#'s 1, 2, 3, 4 & 5

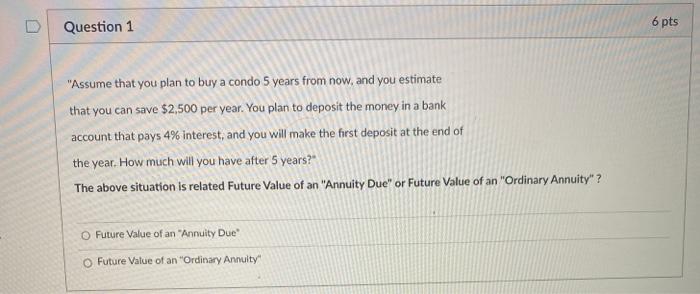

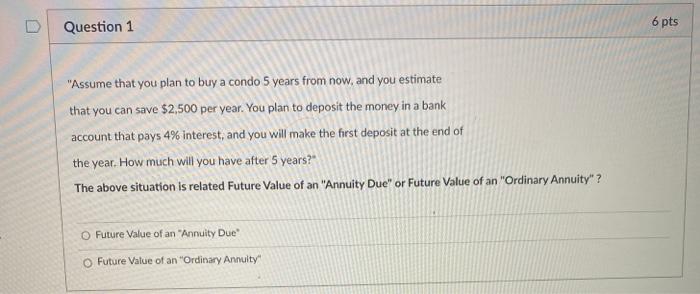

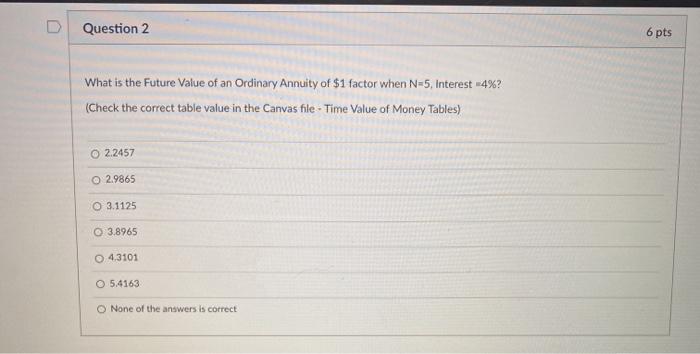

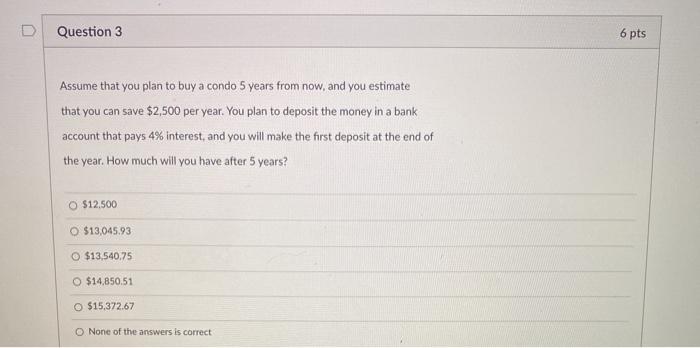

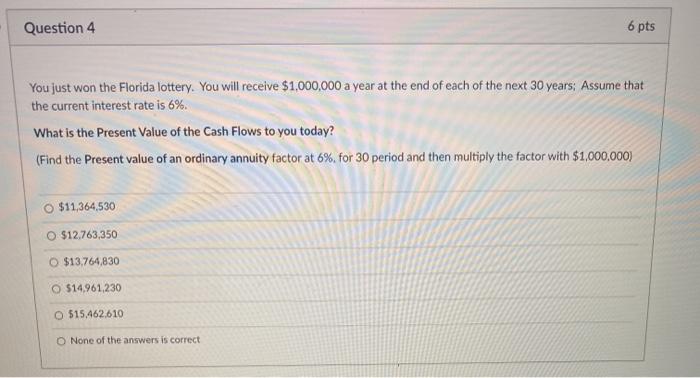

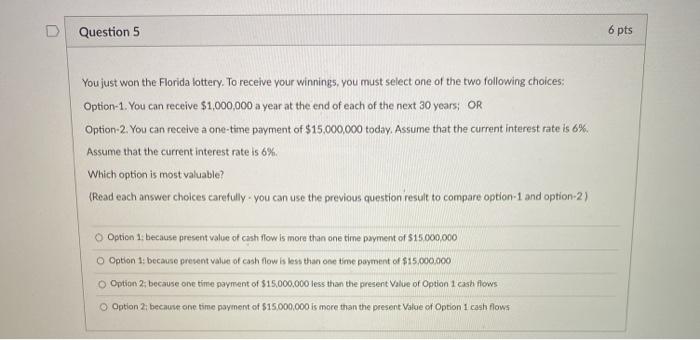

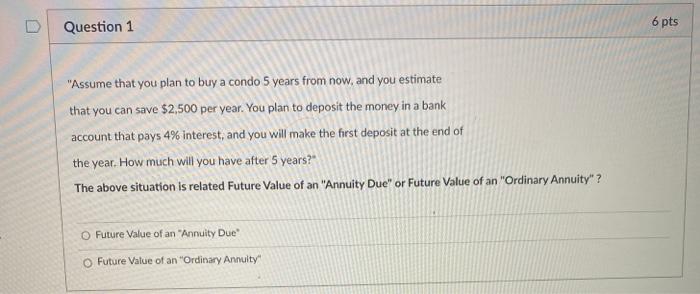

Question 1 6 pts "Assume that you plan to buy a condo 5 years from now, and you estimate that you can save $2,500 per year. You plan to deposit the money in a bank account that pays 4% interest, and you will make the first deposit at the end of the year. How much will you have after 5 years?" The above situation is related Future Value of an "Annuity Due" or Future Value of an "Ordinary Annuity"? Future Value of an "Annuity Due O Future Value of an "Ordinary Annuity D Question 2 6 pts What is the Future Value of an Ordinary Annuity of $1 factor when N-5, Interest -4%? (Check the correct table value in the Canvas file-Time Value of Money Tables) 2.2457 2.9865 0 3.1125 3.8965 O 4.3101 O 5.4163 None of the answers is correct Question 3 6 pts Assume that you plan to buy a condo 5 years from now, and you estimate that you can save $2,500 per year. You plan to deposit the money in a bank account that pays 4% interest, and you will make the first deposit at the end of the year. How much will you have after 5 years? O $12.500 $13,045.93 $13,540.75 O $14,850.51 O $15,372.67 None of the answers is correct Question 4 6 pts You just won the Florida lottery. You will receive $1,000,000 a year at the end of each of the next 30 years: Assume that the current interest rate is 6%. What is the Present Value of the Cash Flows to you today? (Find the Present value of an ordinary annuity factor at 6%. for 30 period and then multiply the factor with $1,000,000) O $11,364,530 $12.763.350 O $13.764,830 O $14,961,230 515.462.610 O None of the answers is correct D Question 5 6 pts You just won the Florida lottery. To receive your winnings, you must select one of the two following choices: Option-1. You can receive $1,000,000 a year at the end of each of the next 30 years; OR Option-2. You can receive a one-time payment of $15.000.000 today. Assume that the current interest rate is 6%. Assume that the current interest rate is 6%. Which option is most valuable? (Read each answer choices carefully you can use the previous question result to compare option-1 and option-2) Option 1. because present value of cash flow is more than one time payment of $15.000.000 Option 1: because present value of cash flow is less than one time payment of $15.000.000 Option 2: because one time payment of $15,000,000 less than the present Value of Option 1 cash flows O Option 2. because one time payment of $15,000,000 is more than the present Valoe of Option 1 cash flows