Answered step by step

Verified Expert Solution

Question

1 Approved Answer

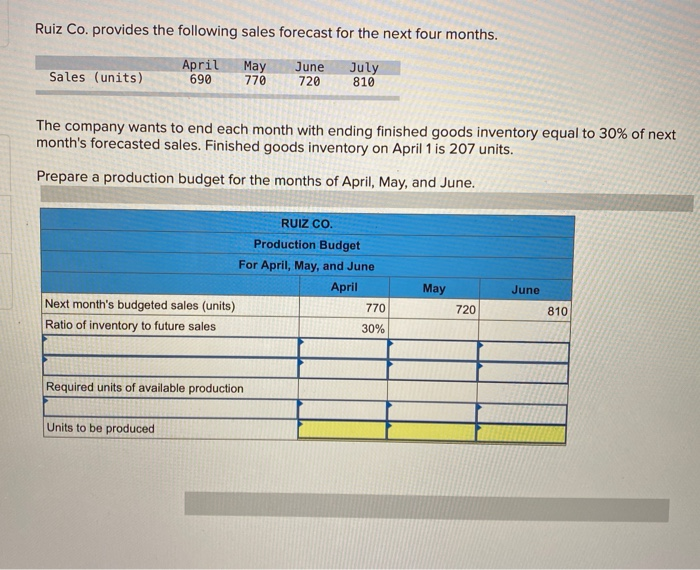

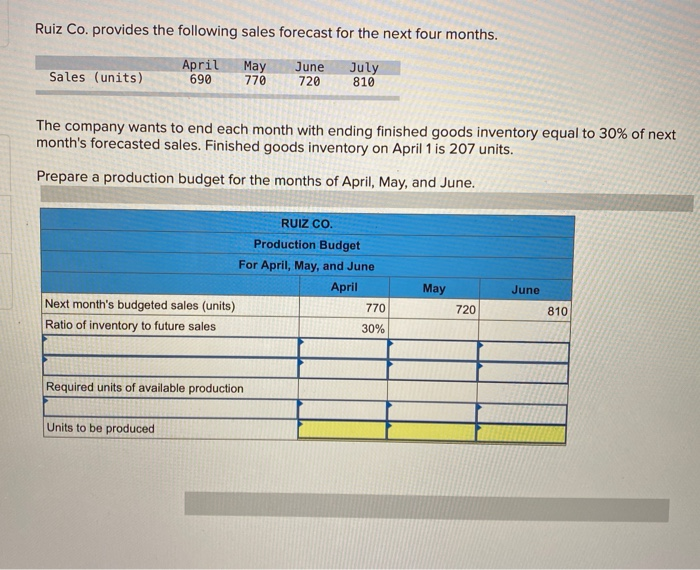

Ruiz Co. provides the following sales forecast for the next four months. Sales (units) April 690 May 770 June 720 July 810 The company wants

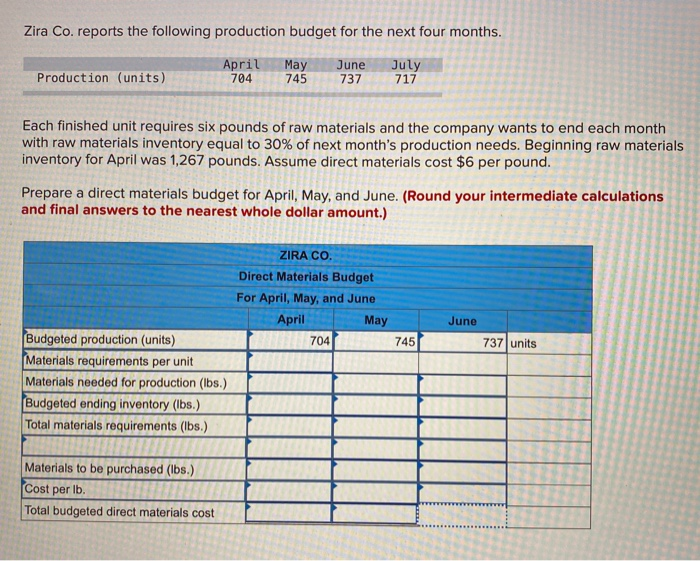

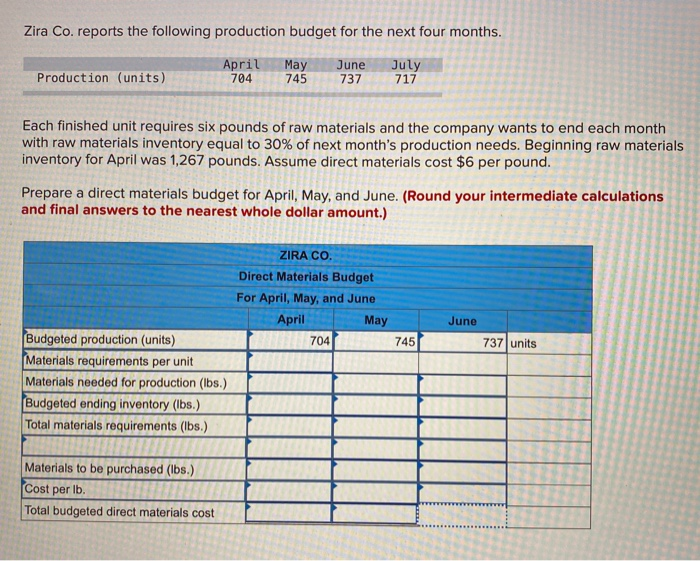

Ruiz Co. provides the following sales forecast for the next four months. Sales (units) April 690 May 770 June 720 July 810 The company wants to end each month with ending finished goods inventory equal to 30% of next month's forecasted sales. Finished goods inventory on April 1 is 207 units. Prepare a production budget for the months of April, May, and June. RUIZ CO. Production Budget For April, May, and June April Next month's budgeted sales (units) 770 Ratio of inventory to future sales 30% May June 810 720 Required units of available production Units to be produced Zira Co. reports the following production budget for the next four months. April 704 May 745 June 737 July 717 Production (units) Each finished unit requires six pounds of raw materials and the company wants to end each month with raw materials inventory equal to 30% of next month's production needs. Beginning raw materials inventory for April was 1,267 pounds. Assume direct materials cost $6 per pound. Prepare a direct materials budget for April, May, and June. (Round your intermediate calculations and final answers to the nearest whole dollar amount.) June ZIRA CO. Direct Materials Budget For April, May, and June April May Budgeted production (units) 704 745 Materials requirements per unit uirements per unit Materials needed for production (lbs.) Budgeted ending inventory (lbs.) Total materials requirements (lbs.) 737 units I Materials to be purchased (lbs.) Cost per lb. Total budgeted direct materials cost

Ruiz Co. provides the following sales forecast for the next four months. Sales (units) April 690 May 770 June 720 July 810 The company wants to end each month with ending finished goods inventory equal to 30% of next month's forecasted sales. Finished goods inventory on April 1 is 207 units. Prepare a production budget for the months of April, May, and June. RUIZ CO. Production Budget For April, May, and June April Next month's budgeted sales (units) 770 Ratio of inventory to future sales 30% May June 810 720 Required units of available production Units to be produced Zira Co. reports the following production budget for the next four months. April 704 May 745 June 737 July 717 Production (units) Each finished unit requires six pounds of raw materials and the company wants to end each month with raw materials inventory equal to 30% of next month's production needs. Beginning raw materials inventory for April was 1,267 pounds. Assume direct materials cost $6 per pound. Prepare a direct materials budget for April, May, and June. (Round your intermediate calculations and final answers to the nearest whole dollar amount.) June ZIRA CO. Direct Materials Budget For April, May, and June April May Budgeted production (units) 704 745 Materials requirements per unit uirements per unit Materials needed for production (lbs.) Budgeted ending inventory (lbs.) Total materials requirements (lbs.) 737 units I Materials to be purchased (lbs.) Cost per lb. Total budgeted direct materials cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started