Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ruth Madlala is 26 years old. She and her husband are members of a registered medical scheme. She contributed R2 500 a month to the

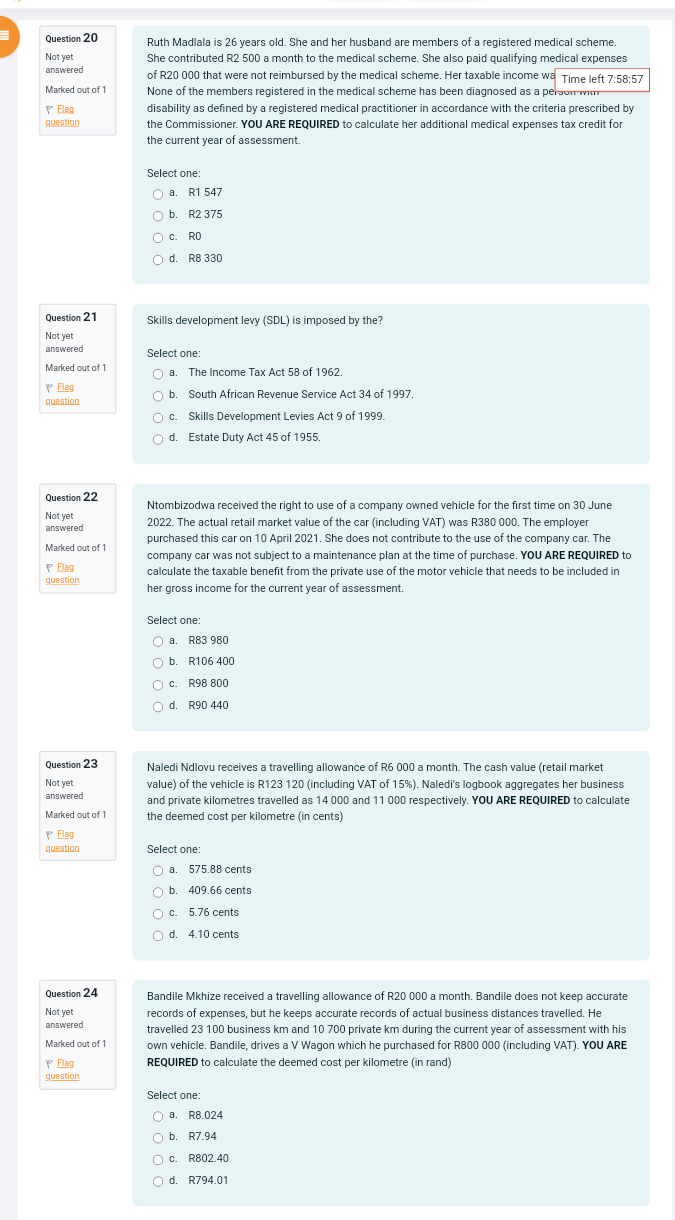

Ruth Madlala is 26 years old. She and her husband are members of a registered medical scheme. She contributed R2 500 a month to the medical scheme. She also paid qualifying medical expenses of R20 000 that were not reimbursed by the medical scheme. Her taxable income wa Time left 7:58:57 None of the members registered in the medical scheme has been diagnosed as a perour wrrt disability as defined by a registered medical practitioner in accordance with the criteria prescribed by the Commissioner. YOU ARE REQUIRED to calculate her additional medical expenses tax credit for the current year of assessment. Select one: a. R1547 b. R2 375 c. RO d. R8330 Skills development levy (SDL) is imposed by the? Select one: a. The Income Tax Act 58 of 1962. b. South African Revenue Service Act 34 of 1997. c. Skills Development Levies Act 9 of 1999. d. Estate Duty Act 45 of 1955. Ntombizodwa received the right to use of a company owned vehicle for the first time on 30 June 2022. The actual retail market value of the car (including VAT) was R380 000. The employer purchased this car on 10 April 2021. She does not contribute to the use of the company car. The company car was not subject to a maintenance plan at the time of purchase. YOU ARE REQUIRED to calculate the taxable benefit from the private use of the motor vehicle that needs to be included in her gross income for the current year of assessment. Select one: a. R83980 b. R106 400 c. R98 800 d. R90 440 Naledi Ndlovu receives a travelling allowance of R6 000 a month. The cash value (retail market value) of the vehicle is R123 120 (including VAT of 15\%). Naledi's logbook aggregates her business and private kilometres travelled as 14000 and 11000 respectively. YOU ARE REQUIRED to calculate the deemed cost per kilometre (in cents) Select one: a. 575.88 cents b. 409.66 cents c. 5.76 cents d. 4.10 cents Bandile Mkhize received a travelling allowance of R20 000 a month. Bandile does not keep accurate records of expenses, but he keeps accurate records of actual business distances travelled. He travelled 23100 business km and 10700 private km during the current year of assessment with his own vehicle. Bandile, drives a V Wagon which he purchased for R800 000 (including VAT). YOU ARE REQUIRED to calculate the deemed cost per kilometre (in rand) Select one: a. R8.024 b. R7.94 c. R802.40 d. R794.01

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started