account at the end of each transaction cycle. Transaction 1 has been completed for you. Please show your work and complete the entire chart. Thank you.

Question 1 continued

Short Questions- please show your work and explain. Thank you

1. Kevin Foster begins business by investing $20,000 in cash, equipment valued at $60,000, and $5,000 worth of supplies. What is the equity of the company? Show all workings in an acceptable format.

2. If Kevin Foster included $30,000 in notes payable (treated as part of liabilities), what is the amount of the owners equity account? Incorporate the information from the previous question (Question 1, above).

AssetsLiabilitiesOwners Equity Balance April 1 +CashSupplies Machines Accounts Ruddy Payable Lewis, Capital Balance (April 1) $10,800 $1,200$6,400 $6,000 $12,400 Transaction Numbers -700 0 0 0 -700 Balance 10,100$1,200 $6,400 $6,000$11,700 Balance Balance 4 Balance 5 Balance 6 Balance Balance Balance 9 Balance 10 Balance, April 30 $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started