Answered step by step

Verified Expert Solution

Question

1 Approved Answer

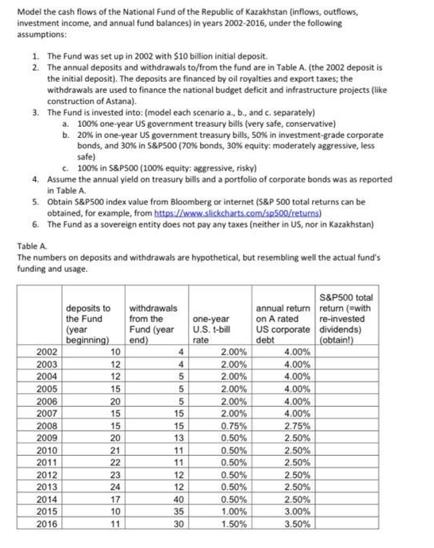

Model the cash flows of the National Fund of the Republic of Kazakhstan (inflows, outflows, investment income, and annual fund balances) in years 2002-2016,

Model the cash flows of the National Fund of the Republic of Kazakhstan (inflows, outflows, investment income, and annual fund balances) in years 2002-2016, under the following assumptions: 1. The Fund was set up in 2002 with $10 billion initial deposit. 2. The annual deposits and withdrawals to/from the fund are in Table A. (the 2002 deposit is the initial deposit). The deposits are financed by oil royalties and export taxes; the withdrawals are used to finance the national budget deficit and infrastructure projects (like construction of Astana). 3. The Fund is invested into: (model each scenario a., b., and c. separately) a. 100% one-year US government treasury bills (very safe, conservative) b. c. 100% in S&P500 (100% equity: aggressive, risky) 4. Assume the annual yield on treasury bills and a portfolio of corporate bonds was as reported in Table A 5. Obtain S&P500 index value from Bloomberg or internet (S&P 500 total returns can be obtained, for example, from https://www.slickcharts.com/sp500/retums) 6. The Fund as a sovereign entity does not pay any taxes (neither in US, nor in Kazakhstan) Table A The numbers on deposits and withdrawals are hypothetical, but resembling well the actual fund's funding and usage. 2002 2003 2004 2005 2006 2007 20% in one-year US government treasury bills, 50% in investment-grade corporate bonds, and 30% in S&P500 (70 % bonds, 30% equity: moderately aggressive, less safe) 2008 2009 2010 2011 2012 2013 2014 2015 2016 deposits to the Fund (year beginning) 10 12 12 15 20 15 15 20 21 22 23 24 17 10 11 withdrawals from the Fund (year end) 4 4 5 5 5 SERHIESSSS 15 15 13 11 11 12 12 40 35 30 one-year U.S. t-bill rate 2.00% 2.00% 2.00% 2.00% 2.00% 2.00% 0.75% 0.50% 0.50% 0.50% 0.50% 0.50% 0.50% 1.00% 1.50% annual return on A rated US corporate debt 4.00% 4.00% 4.00% 4.00% 4.00% 4.00% 2.75% 2.50% 2.50% 2.50% 2.50% 2.50% 2.50% 3.00% 3.50% S&P500 total return (with re-invested dividends) (obtain!)

Step by Step Solution

★★★★★

3.30 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Scenario A 100 oneyear US Government Treasury Bills Cash Inflows The primary source of cash inflow for the Fund is from deposits made by th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started