Answered step by step

Verified Expert Solution

Question

1 Approved Answer

RZ at present has no debt in its capital structure. The directors, who are the major shareholders, would be prepared to finance the purchase of

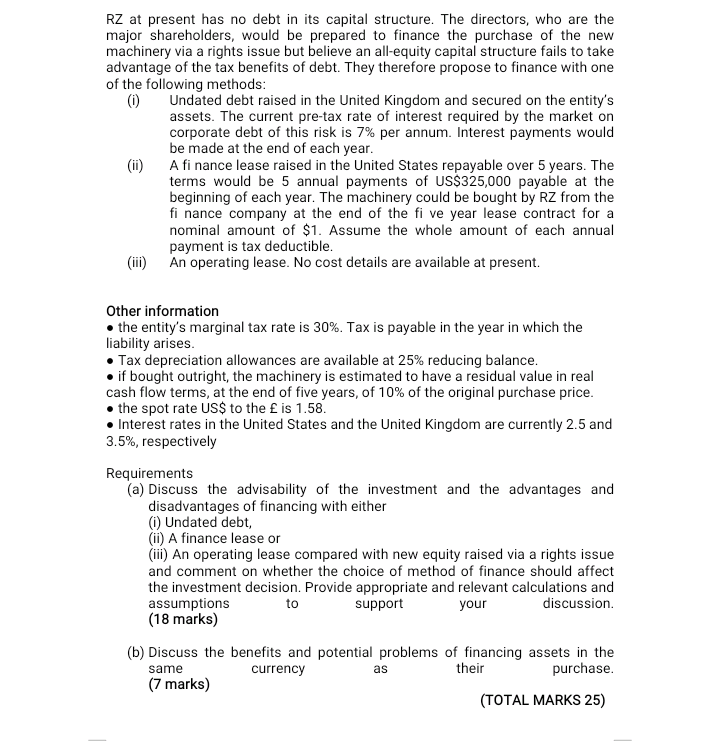

RZ at present has no debt in its capital structure. The directors, who are the major shareholders, would be prepared to finance the purchase of the new machinery via a rights issue but believe an all-equity capital structure fails to take advantage of the tax benefits of debt. They therefore propose to finance with one of the following methods: 0 Undated debt raised in the United Kingdom and secured on the entity's assets. The current pre-tax rate of interest required by the market on corporate debt of this risk is 7% per annum. Interest payments would be made at the end of each year. (ii) A fi nance lease raised in the United States repayable over 5 years. The terms would be 5 annual payments of US$325,000 payable at the beginning of each year. The machinery could be bought by RZ from the fi nance company at the end of the fi ve year lease contract for a nominal amount of $1. Assume the whole amount of each annual payment is tax deductible. (iii) An operating lease. No cost details are available at present. Other information the entity's marginal tax rate is 30%. Tax is payable in the year in which the liability arises. Tax depreciation allowances are available at 25% reducing balance. . if bought outright, the machinery is estimated to have a residual value in real cash flow terms, at the end of five years, of 10% of the original purchase price. the spot rate US$ to the is 1.58. Interest rates in the United States and the United Kingdom are currently 2.5 and 3.5%, respectively Requirements (a) Discuss the advisability of the investment and the advantages and disadvantages of financing with either (i) Undated debt, (ii) A finance lease or (iiiAn operating lease compared with new equity raised via a rights issue and comment on whether the choice of method of finance should affect the investment decision. Provide appropriate and relevant calculations and assumptions to support your discussion (18 marks) as (b) Discuss the benefits and potential problems of financing assets in the same currency their purchase. (7 marks) (TOTAL MARKS 25)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started