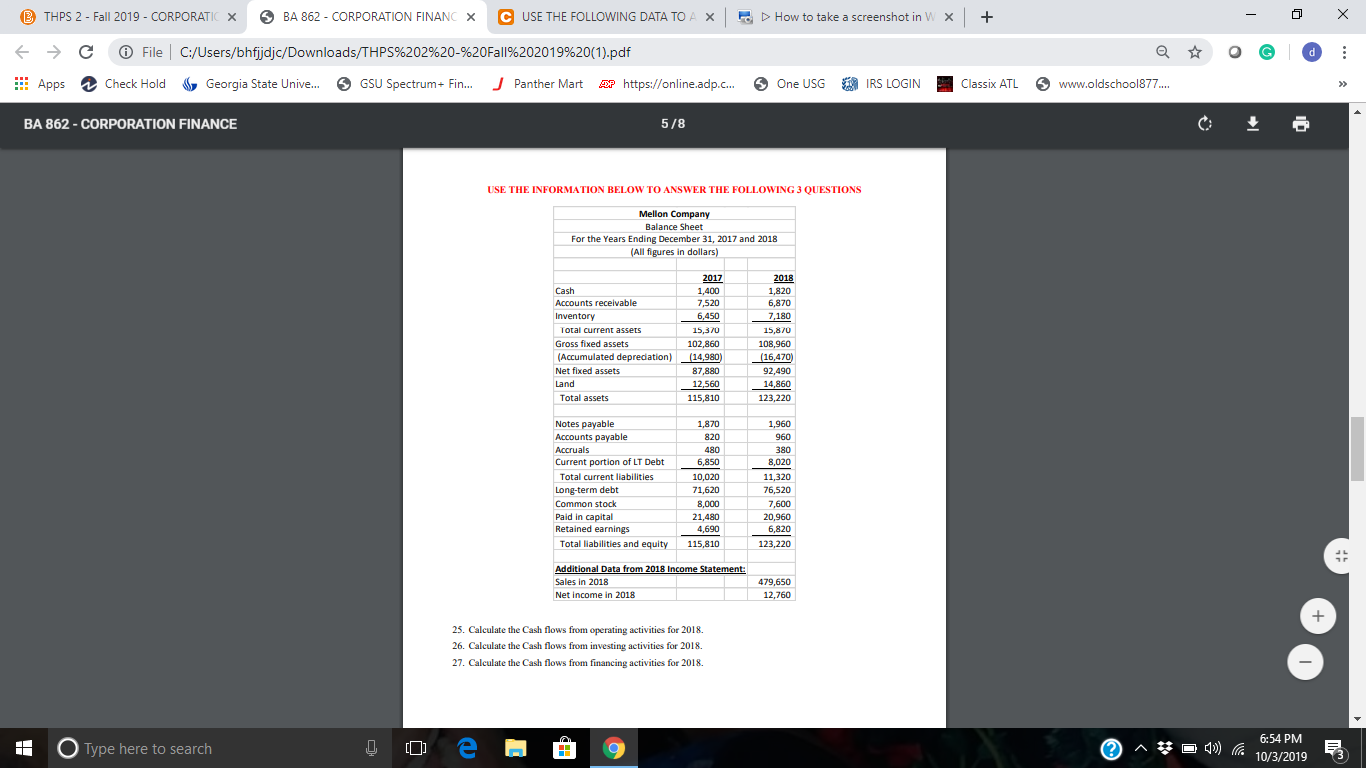

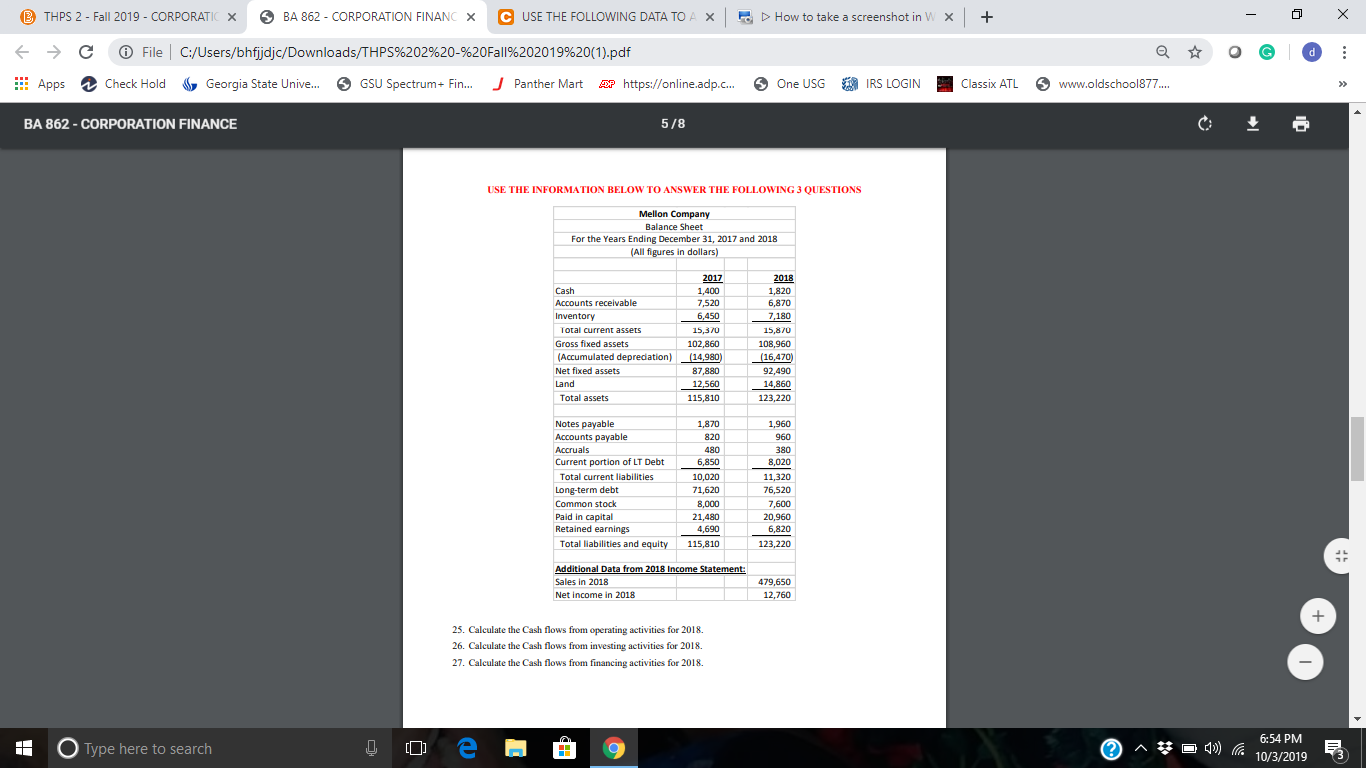

S BA 862 - CORPORATION FINANC X C USE THE FOLLOWING DATA TO A X How to take a screenshot in W X THPS 2 - Fall 2019 CORPORATIX X C File C:/Users/bhfijdjc/Downloads/THPS%202%20-%20Fall%202019%20(1).pdf GSU Spectrum Fin... Panther Mart Apps One USG IRS LOGIN Georgia State Unive... Check Hold https://online.adp.c... Classix ATL www.oldschool877.. 5/8 BA 862 -CORPORATION FINANCE USE THE INFORMATION BELOW TO ANSWER THE FOLLOWING 3 QUESTIONS Mellon Company Balance Sheet For the Years Ending December 31, 2017 and 2018 (All figures in dollars) 2017 2018 Cash 1,400 1,820 6,870 Accounts receivable 7,520 6,450 7,180 Inventory Total current assets 15,870 15,370 Gross fixed assets 102,860 108,960 (Accumulated depredation) (14,980) 87,880 12,560 (16,470) Net fixed assets 92,490 14,860 Land Total assets 123,220 115,810 Notes payable Accounts payable 1,870 1,960 820 960 Accruals 480 380 6,850 Current portion of LT Debt 8,020 11,320 76,520 Total current liabilities 10,020 Long-term debt 71,620 Common stock 8,000 7,600 20,960 6,820 21.480 Paid in capital Retained earnings 4,690 Total liabilities and equity 123,220 115,810 Additional Data from 2018 Income Statement Sales in 2018 479,650 12,760 Net income in 2018 25, Calculate the Cash flows from operating activities for 2018. 26. Calculate the Cash flows from investing activities for 2018. 27. Calculate the Cash flows from financing activities for 2018 e 6:54 PM #D O Type here to search 10/3/2019 S BA 862 - CORPORATION FINANC X C USE THE FOLLOWING DATA TO A X How to take a screenshot in W X THPS 2 - Fall 2019 CORPORATIX X C File C:/Users/bhfijdjc/Downloads/THPS%202%20-%20Fall%202019%20(1).pdf GSU Spectrum Fin... Panther Mart Apps One USG IRS LOGIN Georgia State Unive... Check Hold https://online.adp.c... Classix ATL www.oldschool877.. 5/8 BA 862 -CORPORATION FINANCE USE THE INFORMATION BELOW TO ANSWER THE FOLLOWING 3 QUESTIONS Mellon Company Balance Sheet For the Years Ending December 31, 2017 and 2018 (All figures in dollars) 2017 2018 Cash 1,400 1,820 6,870 Accounts receivable 7,520 6,450 7,180 Inventory Total current assets 15,870 15,370 Gross fixed assets 102,860 108,960 (Accumulated depredation) (14,980) 87,880 12,560 (16,470) Net fixed assets 92,490 14,860 Land Total assets 123,220 115,810 Notes payable Accounts payable 1,870 1,960 820 960 Accruals 480 380 6,850 Current portion of LT Debt 8,020 11,320 76,520 Total current liabilities 10,020 Long-term debt 71,620 Common stock 8,000 7,600 20,960 6,820 21.480 Paid in capital Retained earnings 4,690 Total liabilities and equity 123,220 115,810 Additional Data from 2018 Income Statement Sales in 2018 479,650 12,760 Net income in 2018 25, Calculate the Cash flows from operating activities for 2018. 26. Calculate the Cash flows from investing activities for 2018. 27. Calculate the Cash flows from financing activities for 2018 e 6:54 PM #D O Type here to search 10/3/2019