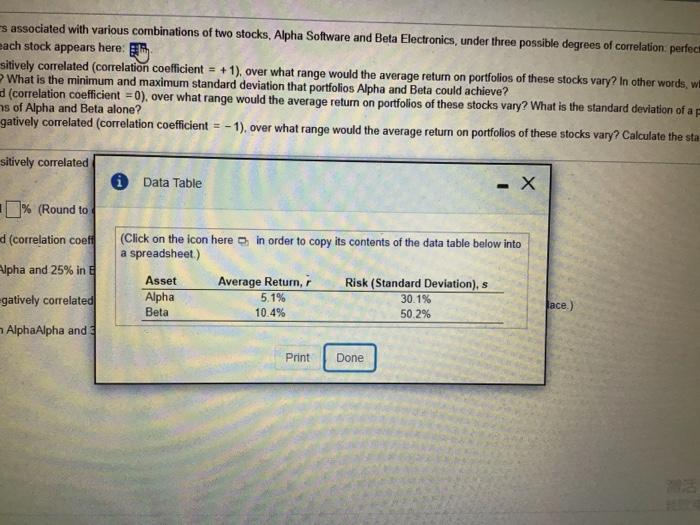

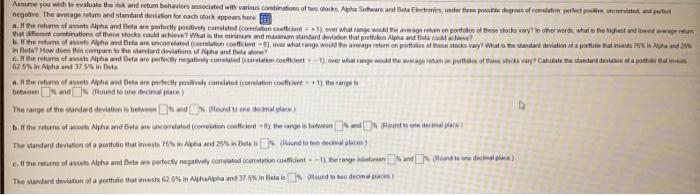

-s associated with various combinations of two stocks, Alpha Software and Beta Electronics, under three possible degrees of correlation, perfect each stock appears here: sitively correlated (correlation coefficient = + 1), over what range would the average return on portfolios of these stocks vary? In other words, will What is the minimum and maximum standard deviation that portfolios Alpha and Beta could achieve? (correlation coefficient = 0), over what range would the average return on portfolios of these stocks vary? What is the standard deviation of a as of Alpha and Beta alone? gatively correlated (correlation coefficient = -1), over what range would the average return on portfolios of these stocks vary? Calculate the sta sitively correlated Data Table -X 1% (Round to (correlation coeft Alpha and 25% in (Click on the icon here in order to copy its contents of the data table below into a spreadsheet.) Asset Average Return, Risk (Standard Deviation), s Alpha 51% 30.1% Beta 10.4% 50.2% gatively correlated Jace.) AlphaAlpha and Print Done Mare you wish to evaluate the round retum behaviors sociated with various contains of stock pha Software and Beta El poble de como production comedende negative. The average ratom and standard deviation for each stack pear here at thereum of Alpha and Bete perfectly povely correlated comic) over what range wote women portfotos of the odo way Inter ww what the chest in warm that combination of the stocks could achieve? What is the minimum and maximam standard deviation portfolio Alphen Bedde? b. If the form of the and Bacolod formation counter what ngewegunon portion of the day What is the standard deviation of a portiera and in Bata? How does this compare to the standard deviations of pha and one seuranta and late and perfectly negatively commuted concett) over what ange wote werage putand van Calendari dunia dapat 62.5% in Alpha and in a all the stufe and Beere perfectly positively could content + 1) stangen between a sound to be done proce) The range of the orderd deviation towel and I dont ce ducato) b. If the return of the Alpha mala corretto contentcontent is www sa Hoond dan The standard deviation of a portato in Aland Isle odlete che return of assets Alpha and Beta are perfectly negatively contacto count there and te ne ach) The standard deviation of a portfolio that its 25% in Alpha Alpha and 37 in Baddom -s associated with various combinations of two stocks, Alpha Software and Beta Electronics, under three possible degrees of correlation, perfect each stock appears here: sitively correlated (correlation coefficient = + 1), over what range would the average return on portfolios of these stocks vary? In other words, will What is the minimum and maximum standard deviation that portfolios Alpha and Beta could achieve? (correlation coefficient = 0), over what range would the average return on portfolios of these stocks vary? What is the standard deviation of a as of Alpha and Beta alone? gatively correlated (correlation coefficient = -1), over what range would the average return on portfolios of these stocks vary? Calculate the sta sitively correlated Data Table -X 1% (Round to (correlation coeft Alpha and 25% in (Click on the icon here in order to copy its contents of the data table below into a spreadsheet.) Asset Average Return, Risk (Standard Deviation), s Alpha 51% 30.1% Beta 10.4% 50.2% gatively correlated Jace.) AlphaAlpha and Print Done Mare you wish to evaluate the round retum behaviors sociated with various contains of stock pha Software and Beta El poble de como production comedende negative. The average ratom and standard deviation for each stack pear here at thereum of Alpha and Bete perfectly povely correlated comic) over what range wote women portfotos of the odo way Inter ww what the chest in warm that combination of the stocks could achieve? What is the minimum and maximam standard deviation portfolio Alphen Bedde? b. If the form of the and Bacolod formation counter what ngewegunon portion of the day What is the standard deviation of a portiera and in Bata? How does this compare to the standard deviations of pha and one seuranta and late and perfectly negatively commuted concett) over what ange wote werage putand van Calendari dunia dapat 62.5% in Alpha and in a all the stufe and Beere perfectly positively could content + 1) stangen between a sound to be done proce) The range of the orderd deviation towel and I dont ce ducato) b. If the return of the Alpha mala corretto contentcontent is www sa Hoond dan The standard deviation of a portato in Aland Isle odlete che return of assets Alpha and Beta are perfectly negatively contacto count there and te ne ach) The standard deviation of a portfolio that its 25% in Alpha Alpha and 37 in Baddom