Answered step by step

Verified Expert Solution

Question

1 Approved Answer

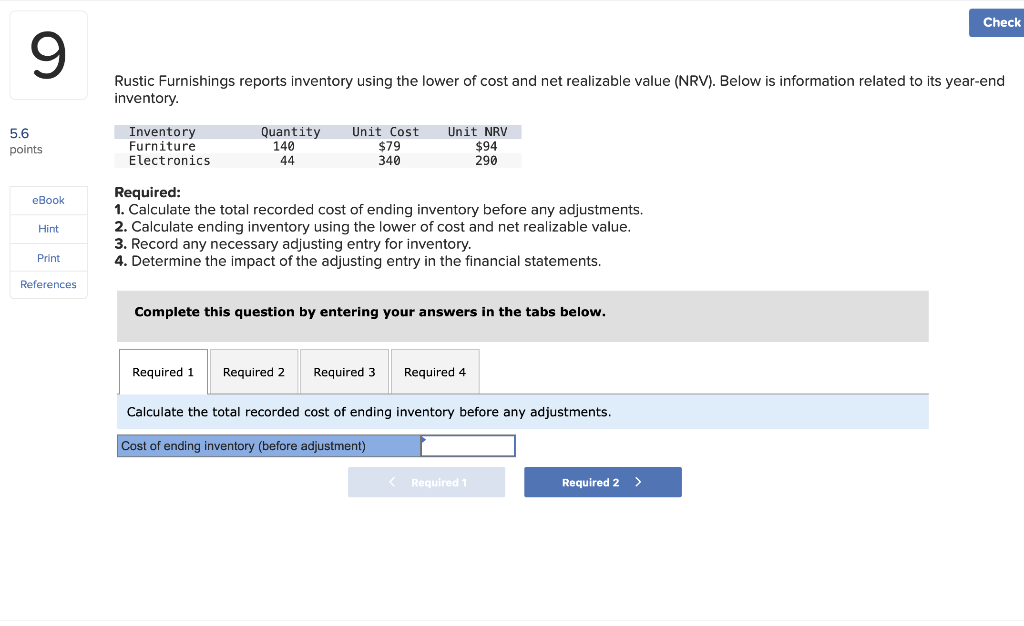

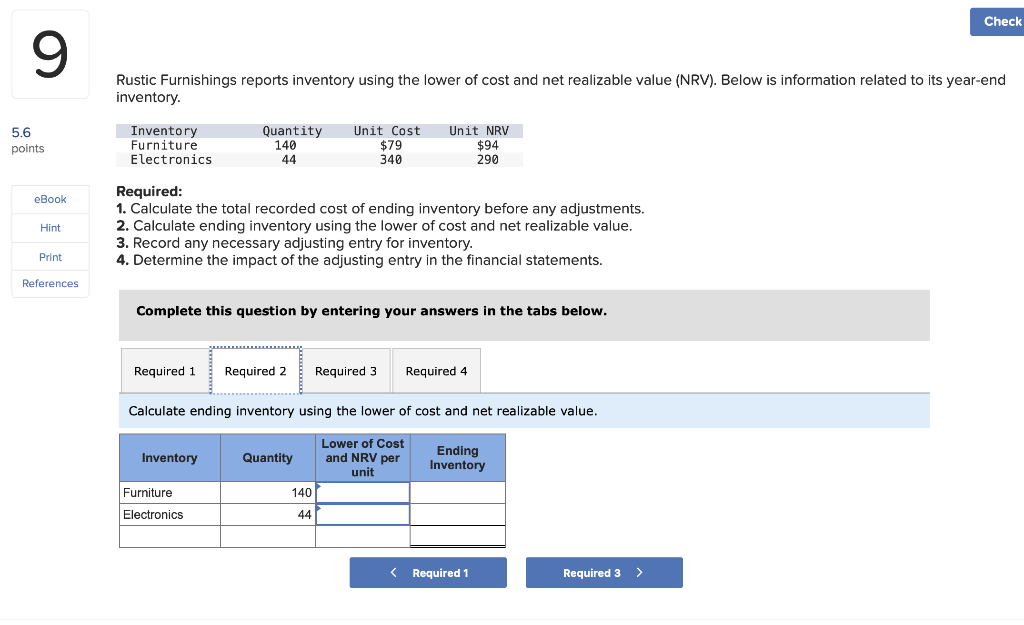

Rustic Furnishings reports inventory using the lower of cost and net realizable value (NRV). Below is information related to its year-end inventory. (Pls show each

Rustic Furnishings reports inventory using the lower of cost and net realizable value (NRV). Below is information related to its year-end inventory.

(Pls show each step on how to solve it, thank you!)

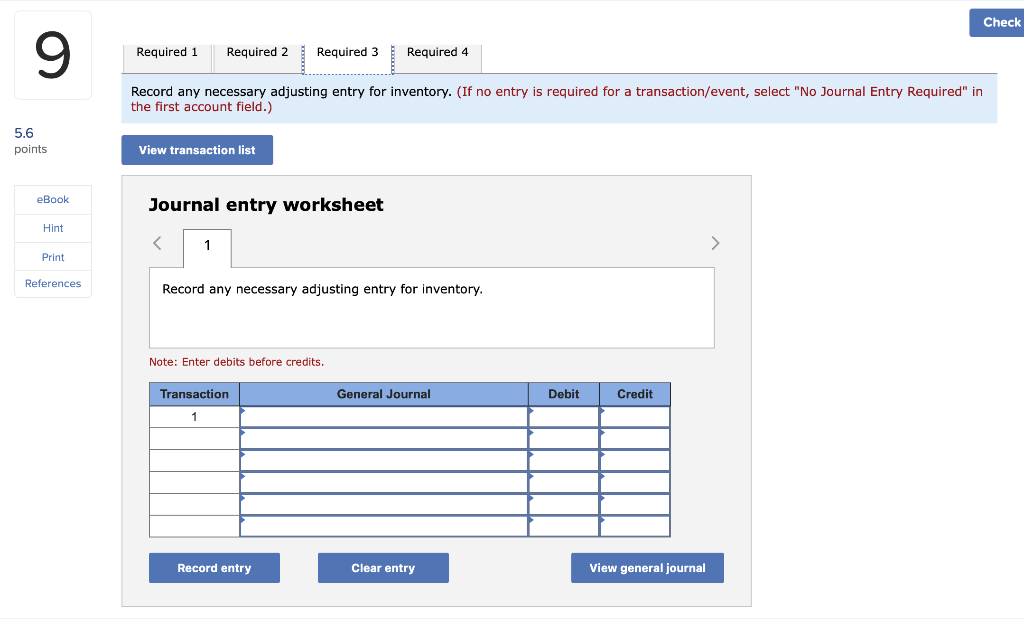

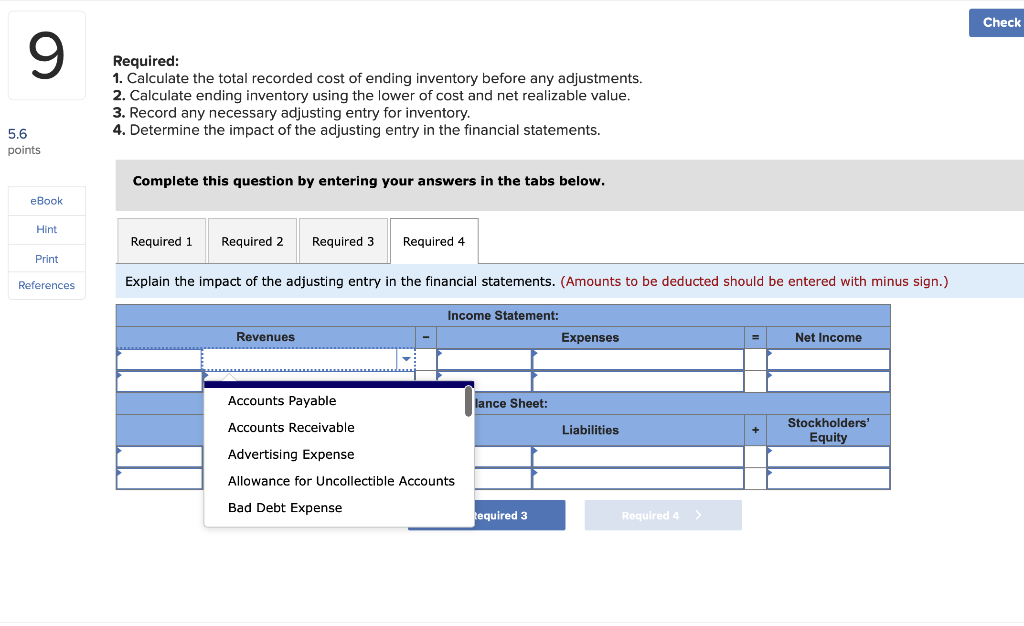

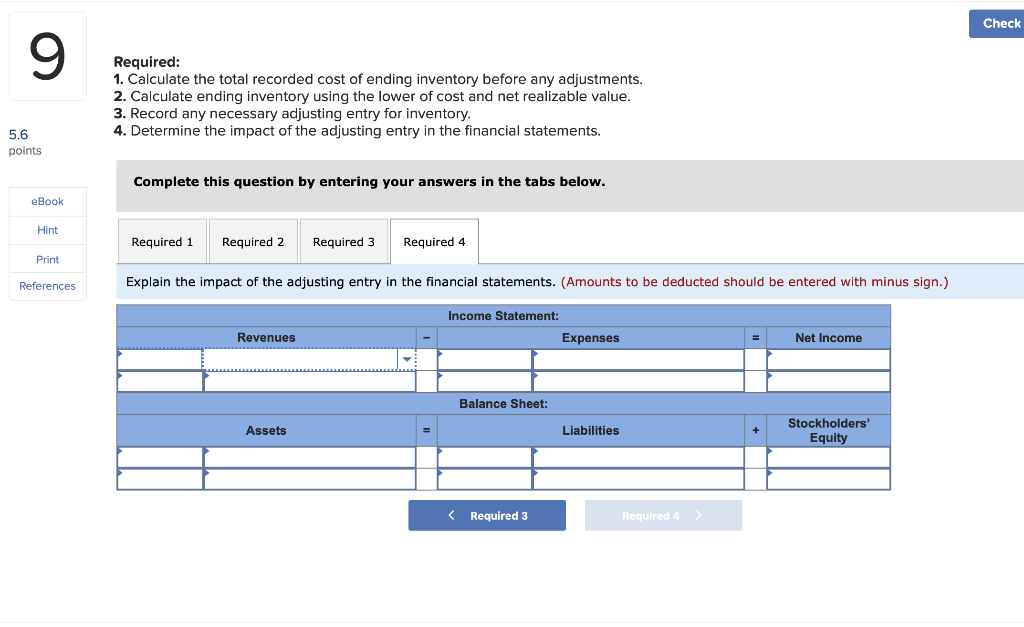

Rustic Furnishings reports inventory using the lower of cost and net realizable value (NRV). Below is information related to its year-eno inventory. Required: 1. Calculate the total recorded cost of ending inventory before any adjustments. 2. Calculate ending inventory using the lower of cost and net realizable value. 3. Record any necessary adjusting entry for inventory. 4. Determine the impact of the adjusting entry in the financial statements. Complete this question by entering your answers in the tabs below. Calculate the total recorded cost of ending inventory before any adjustments. Rustic Furnishings reports inventory using the lower of cost and net realizable value (NRV). Below is information related to its year-end inventory. Required: 1. Calculate the total recorded cost of ending inventory before any adjustments. 2. Calculate ending inventory using the lower of cost and net realizable value. 3. Record any necessary adjusting entry for inventory. 4. Determine the impact of the adjusting entry in the financial statements. Complete this question by entering your answers in the tabs below. Calculate ending inventory using the lower of cost and net realizable value. Record any necessary adjusting entry for inventory. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record any necessary adjusting entry for inventory. Note: Enter debits before credits. Required: 1. Calculate the total recorded cost of ending inventory before any adjustments. 2. Calculate ending inventory using the lower of cost and net realizable value. 3. Record any necessary adjusting entry for inventory. 4. Determine the impact of the adjusting entry in the financial statements. Complete this question by entering your answers in the tabs below. Required: 1. Calculate the total recorded cost of ending inventory before any adjustments. 2. Calculate ending inventory using the lower of cost and net realizable value. 3. Record any necessary adjusting entry for inventory. 4. Determine the impact of the adjusting entry in the financial statements. Complete this question by entering your answers in the tabs belowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started