Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rustam Inc. began operations in Year 1. During its first two years, the company completed a number of transactions involving sales on credit, accounts receivable

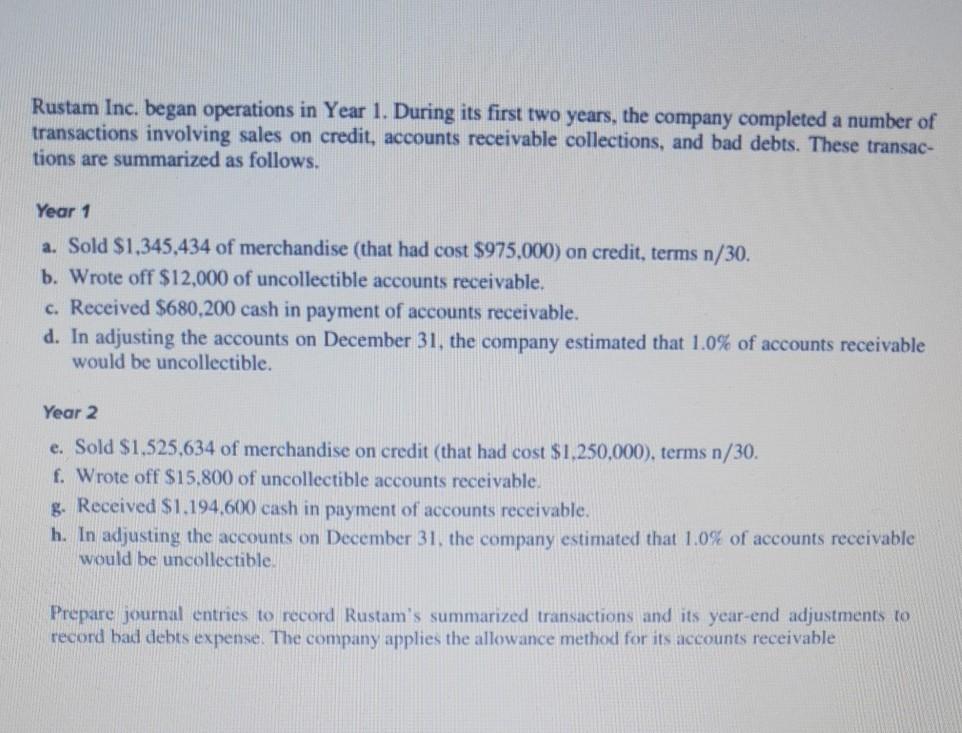

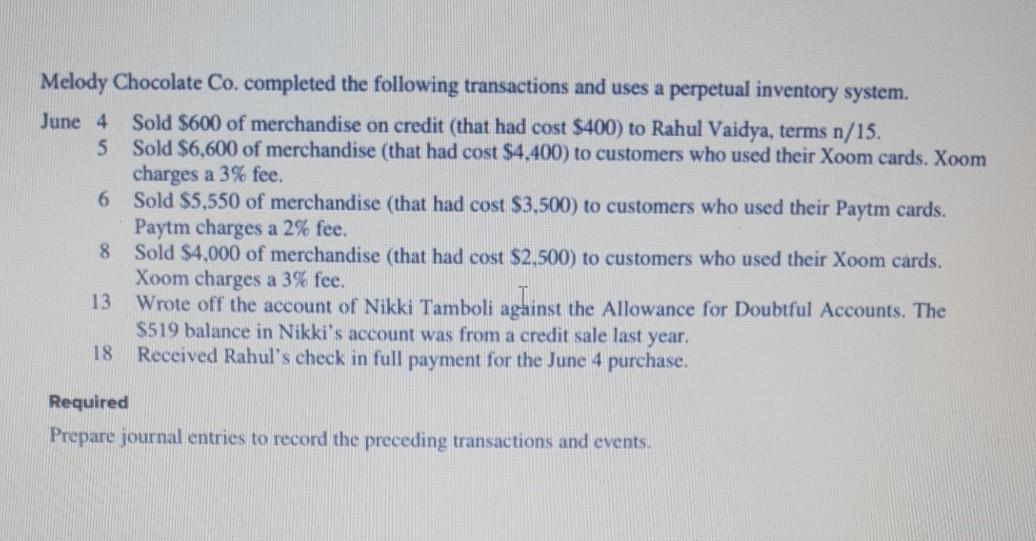

Rustam Inc. began operations in Year 1. During its first two years, the company completed a number of transactions involving sales on credit, accounts receivable collections, and bad debts. These transac- tions are summarized as follows. Year 1 a. Sold $1,345,434 of merchandise (that had cost $975,000) on credit, terms n/30. b. Wrote off $12,000 of uncollectible accounts receivable. c. Received $680,200 cash in payment of accounts receivable. d. In adjusting the accounts on December 31, the company estimated that 1.0% of accounts receivable would be uncollectible. Year 2 e. Sold $1.525,634 of merchandise on credit (that had cost $1.250,000). terms n/30. f. Wrote off $15,800 of uncollectible accounts receivable. g. Received $1.194,600 cash in payment of accounts receivable. h. In adjusting the accounts on December 31, the company estimated that 1.0% of accounts receivable would be uncollectible. Prepare journal entries to record Rustam's summarized transactions and its year-end adjustments to record bad debts expense. The company applies the allowance method for its accounts receivable Melody Chocolate Co. completed the following transactions and uses a perpetual inventory system. June 4 Sold $600 of merchandise on credit (that had cost $400) to Rahul Vaidya, terms n/15. 5 Sold $6,600 of merchandise (that had cost $4,400) to customers who used their Xoom cards. Xoom charges a 3% fee. 6 Sold $5,550 of merchandise (that had cost $3,500) to customers who used their Paytm cards. Paytm charges a 2% fee. 8 Sold $4,000 of merchandise (that had cost $2,500) to customers who used their Xoom cards. Xoom charges a 3% fee. 13 Wrote off the account of Nikki Tamboli against the Allowance for Doubtful Accounts. The $519 balance in Nikki's account was from a credit sale last year. 18 Received Rahul's check in full payment for the June 4 purchase. Required Prepare journal entries to record the preceding transactions and events

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started