Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ryann Spencer has recently been appointed Regional Director of sales and marketing for Fun Vacations Limited, a public company. Ryann has come to you

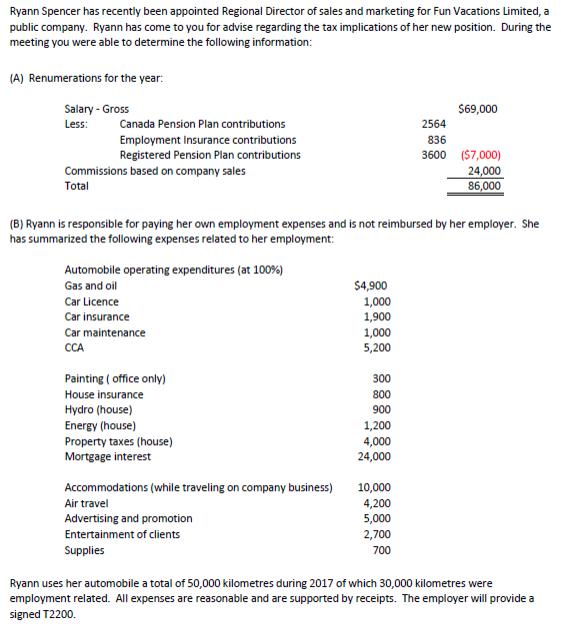

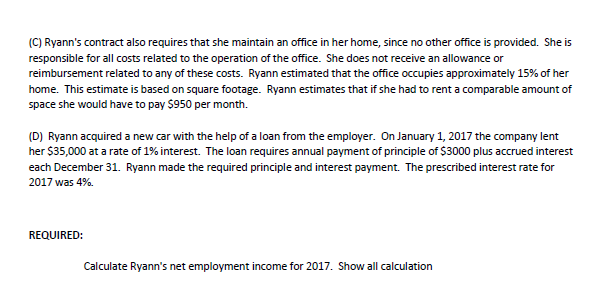

Ryann Spencer has recently been appointed Regional Director of sales and marketing for Fun Vacations Limited, a public company. Ryann has come to you for advise regarding the tax implications of her new position. During the meeting you were able to determine the following information: (A) Renumerations for the year: Salary - Gross Less: Canada Pension Plan contributions Employment Insurance contributions Registered Pension Plan contributions Commissions based on company sales $69,000 2564 836 3600 ($7,000) 24,000 Total 86,000 (B) Ryann is responsible for paying her own employment expenses and is not reimbursed by her employer. She has summarized the following expenses related to her employment: Automobile operating expenditures (at 100%) Gas and oil Car Licence Car insurance Car maintenance CCA Painting (office only) House insurance $4,900 1,000 1,900 1,000 5,200 300 800 Hydro (house) 900 Energy (house) 1,200 Property taxes (house) 4,000 Mortgage interest 24,000 Accommodations (while traveling on company business) 10,000 Air travel 4,200 Advertising and promotion 5,000 Entertainment of clients 2,700 Supplies 700 Ryann uses her automobile a total of 50,000 kilometres during 2017 of which 30,000 kilometres were employment related. All expenses are reasonable and are supported by receipts. The employer will provide a signed T2200. (C) Ryann's contract also requires that she maintain an office in her home, since no other office is provided. She is responsible for all costs related to the operation of the office. She does not receive an allowance or reimbursement related to any of these costs. Ryann estimated that the office occupies approximately 15% of her home. This estimate is based on square footage. Ryann estimates that if she had to rent a comparable amount of space she would have to pay $950 per month. (D) Ryann acquired a new car with the help of a loan from the employer. On January 1, 2017 the company lent her $35,000 at a rate of 1% interest. The loan requires annual payment of principle of $3000 plus accrued interest each December 31. Ryann made the required principle and interest payment. The prescribed interest rate for 2017 was 4%. REQUIRED: Calculate Ryann's net employment income for 2017. Show all calculation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Ryanns net employment income for 2017 we need to deduct the applicable deductions and e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started