Answered step by step

Verified Expert Solution

Question

1 Approved Answer

RW Chocolate Company is a chocolate shop producing and selling customised luxury chocolates. The company was founded in 1990 and has 80 staff now.

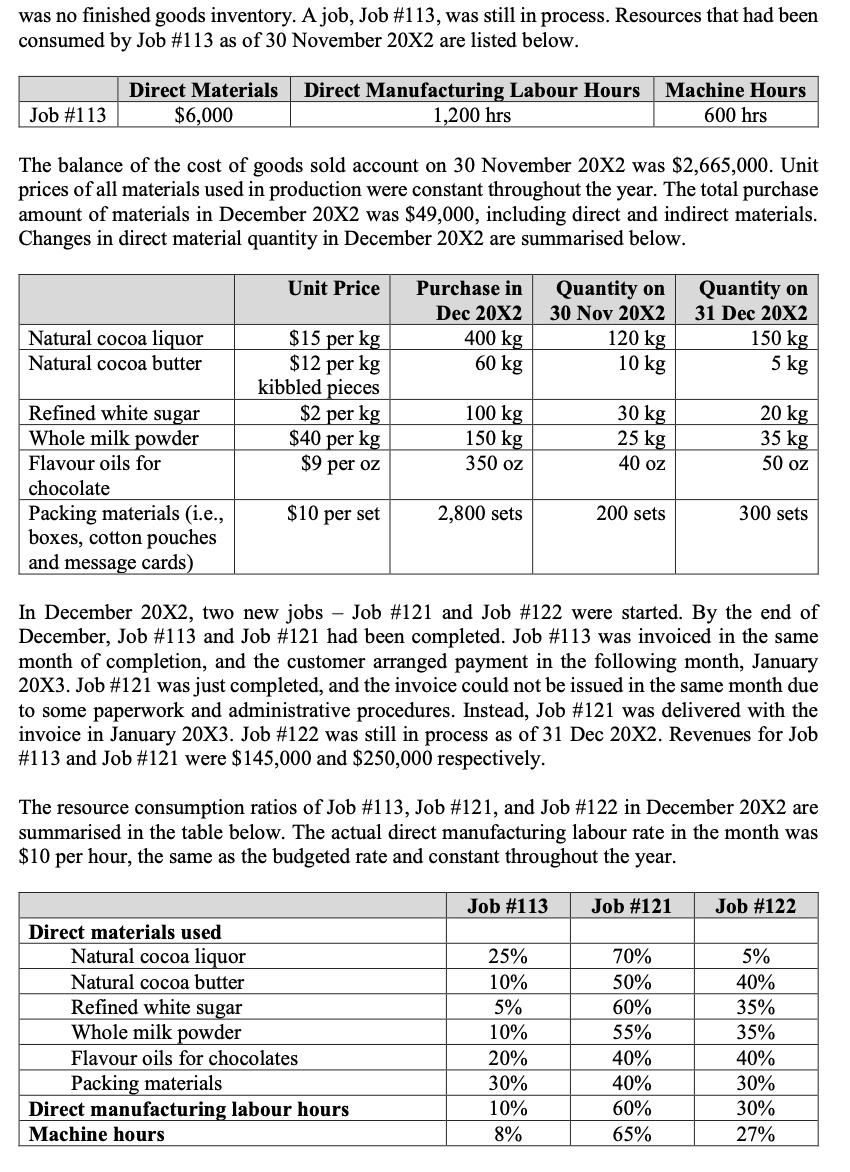

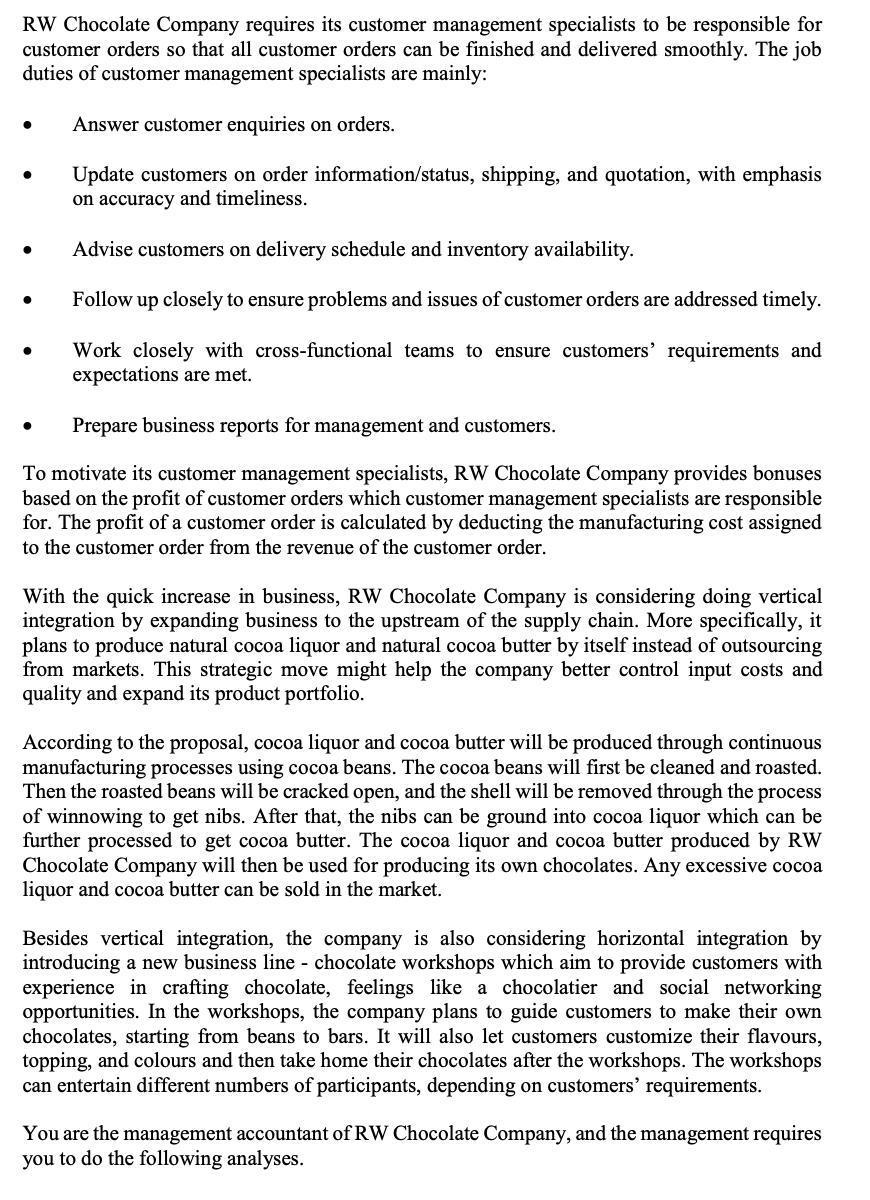

RW Chocolate Company is a chocolate shop producing and selling customised luxury chocolates. The company was founded in 1990 and has 80 staff now. Its chocolates are well known for high-quality ingredients, exceptional flavours, sophisticated packaging, and order customisation. The products are mainly dark, milk and white chocolates or a combination of different chocolates with a wide range of flavours and fillings. Dark chocolate is made of cocoa liquor, cocoa butter, and sugar. Milk chocolate is made of cocoa liquor, cocoa butter, sugar, and milk powder. White chocolate is made of cocoa butter, sugar, and milk powder. Premium chocolate typically has high cocoa content including cocoa liquor and cocoa butter. Compared to other chocolate producers on the high street, the company's chocolates have relatively higher cocoa content. Its dark, milk and white chocolates have at least 70%, 40% and 30% cocoa content respectively. The company aims to build a brand image of expertise, customised luxury gifts and ethical trading. It provides custom options to customers, including chocolates of different flavours in different shapes, custom boxes, tailored cotton pouches, stylish message cards, and personal engravings. The company uses a job-order costing system to determine the manufacturing cost of each customer order. The manufacturing cost of customer orders, together with other factors like the required return rate, competition conditions and the negotiation power of customers, determine the prices of customer orders. The costing system has two direct manufacturing cost pools direct materials and direct manufacturing labour, and one indirect manufacturing cost pool - manufacturing overheads. Manufacturing overheads are charged to customer orders using a predetermined overhead rate based on machine hours. All manufacturing overhead variances are closed to the cost of goods sold account at the end of each year. The company's budgeted and actual cost for 20X2 and actual cost for December 20X2 are listed in the table below. 20X2 Budget 20X2 Actual Dec 20X2 Actual Manufacturing labour Direct manufacturing labour $960,000 $1,000,000 $85,000 Indirect manufacturing labour $200,000 $210,000 $17,200 Materials Direct materials $510,000 $520,000 $42,210 Indirect materials $30,000 $28,500 $2,370 Other overheads Machine and factory depreciation $500,000 $500,000 $41,667 Utility costs incurred in the factory $400,000 $460,000 $38,000 Transferred-out cost $100,000 $110,000 $9,000 Selling and administrative expenses $800,000 $850,000 $70,000 Direct manufacturing labour hours 96,000 hrs 100,000 hrs 8,500 hrs Machine hours 25,000 hrs 25,200 hrs 2,050 hrs To better manage inventories, the company produces for customer orders which means it starts manufacturing after receiving customer orders. Normally, products are sent to customers together with invoices right after orders are completed. At the end of November 20X2, there was no finished goods inventory. A job, Job #113, was still in process. Resources that had been consumed by Job #113 as of 30 November 20X2 are listed below. Job #113 Direct Materials $6,000 Direct Manufacturing Labour Hours Machine Hours 1,200 hrs 600 hrs The balance of the cost of goods sold account on 30 November 20X2 was $2,665,000. Unit prices of all materials used in production were constant throughout the year. The total purchase amount of materials in December 20X2 was $49,000, including direct and indirect materials. Changes in direct material quantity in December 20X2 are summarised below. Unit Price Purchase in Dec 20X2 Quantity on 30 Nov 20X2 Quantity on 31 Dec 20X2 Natural cocoa liquor Natural cocoa butter $15 per kg 400 kg 120 kg 150 kg $12 per kg 60 kg 10 kg 5 kg kibbled pieces Refined white sugar $2 per kg 100 kg 30 kg 20 kg Whole milk powder Flavour oils for $40 per kg 150 kg 25 kg 35 kg $9 per oz 350 oz 40 oz 50 oz chocolate Packing materials (i.e., $10 per set 2,800 sets 200 sets 300 sets boxes, cotton pouches and message cards) In December 20X2, two new jobs - Job #121 and Job #122 were started. By the end of December, Job #113 and Job #121 had been completed. Job #113 was invoiced in the same month of completion, and the customer arranged payment in the following month, January 20X3. Job #121 was just completed, and the invoice could not be issued in the same month due to some paperwork and administrative procedures. Instead, Job #121 was delivered with the invoice in January 20X3. Job #122 was still in process as of 31 Dec 20X2. Revenues for Job # 113 and Job # 121 were $145,000 and $250,000 respectively. The resource consumption ratios of Job #113, Job #121, and Job #122 in December 20X2 are summarised in the table below. The actual direct manufacturing labour rate in the month was $10 per hour, the same as the budgeted rate and constant throughout the year. Job #113 Job #121 Job #122 Direct materials used Natural cocoa liquor Natural cocoa butter 25% 70% 5% 10% 50% 40% Refined white sugar 5% 60% 35% Whole milk powder 10% 55% 35% Flavour oils for chocolates 20% 40% 40% Packing materials 30% 40% 30% Direct manufacturing labour hours 10% 60% 30% Machine hours 8% 65% 27% RW Chocolate Company requires its customer management specialists to be responsible for customer orders so that all customer orders can be finished and delivered smoothly. The job duties of customer management specialists are mainly: . . Answer customer enquiries on orders. Update customers on order information/status, shipping, and quotation, with emphasis on accuracy and timeliness. Advise customers on delivery schedule and inventory availability. Follow up closely to ensure problems and issues of customer orders are addressed timely. Work closely with cross-functional teams to ensure customers' requirements and expectations are met. Prepare business reports for management and customers. To motivate its customer management specialists, RW Chocolate Company provides bonuses based on the profit of customer orders which customer management specialists are responsible for. The profit of a customer order is calculated by deducting the manufacturing cost assigned to the customer order from the revenue of the customer order. With the quick increase in business, RW Chocolate Company is considering doing vertical integration by expanding business to the upstream of the supply chain. More specifically, it plans to produce natural cocoa liquor and natural cocoa butter by itself instead of outsourcing from markets. This strategic move might help the company better control input costs and quality and expand its product portfolio. According to the proposal, cocoa liquor and cocoa butter will be produced through continuous manufacturing processes using cocoa beans. The cocoa beans will first be cleaned and roasted. Then the roasted beans will be cracked open, and the shell will be removed through the process of winnowing to get nibs. After that, the nibs can be ground into cocoa liquor which can be further processed to get cocoa butter. The cocoa liquor and cocoa butter produced by RW Chocolate Company will then be used for producing its own chocolates. Any excessive cocoa liquor and cocoa butter can be sold in the market. Besides vertical integration, the company is also considering horizontal integration by introducing a new business line - chocolate workshops which aim to provide customers with experience in crafting chocolate, feelings like a chocolatier and social networking opportunities. In the workshops, the company plans to guide customers to make their own chocolates, starting from beans to bars. It will also let customers customize their flavours, topping, and colours and then take home their chocolates after the workshops. The workshops can entertain different numbers of participants, depending on customers' requirements. You are the management accountant of RW Chocolate Company, and the management requires you to do the following analyses. Required: (a) Calculate the predetermined overhead rate for 20X2. (b) Calculate the manufacturing overhead variance for 20X2. (c) (4 marks) (6 marks) (d) (e) (f) (g) Use normal job-order costing to calculate the balances of work-in-process inventory, finished goods inventory, and cost of goods sold as of 31 December 20X2 after any necessary adjustment(s). (30 marks) With the information provided, give the necessary journal entries to record the transactions for December 20X2. Show each job separately for the work-in-process inventory accounts only. Narrations can be ignored. (20 marks) The company's factory manager suggested using direct manufacturing labour hours instead of machine hours to apply manufacturing overheads to customer orders. The customer management specialist who was responsible for Job #113 strongly supported the change. Provide comments with supporting calculations. (12 marks) Based on the information of customer management specialists, comment on the current organisational architecture (OA) at RW Chocolate Company. Propose improvement/s if you think it necessary. (8 marks) Analyse the impact of vertical integration on the company's costing system. Describe the costing system(s) needed to calculate the cost of cocoa liquor, cocoa butter, and orders for customised chocolates. (12 marks) (h) To assess the return of chocolate workshops, the costs of the workshops should be widely and carefully studied. Using each participant as a cost object, provide and discuss examples of the following cost categories: (i) Variable cost (ii) Fixed cost (iii) Direct cost (iv) Indirect cost (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started