Question

S & R Company uses the aging of accounts receivable approach to estimate bad debt expense. On December 31, 2015, an analysis of accounts receivable

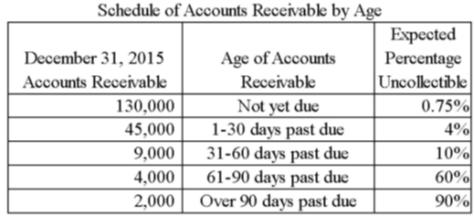

S & R Company uses the aging of accounts receivable approach to estimate bad debt expense. On December 31, 2015, an analysis of accounts receivable revealed the following:

Required:

(a) Calculate the amount of allowance for doubtful accounts that should be reported on the balance sheet at December 31, 2015.

(b) Calculate the amount of bad debts expense that should be reported on the 2015 income statement, assuming that the balance of Allowance for Doubtful Accounts on January 1 was $44,000 (credit balance) and accounts receivable written off during the year totaled $49,200.

(c) Present the appropriate general journal entry to record bad debts expense on December 31, 2015.

(d) Show how accounts receivable will appear on the balance sheet at December 31, 2015.

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Doubtful account written off If a specific customers accounts receivable is estimated to be as uncol...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South Western Federal Taxation 2016 Corporations Partnerships Estates And Trusts

Authors: James Boyd, William Hoffman, Raabe, David Maloney, Young

39th Edition

978-1305399884

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App