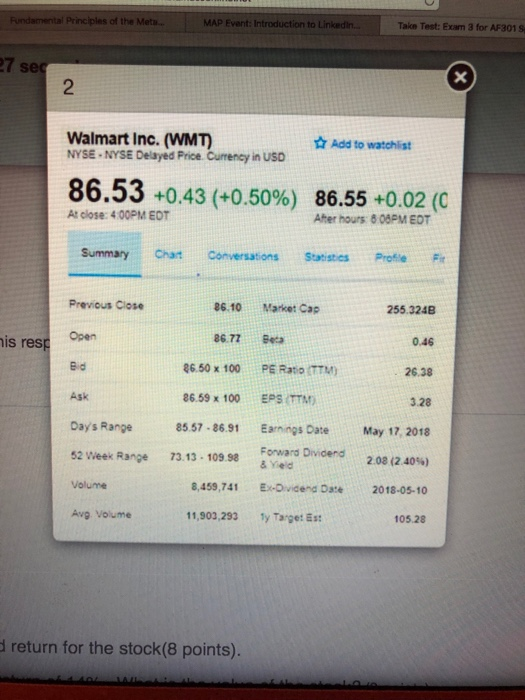

Rundamental Principles of the Meta.. MAP Event: Introduction to Linkedin. Take Test: Exam 3 for AF301 S 27 sec Walmart Inc. (WMT) NYSE. NYSE Delayed Price. Currency in USD Add to watchlist 86.53 +0.43 (+0.50%) 86.55 +0.02 (O At close: 400PM EDT After hours: 808PM EOT Summary Chart Conversations Statistics Profile Previous Close 86.10 Market Cap 255.324B his resp Open 86.77 Besa 0.46 Bid 26.38 86.50 x 100 86.59 x 100 PE Ratio (TTM) EPS (TTM) 3.28 Day's Range 85.57.86.91 Earnings Date May 17, 2018 52 Week Range 73.13 - 109.98 Forward Dividend & Yield 2.08 (2.40%) Volume 2018-05-10 8,459,741 11,903,293 Ex-Dividend Dare Ty Target is: Avg. Volume 105.28 return for the stock(8 points). Moving to another question will save this response. stion 1 View Photo 1. Compute the holding period return for the stock(8 points). 2. The stock has a required return of 14%. What is the value of the stock? (8 points) 3. Should you buy the stock or short the stock? (2points) 4. Is the stock overvalued or undervalued? (2points) Moving to another question will save this response. MacBook Air 8053 Fb A T Rundamental Principles of the Meta.. MAP Event: Introduction to Linkedin. Take Test: Exam 3 for AF301 S 27 sec Walmart Inc. (WMT) NYSE. NYSE Delayed Price. Currency in USD Add to watchlist 86.53 +0.43 (+0.50%) 86.55 +0.02 (O At close: 400PM EDT After hours: 808PM EOT Summary Chart Conversations Statistics Profile Previous Close 86.10 Market Cap 255.324B his resp Open 86.77 Besa 0.46 Bid 26.38 86.50 x 100 86.59 x 100 PE Ratio (TTM) EPS (TTM) 3.28 Day's Range 85.57.86.91 Earnings Date May 17, 2018 52 Week Range 73.13 - 109.98 Forward Dividend & Yield 2.08 (2.40%) Volume 2018-05-10 8,459,741 11,903,293 Ex-Dividend Dare Ty Target is: Avg. Volume 105.28 return for the stock(8 points). Moving to another question will save this response. stion 1 View Photo 1. Compute the holding period return for the stock(8 points). 2. The stock has a required return of 14%. What is the value of the stock? (8 points) 3. Should you buy the stock or short the stock? (2points) 4. Is the stock overvalued or undervalued? (2points) Moving to another question will save this response. MacBook Air 8053 Fb A T