#'s 4,5,6,7?

#'s 4,5,6,7?

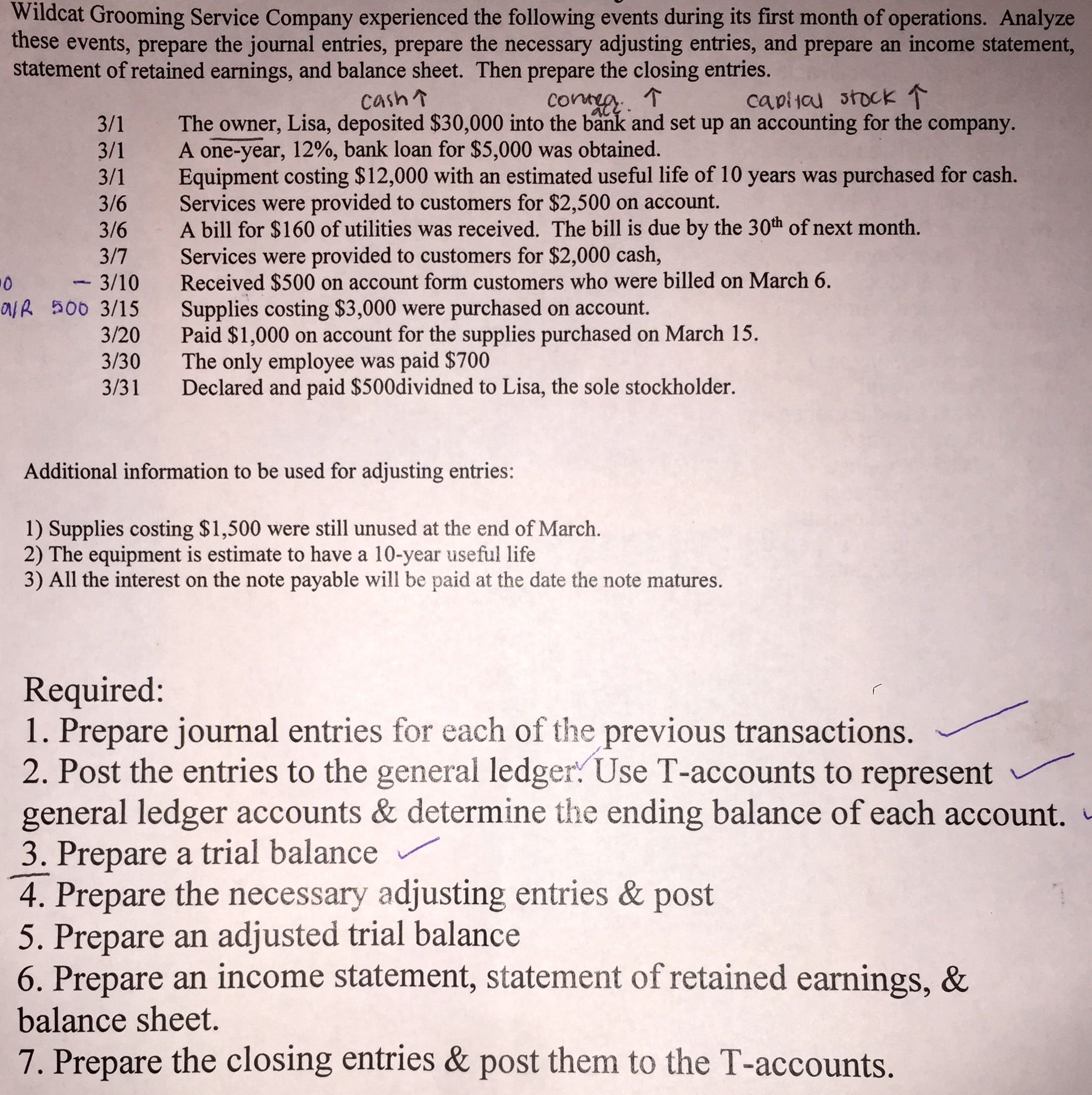

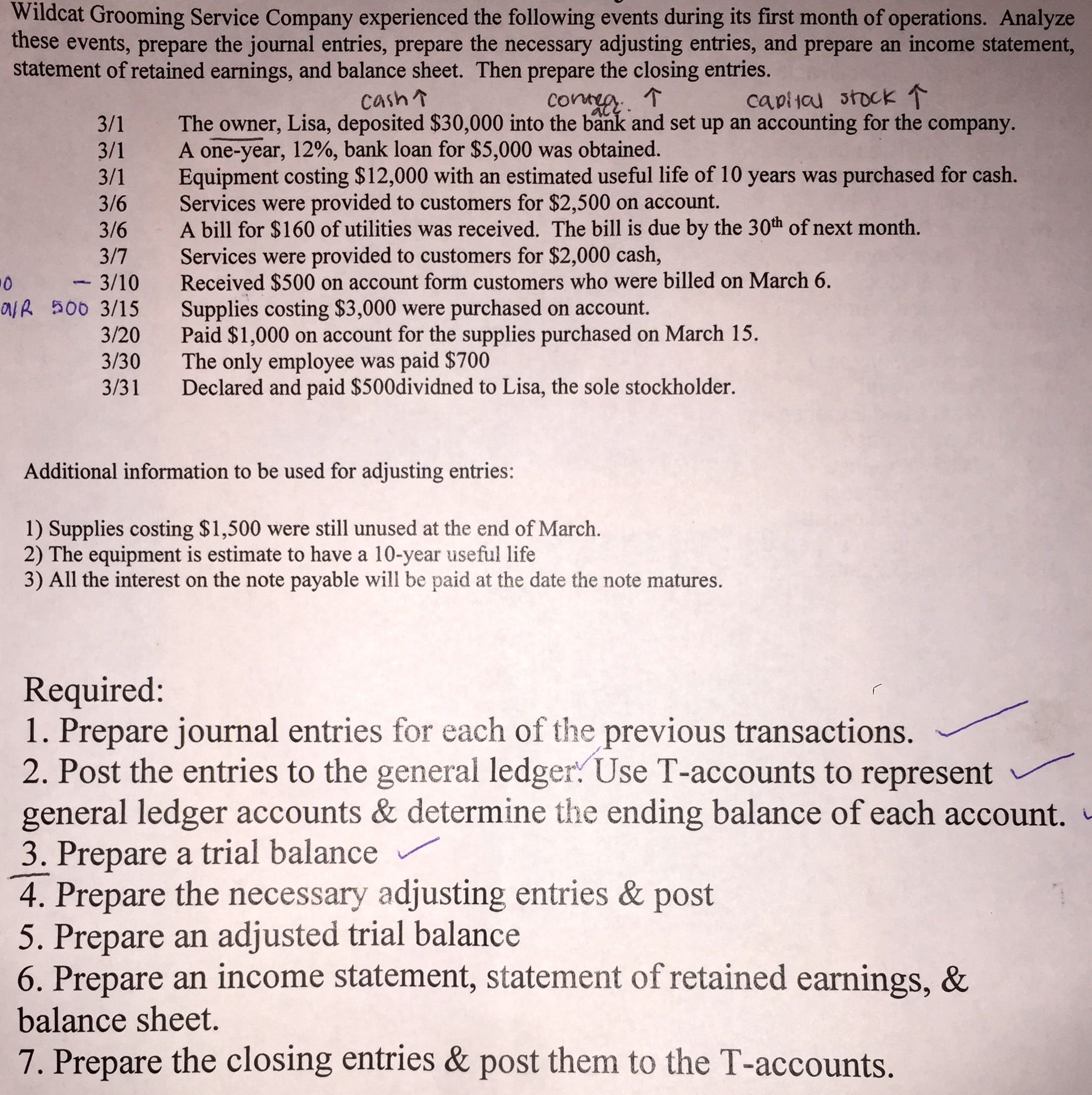

Wildcat Grooming Service Company experienced the following events during these events, prepare the journal entries, prepare the necessary adjusting entries, statement of retained earnings, and balance sheet. Then prepare the closing entries. 3/1 The owner, Lisa, deposited $30,000 into the bank and set up an accounting for the 3/1 A one-year, 12%, bank loan for $5,000 was obtained 3/1 Equipment costing $12,000 with an estimated useful life of 10 years was purchased for cash. 3/6 Services were provided to customers for $2,500 on account. 3/6 A bill for $160 of utilities was received. The bill is due by the 30th of next month. 3/7 Services were provided to customers for $2,000 cash, - 3/10 Received $500 on account form customers who were billed on March 6. 3/15 Supplies costing $3,000 were purchased on account. 3/20 Paid $1,000 on account for the supplies purchased on March 15. 3/30 The only employee was paid $700 3/31 Declared and paid $500dividned to Lisa, the sole stockholder. Additional information to be used for adjusting entries: 1) Supplies costing $1,500 were still unused at the end of March. 2) The equipment is estimate to have a 10-year useful life 3) All the interest on the note payable will be paid at the date the note matures. Required: 1. Prepare journal entries for each of the previous transactions. 2. Post the entries to the general ledger. Use T-accounts to represent general ledger accounts & determine the ending balance of each account. 3. Prepare a trial balance Z Prepare the necessary adjusting entries & post 5. Prepare an adjusted trial balance 6. Prepare an income statement, statement of retained earnings, & balance sheet. 7. Prepare the closing entries & post them to the T-accounts. Wildcat Grooming Service Company experienced the following events during these events, prepare the journal entries, prepare the necessary adjusting entries, statement of retained earnings, and balance sheet. Then prepare the closing entries. 3/1 The owner, Lisa, deposited $30,000 into the bank and set up an accounting for the 3/1 A one-year, 12%, bank loan for $5,000 was obtained 3/1 Equipment costing $12,000 with an estimated useful life of 10 years was purchased for cash. 3/6 Services were provided to customers for $2,500 on account. 3/6 A bill for $160 of utilities was received. The bill is due by the 30th of next month. 3/7 Services were provided to customers for $2,000 cash, - 3/10 Received $500 on account form customers who were billed on March 6. 3/15 Supplies costing $3,000 were purchased on account. 3/20 Paid $1,000 on account for the supplies purchased on March 15. 3/30 The only employee was paid $700 3/31 Declared and paid $500dividned to Lisa, the sole stockholder. Additional information to be used for adjusting entries: 1) Supplies costing $1,500 were still unused at the end of March. 2) The equipment is estimate to have a 10-year useful life 3) All the interest on the note payable will be paid at the date the note matures. Required: 1. Prepare journal entries for each of the previous transactions. 2. Post the entries to the general ledger. Use T-accounts to represent general ledger accounts & determine the ending balance of each account. 3. Prepare a trial balance Z Prepare the necessary adjusting entries & post 5. Prepare an adjusted trial balance 6. Prepare an income statement, statement of retained earnings, & balance sheet. 7. Prepare the closing entries & post them to the T-accounts

#'s 4,5,6,7?

#'s 4,5,6,7?