- Run an updated Trial Balance report (step 8).

- Export your Trial Balance report to Excel (step 10).

- Run your Transaction Detail by Account report (step 11).

- Export your Transaction Detail by Account report to Excel (step 13)

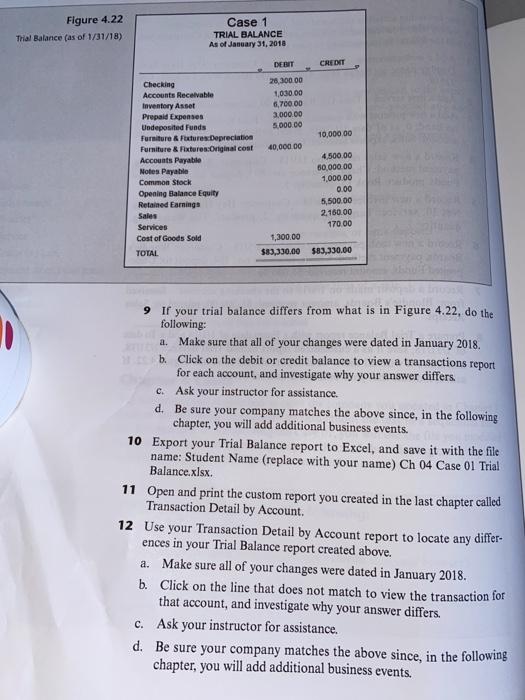

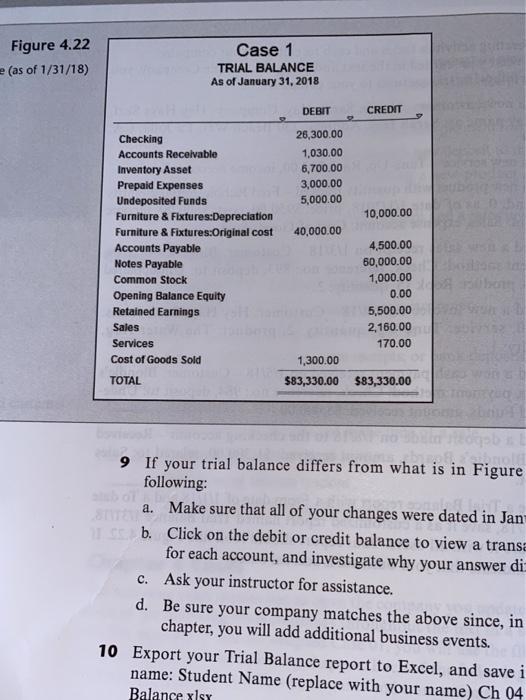

Operating Activities: Sales and Cash Receipts Case 1 92039. Add some operating activities (sales and cash receipts) to your company. Based on what you learned in the text and using the Sample Company, you are to add the following transactions to your company: 1 Add a new customer - Name: Sarah Hay, Company: Hey Hays Surf, Display name as: Sarah Hay, Address: 230 Beach Way, La Jolla, CA, 2 Add a new service - Tune-Up, Rate: $85.00, income account: Services. 3 Add a new product with quantity tracked - Fred Rubble, initial quantity on hand: 0, as of date 1/1/2018, price: $950.00, cost: $600.00, income account: Sales, expense account: Cost of Goods Sold. 4 Record a new sales receipt on 1/3/18 - Customer: Blondie's Boards, payment method: Check, reference no.: 893, deposit to: Undeposited Funds, product: Rook 15, quantity: 2 5 Record a new invoice on 1/4/18 - Customer: Hey Hays Surf, terms: Net 30, service: Tune-Up, quantity: 2, product: The Water Hog. quantity: 1 6 Record a new cash payment received on 1/5/18 - Customer: Blondie's Boards, payment method: Check, reference no.: 984, deposit to: Unde- posited Funds, amount received: $5,000.00 7 Record a deposit made on 1/8/18 to the checking account - Received from: Blondie's Boards, amount received: $1,300.00, related to: Sales Receipt. 8 Prepare a Trial Balance report with a From date of 1/1/18 and a To date of 1/31/18, save it as a customized report named Trial Balance 1/31/18, and share it with all users. Your report should look like Figure 4.22. If asked, indicate that your business is accrual based. Figure 4.22 Trial Balance (as of 1/31/18) Case 1 TRIAL BALANCE As of January 31, 2018 Checking Accounts Receivable Inventory Asset Prepaid Expenses Undeposited Funds Furniture & Fixtures Depreciation Furniture & Fixtures:Original cost Accounts Payable Notes Payable Common Stock Opening Balance Equity Retained Earnings Sales Services Cost of Goods Sold TOTAL DEBIT CREDIT 26,300.00 1,030.00 6,700.00 3.000.00 5.000.00 10,000.00 40,000.00 4.500.00 50,000.00 1,000.00 0.00 5,500.00 2.150.00 170.00 1,300.00 $83,330.00 $83,330.00 9 If your trial balance differs from what is in Figure 4.22, do the following: a. Make sure that all of your changes were dated in January 2018, b. Click on the debit or credit balance to view a transactions report for each account, and investigate why your answer differs. c. Ask your instructor for assistance. d. Be sure your company matches the above since, in the following chapter, you will add additional business events. 10 Export your Trial Balance report to Excel, and save it with the file name: Student Name (replace with your name) Ch 04 Case 01 Trial Balance.xlsx. 11 Open and print the custom report you created in the last chapter called Transaction Detail by Account 12 Use your Transaction Detail by Account report to locate any differ- ences in your Trial Balance report created above. a. Make sure all of your changes were dated in January 2018. b. Click on the line that does not match to view the transaction for that account, and investigate why your answer differs. C. Ask your instructor for assistance. d. Be sure your company matches the above since, in the following chapter, you will add additional business events. Figure 4.22 e (as of 1/31/18) Case 1 TRIAL BALANCE As January 31, 2018 DEBIT CREDIT Checking Accounts Receivable Inventory Asset Prepaid Expenses Undeposited Funds Furniture & Fixtures:Depreciation Furniture & Fixtures:Original cost Accounts Payable Notes Payable Common Stock Opening Balance Equity Retained Earnings Sales Services Cost of Goods Sold 26,300.00 1,030.00 6,700.00 3,000.00 5,000.00 10,000.00 40,000.00 4,500.00 60,000.00 1,000.00 0.00 5,500.00 2,160.00 170.00 1,300.00 $83,330.00 $83,330.00 TOTAL 9 If your trial balance differs from what is in Figure following: a. Make sure that all of your changes were dated in Jan b. Click on the debit or credit balance to view a transa for each account, and investigate why your answer di- c. Ask your instructor for assistance. d. Be sure your company matches the above since, in chapter, you will add additional business events. 10 Export your Trial Balance report to Excel, and save i name: Student Name (replace with your name) Ch 04 Balance xlsy Operating Activities: Sales and Cash Receipts Case 1 92039. Add some operating activities (sales and cash receipts) to your company. Based on what you learned in the text and using the Sample Company, you are to add the following transactions to your company: 1 Add a new customer - Name: Sarah Hay, Company: Hey Hays Surf, Display name as: Sarah Hay, Address: 230 Beach Way, La Jolla, CA, 2 Add a new service - Tune-Up, Rate: $85.00, income account: Services. 3 Add a new product with quantity tracked - Fred Rubble, initial quantity on hand: 0, as of date 1/1/2018, price: $950.00, cost: $600.00, income account: Sales, expense account: Cost of Goods Sold. 4 Record a new sales receipt on 1/3/18 - Customer: Blondie's Boards, payment method: Check, reference no.: 893, deposit to: Undeposited Funds, product: Rook 15, quantity: 2 5 Record a new invoice on 1/4/18 - Customer: Hey Hays Surf, terms: Net 30, service: Tune-Up, quantity: 2, product: The Water Hog. quantity: 1 6 Record a new cash payment received on 1/5/18 - Customer: Blondie's Boards, payment method: Check, reference no.: 984, deposit to: Unde- posited Funds, amount received: $5,000.00 7 Record a deposit made on 1/8/18 to the checking account - Received from: Blondie's Boards, amount received: $1,300.00, related to: Sales Receipt. 8 Prepare a Trial Balance report with a From date of 1/1/18 and a To date of 1/31/18, save it as a customized report named Trial Balance 1/31/18, and share it with all users. Your report should look like Figure 4.22. If asked, indicate that your business is accrual based. Figure 4.22 Trial Balance (as of 1/31/18) Case 1 TRIAL BALANCE As of January 31, 2018 Checking Accounts Receivable Inventory Asset Prepaid Expenses Undeposited Funds Furniture & Fixtures Depreciation Furniture & Fixtures:Original cost Accounts Payable Notes Payable Common Stock Opening Balance Equity Retained Earnings Sales Services Cost of Goods Sold TOTAL DEBIT CREDIT 26,300.00 1,030.00 6,700.00 3.000.00 5.000.00 10,000.00 40,000.00 4.500.00 50,000.00 1,000.00 0.00 5,500.00 2.150.00 170.00 1,300.00 $83,330.00 $83,330.00 9 If your trial balance differs from what is in Figure 4.22, do the following: a. Make sure that all of your changes were dated in January 2018, b. Click on the debit or credit balance to view a transactions report for each account, and investigate why your answer differs. c. Ask your instructor for assistance. d. Be sure your company matches the above since, in the following chapter, you will add additional business events. 10 Export your Trial Balance report to Excel, and save it with the file name: Student Name (replace with your name) Ch 04 Case 01 Trial Balance.xlsx. 11 Open and print the custom report you created in the last chapter called Transaction Detail by Account 12 Use your Transaction Detail by Account report to locate any differ- ences in your Trial Balance report created above. a. Make sure all of your changes were dated in January 2018. b. Click on the line that does not match to view the transaction for that account, and investigate why your answer differs. C. Ask your instructor for assistance. d. Be sure your company matches the above since, in the following chapter, you will add additional business events. Figure 4.22 e (as of 1/31/18) Case 1 TRIAL BALANCE As January 31, 2018 DEBIT CREDIT Checking Accounts Receivable Inventory Asset Prepaid Expenses Undeposited Funds Furniture & Fixtures:Depreciation Furniture & Fixtures:Original cost Accounts Payable Notes Payable Common Stock Opening Balance Equity Retained Earnings Sales Services Cost of Goods Sold 26,300.00 1,030.00 6,700.00 3,000.00 5,000.00 10,000.00 40,000.00 4,500.00 60,000.00 1,000.00 0.00 5,500.00 2,160.00 170.00 1,300.00 $83,330.00 $83,330.00 TOTAL 9 If your trial balance differs from what is in Figure following: a. Make sure that all of your changes were dated in Jan b. Click on the debit or credit balance to view a transa for each account, and investigate why your answer di- c. Ask your instructor for assistance. d. Be sure your company matches the above since, in chapter, you will add additional business events. 10 Export your Trial Balance report to Excel, and save i name: Student Name (replace with your name) Ch 04 Balance xlsy