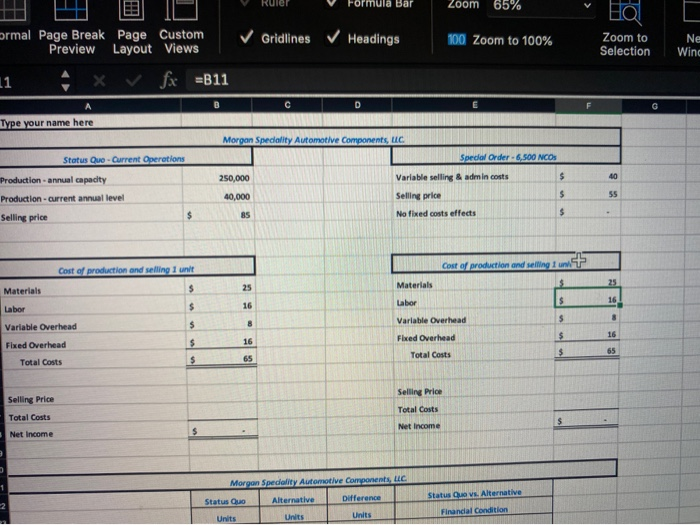

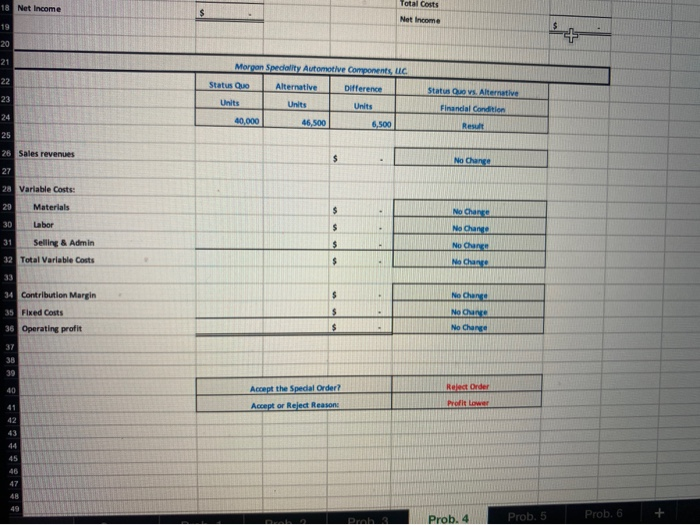

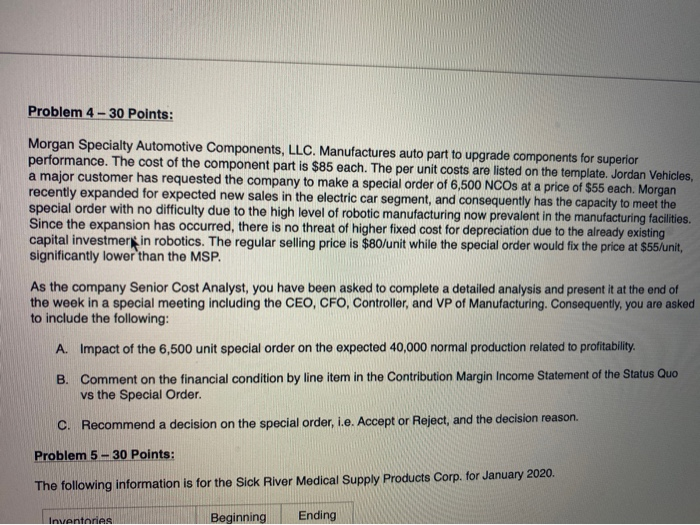

Ruler Formula Bar Zoom 65% to ormal Page Break Page Custom Preview Layout Views Gridlines Headings 100 Zoom to 100% Zoom to Selection Ne Wing 11 =B11 Type your name here Morgan Speciality Automotive Components, LLC Special Order - 6,500 NCOS $ 40 Status Que. Current Operations Production - annual capacity Production - current annual level Selling price $ 250,000 40,000 Variable selling & admin costs Selling price No fixed costs effects $ 55 8S $ Cost of production and selling 1 unit Cost of production and selling In $ 25 Materials Labor $ 16 $ 16 Materials Labor Variable Overhead $ 8 Variable Overhead $ 8 $ 16 $ 16 Fixed Overhead Total Costs Fixed Overhead Total Costs $ 65 $ 65 Selling Price Selling Price Total Costs Net Income Total Costs $ Net Income $ 1 Morgan Speciality Automotive Components, uc Status Quo Alternative Difference Units Units Units Status V. Alternative Financial Condition 18 Net Income Total Costs Net Income 19 $ 20 21 22 Morgan Speality Automotive Components, LLC Status Quo Alternative Difference Units Units Units 23 Status Quo vs. Alternative Financial Condition 24 40,000 46,500 6,500 25 26 Sales revenues $ No Change 27 28 Variable Costs: 29 $ Materials Labor No Chance 30 $ No Change 31 Selling & Admin $ $ No change Nechung 32 Total Variable costs 33 $ Ne Change 34 Contribution Margin 35 Fixed Costs 36 Operating profit $ $ No One No Change 37 38 39 40 Reject Order Accept the Special Order? Accept or Reject Reason Profit lower 41 42 44 46 47 Prob.4 Prob. 5 Prob. 6 Problem 4-30 Points: Morgan Specialty Automotive Components, LLC. Manufactures auto part to upgrade components for superior performance. The cost of the component part is $85 each. The per unit costs are listed on the template. Jordan Vehicles, a major customer has requested the company to make a special order of 6,500 NCOs at a price of $55 each. Morgan recently expanded for expected new sales in the electric car segment, and consequently has the capacity to meet the special order with no difficulty due to the high level of robotic manufacturing now prevalent in the manufacturing facilities. Since the expansion has occurred, there is no threat of higher fixed cost for depreciation due to the already existing capital investmers in robotics. The regular selling price is $80/unit while the special order would fix the price at $55/unit, significantly lower than the MSP. As the company Senior Cost Analyst, you have been asked to complete a detailed analysis and present it at the end of the week in a special meeting including the CEO, CFO, Controller, and VP of Manufacturing. Consequently, you are asked to include the following: A. Impact of the 6,500 unit special order on the expected 40,000 normal production related to profitability. B. Comment on the financial condition by line item in the Contribution Margin Income Statement of the Status Quo vs the Special Order. c. Recommend a decision on the special order, i.e. Accept or Reject, and the decision reason. Problem 5-30 Points: The following information is for the Sick River Medical Supply Products Corp. for January 2020. Inventories Beginning Ending