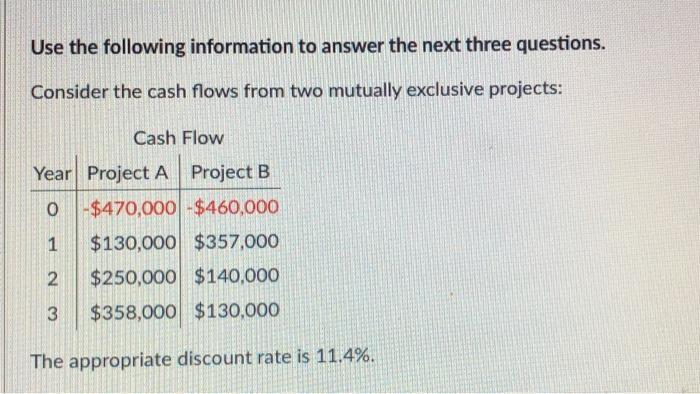

Calculate the net present value (NPV) for both projects, and determine which project should be accepted based on NPV. Round both NPVs to the nearest

- Calculate the net present value (NPV) for both projects, and determine which project should be accepted based on NPV. Round both NPVs to the nearest dollar.

- Calculate the internal rate of return (IRR) for both projects, and determine which project should be accepted based on IRR.

- Calculate the net present value (NPV) for both projects using the crossover rate as your discount rate. Round both NPVs to the nearest dollar.

Use the following information to answer the next three questions. Consider the cash flows from two mutually exclusive projects: Cash Flow Year Project A Project B 0 -$470,000-$460,000 1 $130,000 $357,000 $250,000 $140,000 2 3 $358,000 $130,000 The appropriate discount rate is 11.4%. Use the following information to answer the next three questions. Consider the cash flows from two mutually exclusive projects: Cash Flow Year Project A Project B 0 -$470,000-$460,000 1 $130,000 $357,000 $250,000 $140,000 2 3 $358,000 $130,000 The appropriate discount rate is 11.4%.

Step by Step Solution

3.52 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

a NPV of both projects Project A Year n Cash flow PVIF114 PV 0 47000000 1000 470000 1 13000000 0898 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started