Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rules: Commuting between residence and place of business not deductible. Travel from one job/work area to another is deductible. Travel from home to a temporary

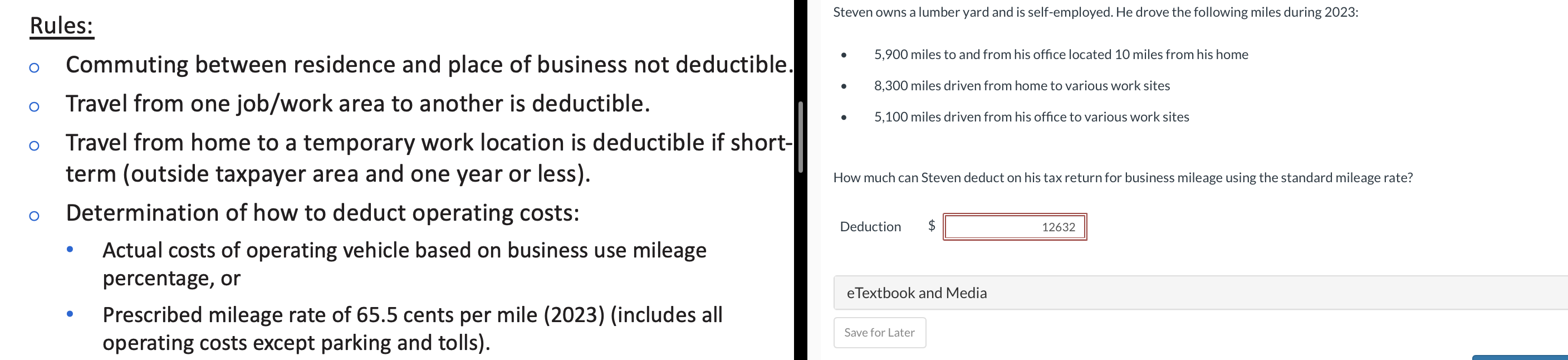

Rules: Commuting between residence and place of business not deductible. Travel from one job/work area to another is deductible. Travel from home to a temporary work location is deductible if shortterm (outside taxpayer area and one year or less). Determination of how to deduct operating costs: - Actual costs of operating vehicle based on business use mileage percentage, or - Prescribed mileage rate of 65.5 cents per mile (2023) (includes all operating costs except parking and tolls). Steven owns a lumber yard and is self-employed. He drove the following miles during 2023: - 5,900 miles to and from his office located 10 miles from his home - 8,300 miles driven from home to various work sites - 5,100 miles driven from his office to various work sites How much can Steven deduct on his tax return for business mileage using the standard mileage rate? Deduction \$ eTextbook and Media

Rules: Commuting between residence and place of business not deductible. Travel from one job/work area to another is deductible. Travel from home to a temporary work location is deductible if shortterm (outside taxpayer area and one year or less). Determination of how to deduct operating costs: - Actual costs of operating vehicle based on business use mileage percentage, or - Prescribed mileage rate of 65.5 cents per mile (2023) (includes all operating costs except parking and tolls). Steven owns a lumber yard and is self-employed. He drove the following miles during 2023: - 5,900 miles to and from his office located 10 miles from his home - 8,300 miles driven from home to various work sites - 5,100 miles driven from his office to various work sites How much can Steven deduct on his tax return for business mileage using the standard mileage rate? Deduction \$ eTextbook and Media Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started