Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ryan Homes produces exterior siding for homes. The Preparation Department begins with wood, which is chopped into small bits. At the end of the process,

Ryan Homes produces exterior siding for homes. The Preparation Department begins with wood, which is chopped into small bits. At the end of the process, an adhesive is added. Then the wood/adhesive mixture goes on to the Compression Department, where the wood is compressed into sheets. Conversion costs are added evenly throughout the preparation process. January data for the Preparation Department are as follows:

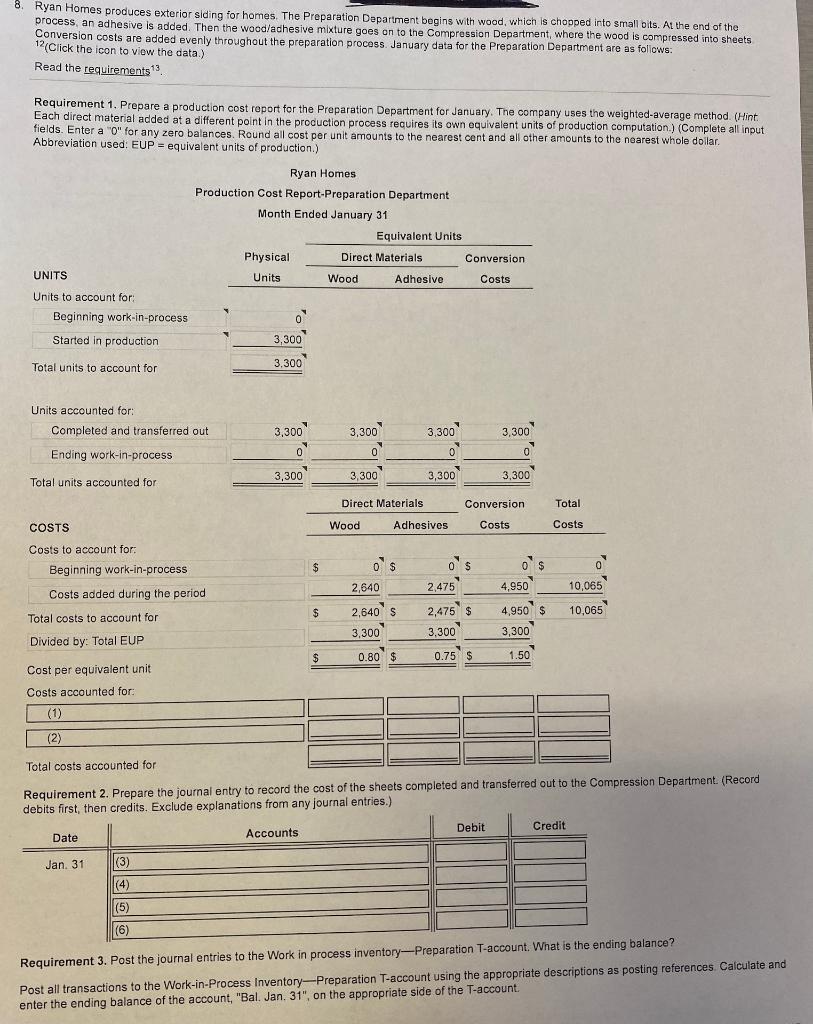

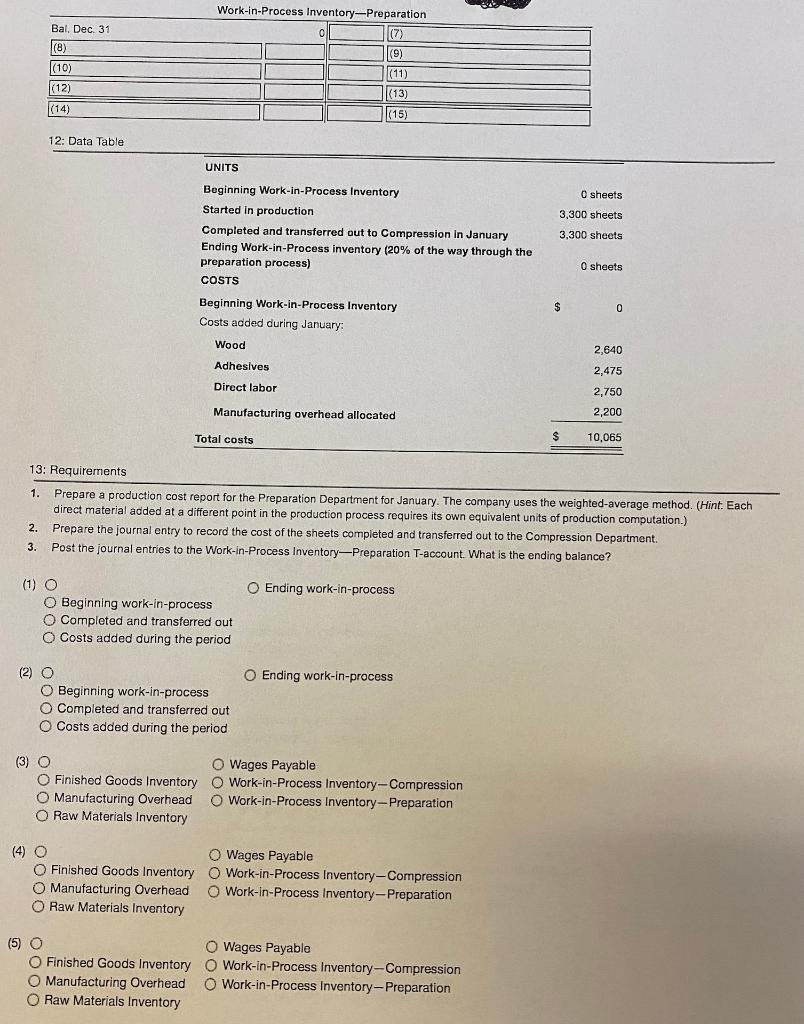

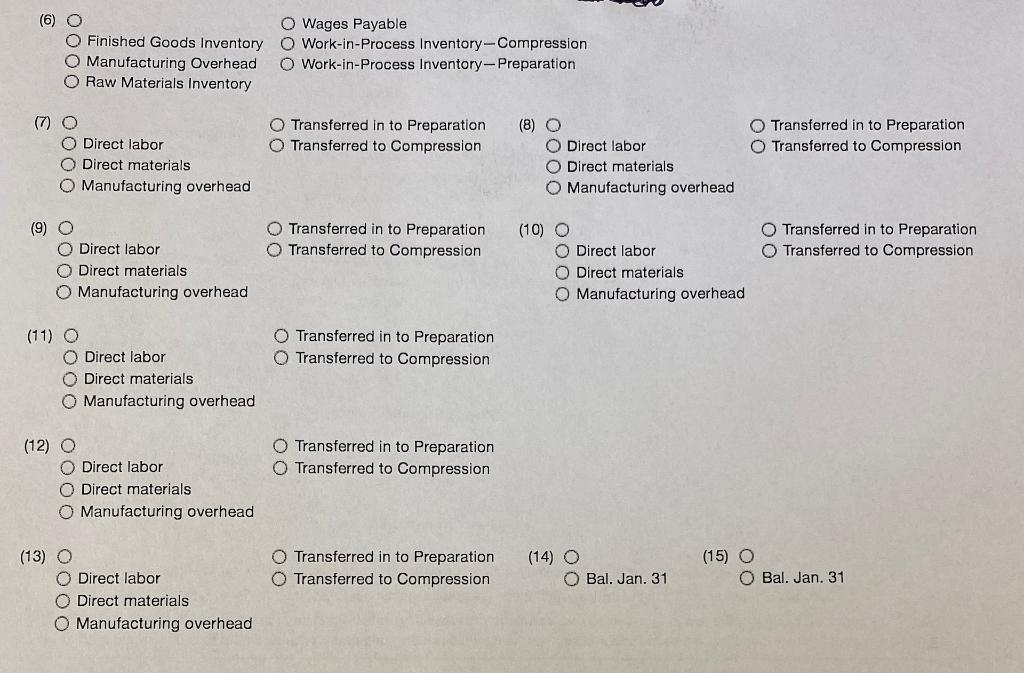

8. Ryan Homes produces exterior siding for homes. The Preparation Department begins with wood, which is chopped into small bits. At the end of the process, an adhesive is added. Then the wood/adhesive mixture goes on to the Compression Department, where the wood is compressed into sheets Conversion costs are added evenly throughout the preparation process. January data for the Preparation Department are as follows: 12(Click the icon to view the data.) Read the requirements Requirement 1. Prepare a production cost report for the Preparation Department for January. The company uses the weighted average method. (Hint Each direct material added at a different point in the production process requires its own equivalent units of production computation.) (Complete all input fields. Enter a "O" for any zero balances. Round all cost per unit amounts to the nearest cent and all other amounts to the nearest whole dollar Abbreviation used: EUP = equivalent units of production.) Ryan Homes Production Cost Report-Preparation Department Month Ended January 31 Equivalent Units Physical Direct Materials Conversion Units Wood Adhesive Costs UNITS Units to account for: Beginning work-in-process 0 Started in production 3,300 Total units to account for 3,300 Units accounted for: 3,300 3,300 3,300 Completed and transferred out Ending work-in-process 3,300 0 0 0 0 3,300 3,300 3,300 3,300 Total units accounted for Direct Materials Conversion Total COSTS Wood Adhesives Costs Costs Costs to account for: Beginning work-in-process $ 0 $ 09 0 $ 0 $ 0 2,640 2,475 4,950 10,065 Costs added during the period $ 2,640 S 10,065 Total costs to account for 2,475 $ 3,300 4,950 $ 3,300 3,300 Divided by: Total EUP $ 0.80 $ 1.50 0.75 $ Cost per equivalent unit Costs accounted for: (1) (2) Total costs accounted for Requirement 2. Prepare the journal entry to record the cost of the sheets completed and transferred out to the Compression Department. (Record debits first, then credits. Exclude explanations from any journal entries.) Credit Debit Accounts Date Jan. 31 (3) (4) (5) (6) Requirement 3. Post the journal entries to the Work in process inventory-Preparation T-account. What is the ending balance? Post all transactions to the Work-in-Process Inventory-Preparation T-account using the appropriate descriptions as posting references Calculate and enter the ending balance of the account, "Bal. Jan. 31", on the appropriate side of the T-account Work-in-Process Inventory-Preparation 0 (7) (9) Bal, Dec. 31 (8) |(10) (12) (11) (13) (14) (15) 12: Data Table UNITS O sheets 3,300 sheets 3,300 sheets Beginning Work-in-Process Inventory Started in production Completed and transferred out to Compression in January Ending Work-in-process inventory (20% of the way through the preparation process) COSTS Beginning Work-in-Process Inventory Costs added during January O sheets $ 0 Wood 2,640 Adhesives 2,475 Direct labor 2,750 Manufacturing overhead allocated 2,200 Total costs $ 10,065 13: Requirements 1. Prepare a production cost report for the Preparation Department for January. The company uses the weighted average method. (Hint. Each direct material added at a different point in the production process requires its own equivalent units of production computation.) 2. Prepare the journal entry to record the cost of the sheets completed and transferred out to the Compression Department. 3. Post the journal entries to the Work-in-Process Inventory-Preparation T-account. What is the ending balance? O Ending work-in-process (1) O O Beginning work-in-process O Completed and transferred out O Costs added during the period O Ending work-in-process (2) O Beginning work-in-process Completed and transferred out O Costs added during the period (3) O O Wages Payable O Finished Goods Inventory O Work-in-Process Inventory-Compression O Manufacturing Overhead O Work-in-Process Inventory- Preparation O Raw Materials Inventory (4) O O Wages Payable O Finished Goods Inventory Work-in-Process Inventory-Compression O Manufacturing Overhead O Work-in-Process Inventory-Preparation O Raw Materials Inventory (5) O O Wages Payable O Finished Goods Inventory Work-in-Process Inventory--Compression Manufacturing Overhead O Work-in-Process Inventory- Preparation Raw Materials Inventory (6) O O Wages Payable O Finished Goods Inventory Work-in-Process Inventory-Compression O Manufacturing Overhead O Work-in-Process Inventory-Preparation O Raw Materials Inventory Transferred in to Preparation O Transferred to Compression Transferred in to Preparation Transferred to Compression ( 70 O Direct labor O Direct materials O Manufacturing overhead (8) a O Direct labor O Direct materials O Manufacturing overhead Transferred in to Preparation Transferred to Compression Transferred in to Preparation Transferred to Compression (9) O O Direct labor O Direct materials O Manufacturing overhead (10) O O Direct labor O Direct materials O Manufacturing overhead (11) O Transferred in to Preparation Transferred to Compression Direct labor Direct materials O Manufacturing overhead (12) Transferred in to Preparation Transferred to Compression O Direct labor O Direct materials O Manufacturing overhead (15) OO Transferred in to Preparation Transferred to Compression (14) O O Bal. Jan. 31 O Bal. Jan. 31 (13) O O Direct labor Direct materials O Manufacturing overheadStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started