Question

The company recognized bad debt expense on December 31 in the amount of $ 12,000 (allowance for doubtful accounts method is used not the direct

The company issued $ 112,000 7 - year, 9% bonds on July 1; the bonds pay interest semiannually on January 1 and July 1, and the effective interest rate method is used to amortize the bonds; The market rate of interest was 8% on the day of issuance

On December 1, the company invested in one debt security investment, which it still held on December 31 nnual inter rate of 10%; (c) pays terest every April 30 and (d) has increased in value since its purchase (round any required balances to the nearest whole number):

Just solve that and if u can tell me which one of them goes on trial

What kind of information?

This all the information I have, for the example for the first question there is only 12,000 then u have to make up the number for the debt expense I believe. so u need to make up the numbers

It's the same as this but my question that I post is different

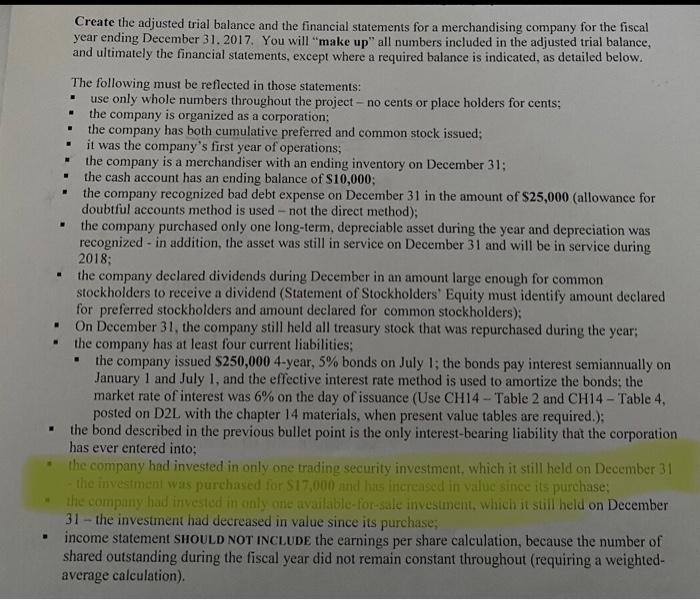

Create the adjusted trial balance and the financial statements for a merchandising company for the fiscal year ending December 31. 2017, You will "make up" all numbers included in the adjusted trial balance, and ultimately the financial statements, except where a required balance is indicated, as detailed below. The following must be reflected in those statements: use only whole numbers throughout the project - no cents or place holders for cents; the company is organized as a corporation; the company has both cumulative preferred and common stock issued; it was the company's first year of operations; the company is a merchandiser with an ending inventory on December 31; the cash account has an ending balance of $10,000; the company recognized bad debt expense on December 31 in the amount of $25,000 (allowance for doubtful accounts method is used - not the direct method); the company purchased only one long-term, depreciable asset during the year and depreciation was recognized - in addition, the asset was still in service on December 31 and will be in service during 2018B the company declared dividends during December in an amount large enough for common stockholders to receive a dividend (Statement of Stockholders' Equity must identify amount declared for preferred stockholders and amount declared for common stockholders); On December 31, the company still held all treasury stock that was repurchased during the year; the company has at least four current liabilities; the company issued $250,000 4-year, 5% bonds on July 1; the bonds pay interest semiannually on January 1 and July 1, and the effective interest rate method is used to amortize the bonds; the market rate of interest was 6% on the day of issuance (Use CH14 - Table 2 and CH14 - Table 4, posted on D2L with the chapter 14 materials, when present value tables are required.); the bond described in the previous bullet point is the only interest-bearing liability that the corporation has ever entered into; the company had invested in only one trading security investment, which it still held on December 31 the investment was purchased for S17,000 and has increased in valuc since its purchase; * the company had invested in only one available-for-sale invesiment, which it still held on December 31-the investment had decreased in value since its purchase; income statement SHOULD NOT INCLUDE the earnings per share calculation, because the number of shared outstanding during the fiscal year did not remain constant throughout (requiring a weighted- average calculation).

Step by Step Solution

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started