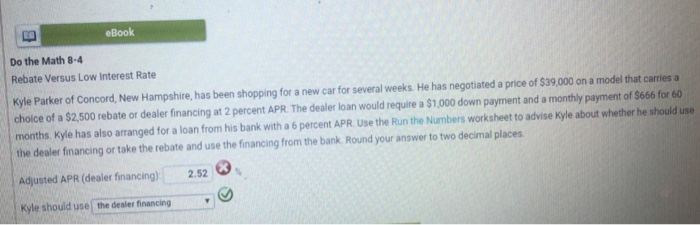

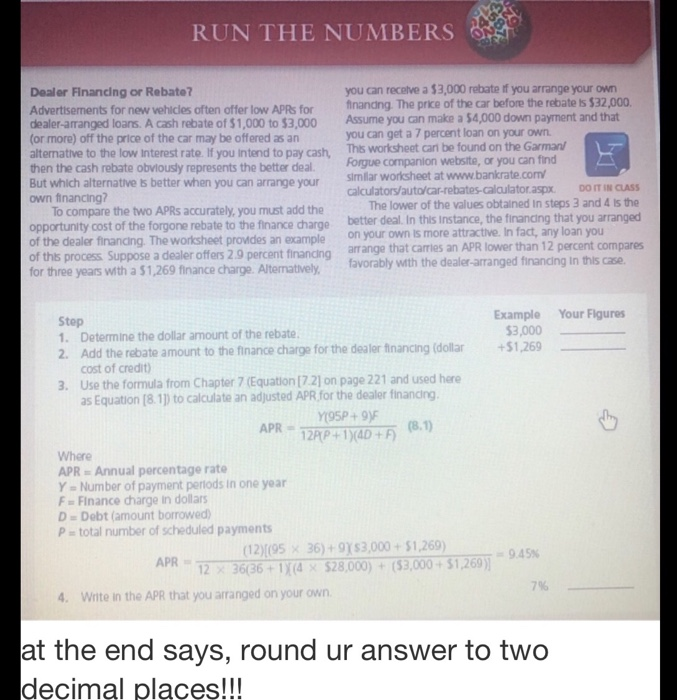

RUN THE NUMBERS Dealer Financing or Rebate? Advertisements for new wides often after low A s for dealer arranged loans. A cash rebate of 51,000 to 53,000 (or more of the price of the car may be offered as an alternative to the low interest rate if you intend to payah then the cash rate obviously represents the board But which alternative is better when you can arrange your own financing? To compare the two APs accurately, you must add the opportunity cost of the forgonerebate to the finance charge of the dealer franana. The worksheet orondosan cromole of this process suppose a dealer ofters 20 porcont troncha for three years with a $1.269 finance charge Alternatively you can crea 3.000 rebate you arrange your own franang The price of the car before the r ate 532,000 Assume you can make a 54.000 down payment and that you can get a 7 percent loan on your own This worksheet can be found on the Garmand Folgue comparan web or you can find Similar worksheet at www.bante con custoto carrebates calculators TICS The lower of the values obtained in steps and is the better deal in this instance, the financing that you arranged on your own is more attractive in fact, any loan you arange that comes an APR lower than 12 porcont compares favorably with the declaranged trancing in this case Example 53.000 Your Figures Step 1. Determine the dollar amount of the rebate 2. Add therebate amount to the finance charge for the dealer nanong cost of credit 3. Use the form from Chaoter 7 Equation 172] on page 221 and used as Equation to calculate an adjusted APR for the de a nang APR-21 VIDA Where APR Annual percentage rate Y Number of payment mods in one year inance change in de D-Debt amount we Pe total number of scheud payments 125 595300051 4. Winte in the AP that you wanged on your own at the end says, round ur answer to two decimal places!!! eBook Do the Math 8-4 Rebate Versus Low Interest Rate Kyle Parker of Concord, New Hampshire, has been shopping for a new car for several weeks. He has negotiated a price of $39,000 on a model that carries a choice of a $2,500 rebate or dealer financing at 2 percent APR. The dealer loan would require a $1,000 down payment and a monthly payment of $666 for 60 months, Kyle has also arranged for a loan from his bank with a 6 percent APR. Use the Run the Numbers worksheet to advise Kyle about whether he should use the dealer financing or take the rebate and use the financing from the bank. Round your answer to two decimal places. Adjusted APR (dealer financing) 2.52 Kyle should use the dealer financing RUN THE NUMBERS Dealer Financing or Rebate? Advertisements for new vehicles often offer low APRs for dealer-arranged loans. A cash rebate of $1,000 to $3,000 (or more) off the price of the car may be offered as an alternative to the low Interest rate. If you intend to pay cash. then the cash rebate obviously represents the better deal. But which alternative is better when you can arrange your own financing? To compare the two APRs accurately, you must add the opportunity cost of the forgone rebate to the finance charge of the dealer financing. The worksheet provides an example of this process Suppose a dealer offers 29 percent financing for three years with a $1,269 finance charge. Alternatively, you can receive a $3,000 rebate if you arrange your own financng. The price of the car before the rebate is $32,000 Assume you can make a 54,000 down payment and that you can get a 7 percent loan on your own This worksheet can be found on the Garmant Forgue companion website, or you can find similar worksheet at www.bankrate.com calculators/auto/car-rebates-calculator.aspx. DOIT IN CLASS The lower of the values obtained in steps 3 and 4 is the better deal. In this instance, the financing that you arranged on your own is more attractive. In fact, any loan you arrange that carries an APR lower than 12 percent compares favorably with the dealer-arranged financing in this case, won daku Your Figures Example $3,000 +$1,269 Step 1. Determine the dollar amount of the rebate 2. Add the rebate amount to the finance charge for the dealer financing (dollar cost of credit) 3. Use the formula from Chapter 7 (Equation [72] on page 221 and used here as Equation (8.11) to calculate an adjusted APR for the dealer financing Y195P+ 9) APR 12PP+1)(4+) Where APR = Annual percentage rate Y = Number of payment periods in one year F - Finance charge in dollars D Debt (amount borrowed) P total number of scheduled payments (12)[(9536) +9Y$3,000 + 51,269) 12 36(36 + 1/4 $28,000) + (53,000 + 51,269) 4. Write in the APR that you arranged on your own at the end says, round ur answer to two decimal places