Answered step by step

Verified Expert Solution

Question

1 Approved Answer

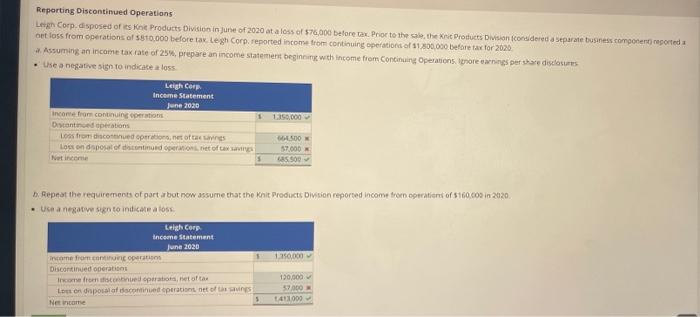

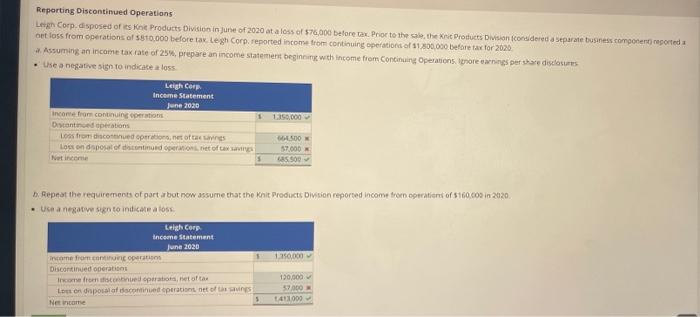

RUSH: (accounting) please fix incorrect answers Reporting Discontinued Operations Leigh Corp. disposed of its Products Division in jure of 2020 at a loss of 576,000

RUSH: (accounting) please fix incorrect answers

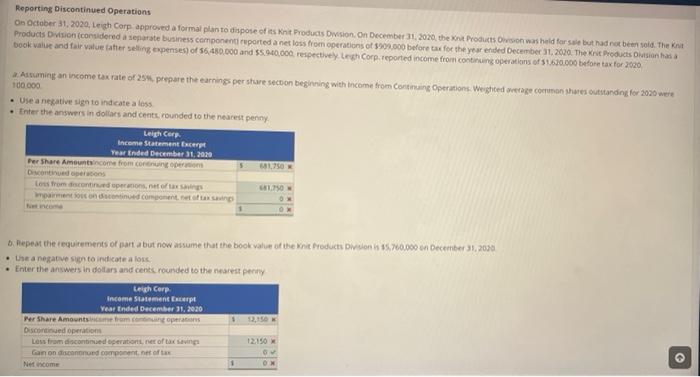

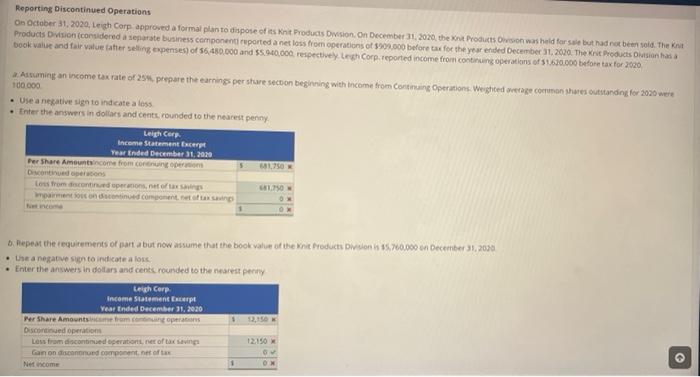

Reporting Discontinued Operations Leigh Corp. disposed of its Products Division in jure of 2020 at a loss of 576,000 before tax. Prior to the sale, the Kut Products Division considered a separate business component reported oet loss from operations of 5810.000 before tax Legh Corp. reported income from continuing operations of 11 300.000 before tax for 2020 2. Assuming an income tax rate of 25%, prepare an income statement beginning with income from Continuing Operations, inorenings per the disclosures Use a negative in to indicate a loss 1.150.000 Leigh Corp Income Statement June 2020 income from continuing operations Discontinued operations Los from scored operation of Lorondsposato continued one of tax av Not income SEDO 57000 5.500 Repeat the requirements of partar but now assume that the Knit Products Division reported income from operation of 5160.09 in 2020 - Use a negative in to indicate a los Leigh Corg income Statement June 2020 Income from contine operation 1.350.000 Discontinued operations Income from operation of 120.000 Loodsposto continued operation of the 57000 Net income 1411000 Reporting Discontinued Operations On October 31, 2020, Leigh Corp approved a formal pianto dispose of iesit Products Division On December 31, 2020, the Xnt Products Division was held for sale but had not be sold. The Knut Products Division considered a separate business component reported a net loss from operations of 900.000 before tak for the year ended December 31, 2020 The Ket Products Division has a book value and fair value herseling expenses of 56.480.000 and 55.900,000. respectively. Corp. reported income from continuing operations of 1.620.000 before tax for 2020 Attuming an income tax rate of 29 prepare the earnings per shure section beginning with income from Continuing Operations. Weighted average corromon shares outstanding for 2020 were 100.000 Use a negative sign to indicate a loss Enter the answers in dollars and cents rounded to the nearest penny Leigh Corp. Income Statement Excerpt Year Ended December 31, 2020 Per Share Amountaincome from cornungen Discontinued Lors from descontinued operations, torta SO Impairment contine comment of taxa 1 OM Repeat the requirements of part a but now assume that the book value of the Knit Products Division is 5.700.000 on December 3, 2000 . Una negative to indicate a los Enter the answers in dollars and cents, rounded to the nearest perny Leigh Cerp Income statement Enterpe Year Ended December 31, 2020 Per Share Amount.com operators 12,150 Discontinued operations Less from discontinued operationer of tax saving 12.150 Ganon discount of Netcome 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started