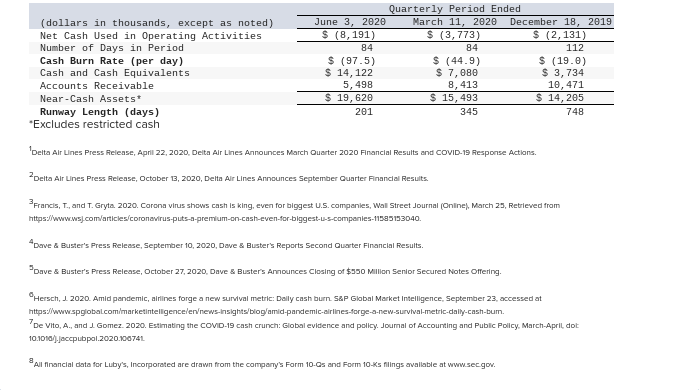

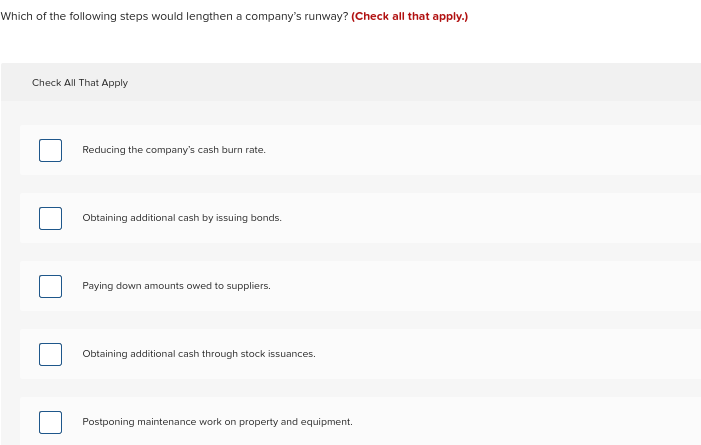

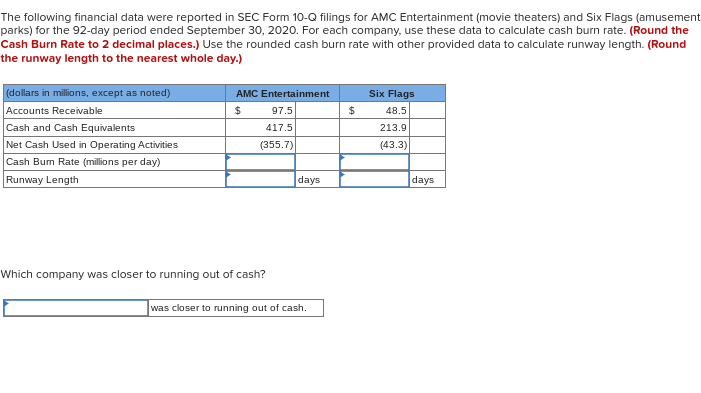

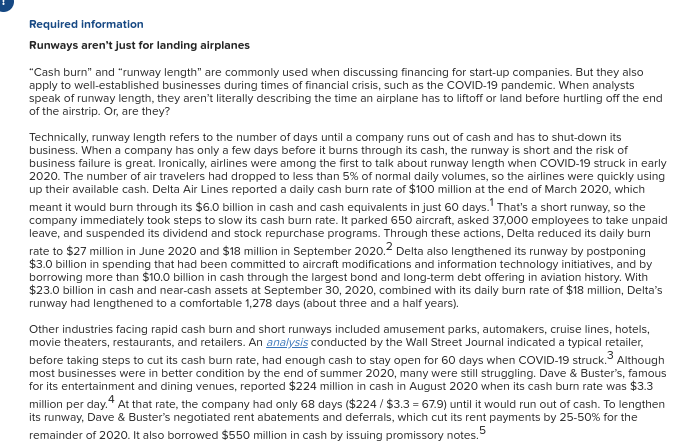

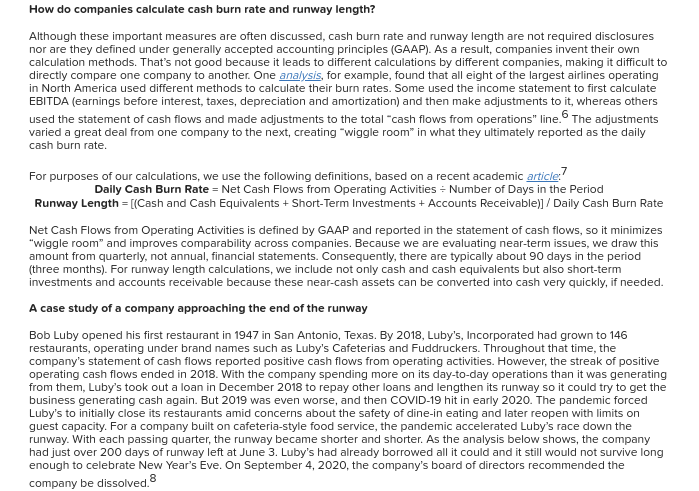

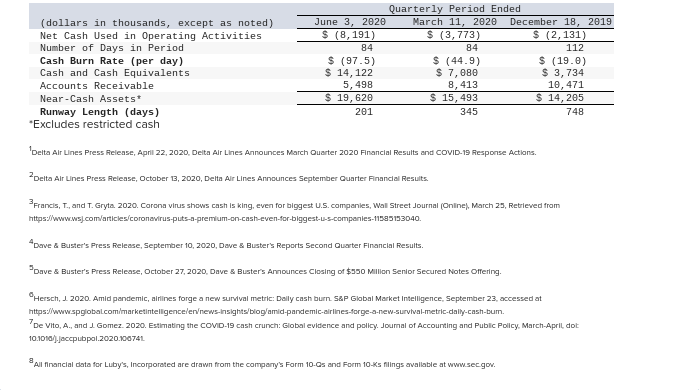

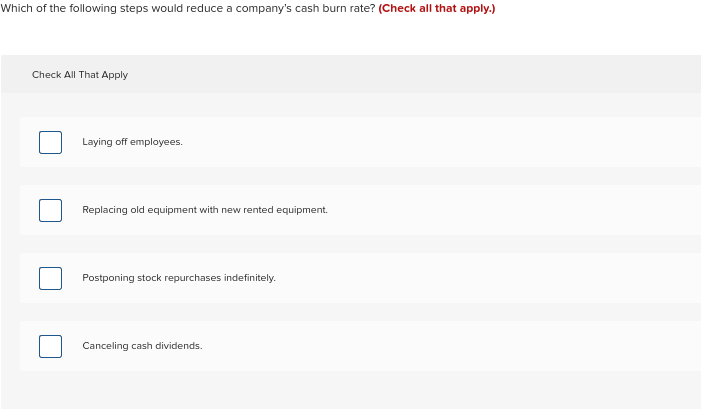

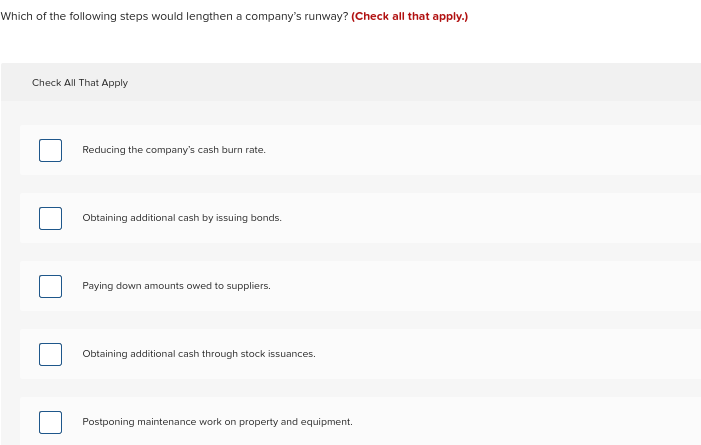

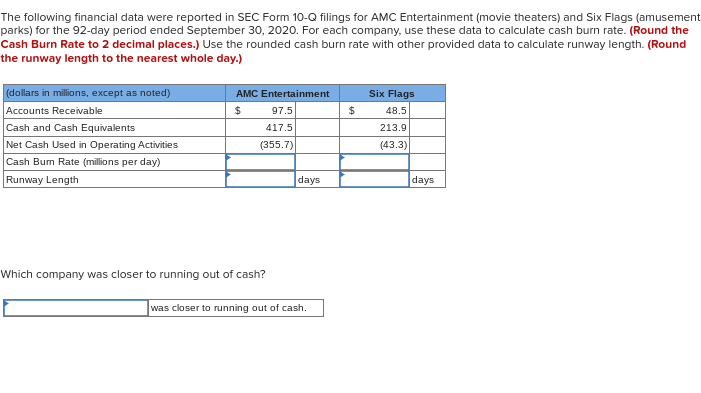

Runways aren't just for landing airplanes "Cash burn" and "runway length" are commonly used when discussing financing for start-up companies. But they also apply to well-established businesses during times of financial crisis, such as the COVID-19 pandemic. When analysts speak of runway length, they aren't literally describing the time an airplane has to liftoff or land before hurtling off the end of the airstrip. Or, are they? Technically, runway length refers to the number of days until a company runs out of cash and has to shut-down its business. When a company has only a few days before it burns through its cash, the runway is short and the risk of business failure is great. Ironically, airlines were among the first to talk about runway length when COVID-19 struck in early 2020. The number of air travelers had dropped to less than 5% of normal daily volumes, so the airlines were quickly using up their available cash. Delta Air Lines reported a daily cash burn rate of $100 million at the end of March 2020 , which meant it would burn through its $6.0 billion in cash and cash equivalents in just 60 days. 1 That's a short runway, so the company immediately took steps to slow its cash burn rate. It parked 650 aircraft, asked 37,000 employees to take unpaid leave, and suspended its dividend and stock repurchase programs. Through these actions, Delta reduced its daily burn rate to $27 million in June 2020 and $18 million in September 2020.2 Delta also lengthened its runway by postponing $3.0 billion in spending that had been committed to aircraft modifications and information technology initiatives, and by borrowing more than $10.0 billion in cash through the largest bond and long-term debt offering in aviation history. With $23.0 billion in cash and near-cash assets at September 30,2020 , combined with its daily burn rate of $18 million, Delta's runway had lengthened to a comfortable 1,278 days (about three and a half years). Other industries facing rapid cash burn and short runways included amusement parks, automakers, cruise lines, hotels, movie theaters, restaurants, and retailers. An analysis conducted by the Wall Street Journal indicated a typical retailer, before taking steps to cut its cash burn rate, had enough cash to stay open for 60 days when COVID-19 struck. 3 Although most businesses were in better condition by the end of summer 2020, many were still struggling. Dave \& Buster's, famous for its entertainment and dining venues, reported $224 million in cash in August 2020 when its cash burn rate was $3.3 million per day. 4 At that rate, the company had only 68 days ($224/$3.3=67.9) until it would run out of cash. To lengthen its runway, Dave \& Buster's negotiated rent abatements and deferrals, which cut its rent payments by 25-50\% for the remainder of 2020 . It also borrowed $550 million in cash by issuing promissory notes. 5 How do companies calculate cash burn rate and runway length? Although these important measures are often discussed, cash burn rate and runway length are not required disclosures nor are they defined under generally accepted accounting principles (GAAP). As a result, companies invent their own calculation methods. That's not good because it leads to different calculations by different companies, making it difficult to directly compare one company to another. One analysis, for example, found that all eight of the largest airlines operating in North America used different methods to calculate their burn rates. Some used the income statement to first calculate EBITDA (earnings before interest, taxes, depreciation and amortization) and then make adjustments to it, whereas others used the statement of cash flows and made adjustments to the total "cash flows from operations" line. 6 The adjustments varied a great deal from one company to the next, creating "wiggle room" in what they ultimately reported as the daily cash burn rate. For purposes of our calculations, we use the following definitions, based on a recent academic article: 7 Dally Cash Burn Rate = Net Cash Flows from Operating Activities Number of Days in the Period Runway Length = [(Cash and Cash Equivalents + Short-Term Investments + Accounts Receivable)] / Daily Cash Burn Rate Net Cash Flows from Operating Activities is defined by GAAP and reported in the statement of cash flows, so it minimizes "wiggle room" and improves comparability across companies. Because we are evaluating near-term issues, we draw this amount from quarterly, not annual, financial statements. Consequently, there are typically about 90 days in the period (three months). For runway length calculations, we include not only cash and cash equivalents but also short-term investments and accounts receivable because these near-cash assets can be converted into cash very quickly, if needed. A case study of a company approaching the end of the runway Bob Luby opened his first restaurant in 1947 in San Antonio, Texas. By 2018, Luby's, Incorporated had grown to 146 restaurants, operating under brand names such as Luby's Cafeterias and Fuddruckers. Throughout that time, the company's statement of cash flows reported positive cash flows from operating activities. However, the streak of positive operating cash flows ended in 2018 . With the company spending more on its day-to-day operations than it was generating from them, Luby's took out a loan in December 2018 to repay other loans and lengthen its runway so it could try to get the business generating cash again. But 2019 was even worse, and then COVID-19 hit in early 2020. The pandemic forced Luby's to initially close its restaurants amid concerns about the safety of dine-in eating and later reopen with limits on guest capacity. For a company built on cafeteria-style food service, the pandemic accelerated Luby's race down the runway. With each passing quarter, the runway became shorter and shorter. As the analysis below shows, the company had just over 200 days of runway left at June 3 . Luby's had already borrowed all it could and it still would not survive long enough to celebrate New Year's Eve. On September 4, 2020, the company's board of directors recommended the company be dissolved. 8 1Delta Alr Unes Press felease, April 22, 2020, Delta Alr Lines Announces March Ouarter 2020 Financial Results and COVID-19 Fiesponse Actians. 2 Delta AIr Unes Press Felease, Octaber 13, 2020, Delta Alr Lines Announces September Guarter Financial Results. 3 Francis, T., and T. Gryta. 2020. Corona virus shows cash is king, even for biggest U.S. companies, Wall Street Journal (Onilne), March 25, Retrieved from https:liwwwisjcomiarticles/coronawirus-puts-a-premium-on-cash-even-for-biggest-u-E-companies-11sa5153040. 4Deve \& Buster's Press Release, September 10, 2020, Dave s Buster's Reports Second Quarter Financial Results. 5 Dave 8 Buster's Press Release, October 27, 2020, Dave 8 Buster's Announces Closing of $550 Millon Senior Secured Notes Otfering. Gersch, 12020 . Amid pandemic, airilines forge a new survival metric: Dally cash burn. Sap Glabal Market Intelligence, September 23, accessed at https:liwwwsglobolcomimarketintellgenceieninews-lnsights'blog/amid-pandemic-dirlines-forge-o-new-survhal-metric-dally-cash-bum. 7 De Vlto, A., and Gomez. 2020. Estimating the CoviD-19 cash crunch: Global evidence and policy. Joumal of Accourting and Public Pollcy. March-April, dot 10.1010 ).jacepubpol.2020.100741 Which of the following steps would reduce a company's cash burn rate? (Check all that apply.) Check All That Apply Laying off employees. Replacing old equipment with new rented equipment. Postponing stock repurchases indefinitely. Canceling cash dividends. Which of the following steps would lengthen a company's runway? (Check all that apply.) Check All That Apply Reducing the company's cash burn rate. Obtaining additional cash by issuing bonds. Paying down amounts owed to suppliers. Obtaining additional cash through stock issuances. Postponing maintenance work on property and equipment. The following financial data were reported in SEC Form 10-Q filings for AMC Entertainment (movie theaters) and Six Flags (amusemen parks) for the 92-day period ended September 30, 2020. For each company, use these data to calculate cash burn rate. (Round the Cash Burn Rate to 2 decimal places.) Use the rounded cash burn rate with other provided data to calculate runway length. (Round the runway length to the nearest whole day.) Which company was closer to running out of cash